Arthur J. Gallagher’s Structured Credit and Political Risk team is one of the market leaders in developing insurance structures to support banks, traders and multinational corporates in their international trade and investment strategies. Our global team of brokers and advisors are located in the world’s financial centres, ensuring that we are close to both the clients we serve and the insurance markets that we utilise. With teams across the world – from New York to Sydney – our clients can access our expertise regardless of timezone, ensuring round-the-clock support.

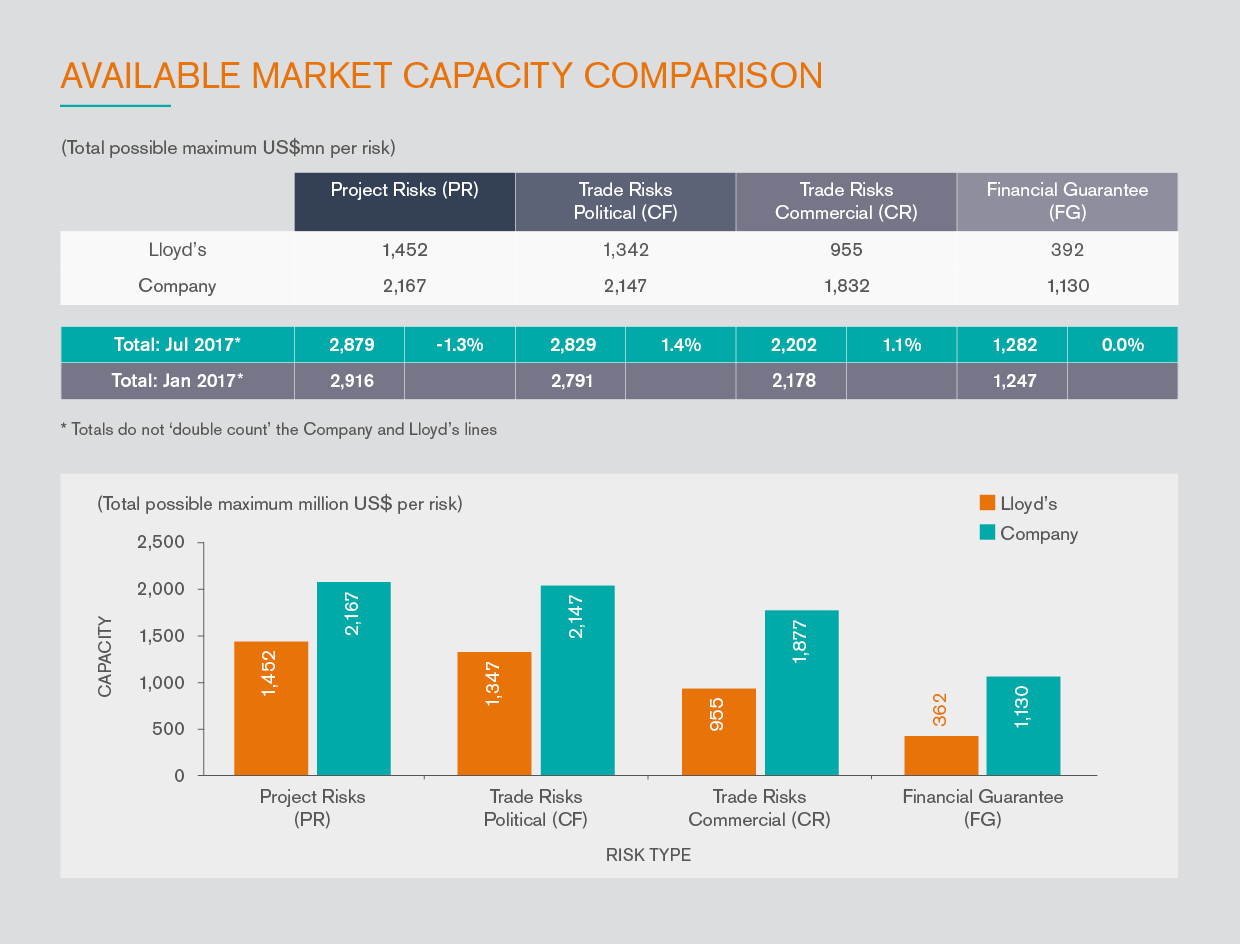

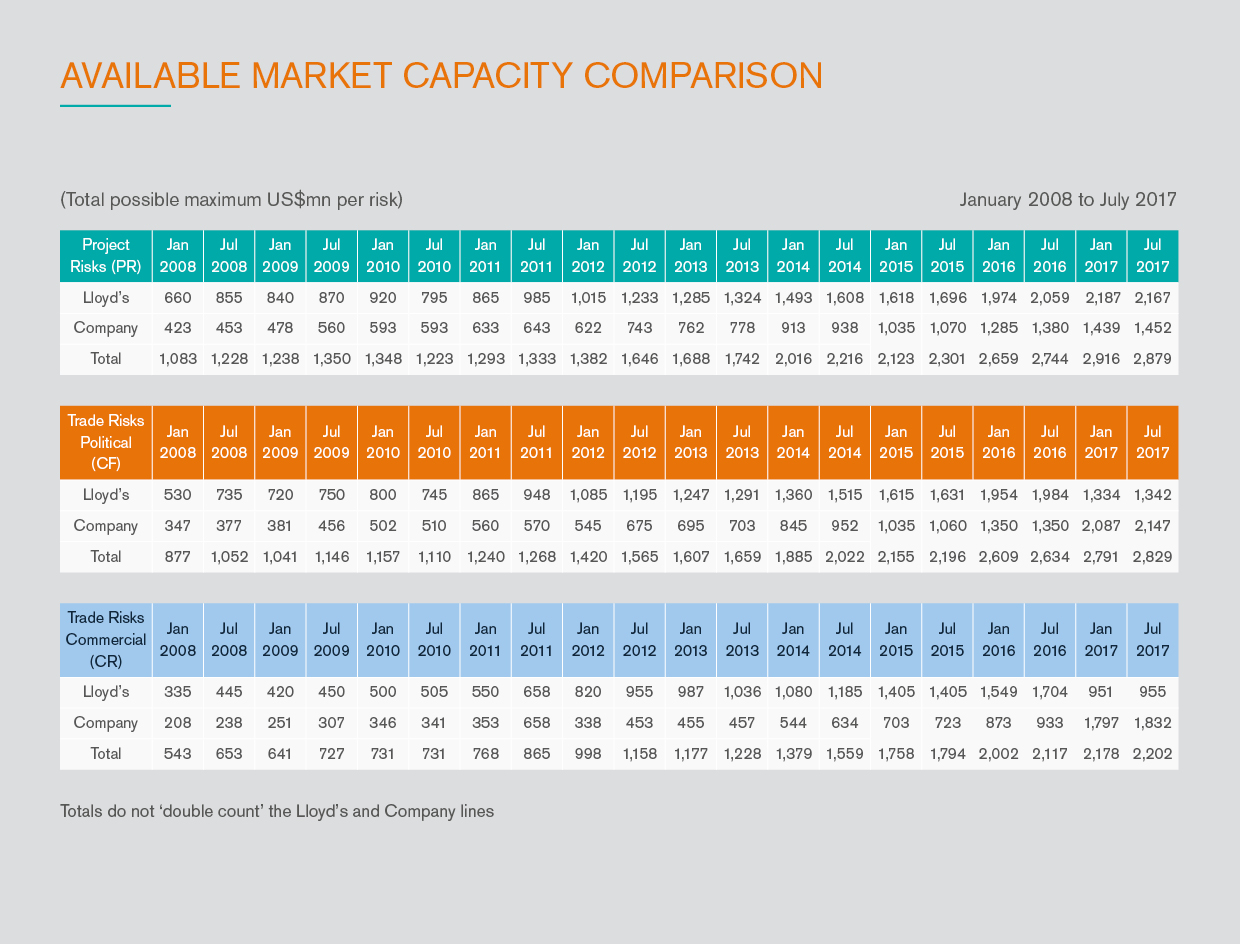

From our global standpoint, we have seen the international credit and political risk insurance market grow substantially since the financial crisis, with over US$2bn of capacity available on a transactional basis. Additional capacity inflows means that there are new players joining the market, leading to enhanced levels of competition both in respect of price and product innovation amongst both the Lloyd’s of London and company markets. The insurance market for non-payment and political risk is therefore at one of the most dynamic points in its development.

For new buyers of this specialist class of insurance, this is an opportune time to test the water, and to see what the market can offer. Buyers that already have a position in the market will be aware of the benefits of cover that extend far beyond pure risk transfer. Yet with the market in a constant state of flux and evolution, it is important to ensure that your broker is keeping up to speed with the latest developments and capabilities of the market and applying them to give the buyer a commercial advantage.

Arthur J. Gallagher’s special report for GTR summarises the recent changes in the credit and political risk insurance market, and what these changes mean for your business. Whether your objective is to grow, open new markets, manage regulatory pressure, or secure market share, our Structured Credit and Political Risk team will show you how to use insurance more strategically across your entire business – giving you the competitive edge you need.

Get in touch if you’d like to discuss your strategy.

Development of the Financial Guarantee (FG) risk code

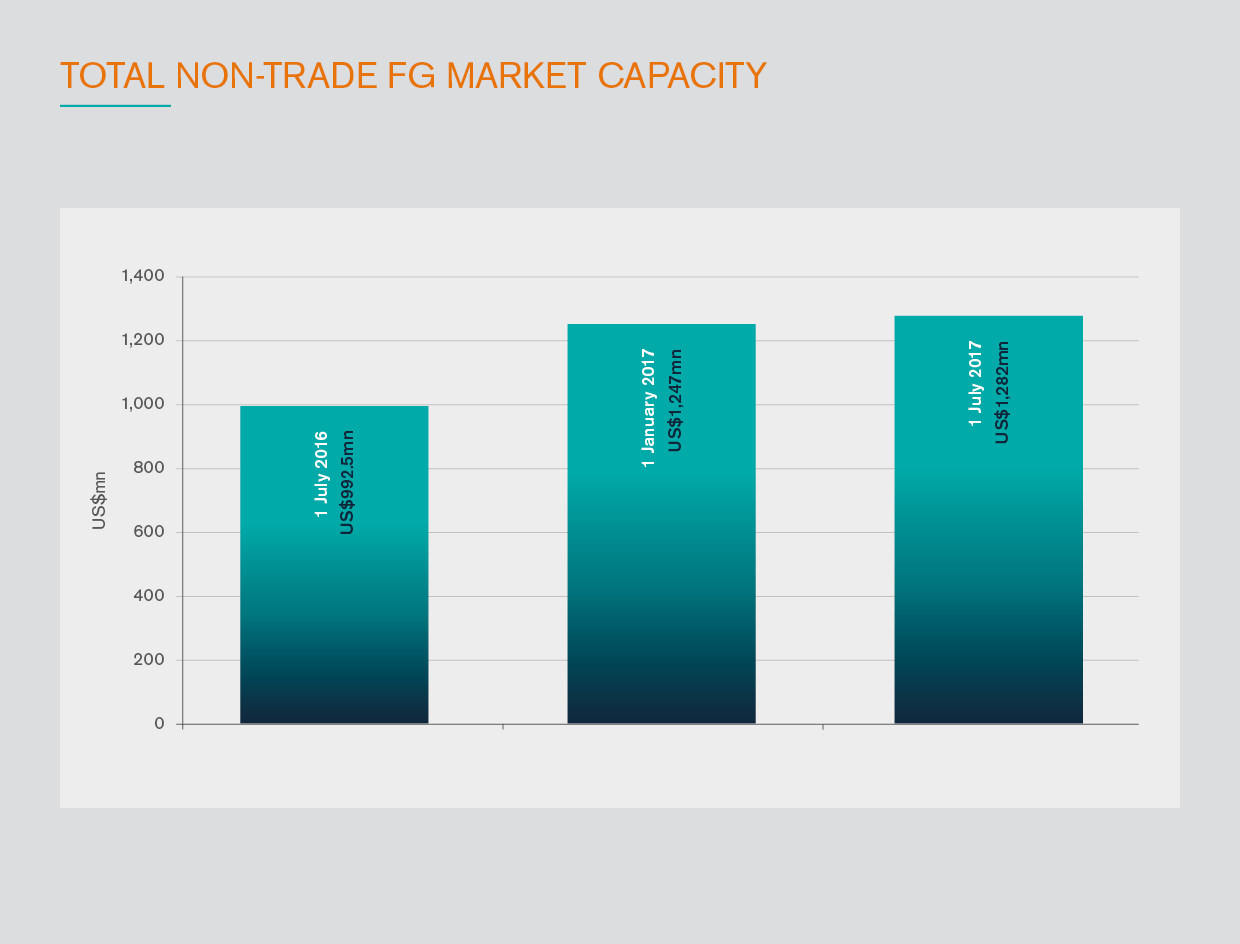

The credit and political risk class of insurance remains highly dynamic and the Financial Guarantee (FG) risk code is a new and rapidly expanding area of development. The FG code is designed for non-trade business – a notable shift for a market that has traditionally focused strictly on trade and cross-border risk. Financial Guarantee insurance indemnifies the insured against loss from the financial failure of any business venture, bankruptcy, or a fluctuation in commodity prices, to list but a few examples.

Appetite for the FG risk code has grown rapidly as insurers seek to differentiate their offering in the face of continued inflows of new capacity. Given the high loss ratio of the private company credit (CR) risk code, the FG risk code opens the market to new revenue streams. However, it is important to note that underwriters are being extremely selective about FG risks and Lloyd’s of London requires all syndicates to employ a qualified Credit Analyst to write this class.

For buyers, the FG risk code means that there are opportunities to strategically manage exposure on a portfolio basis – and Arthur J. Gallagher is well-placed to help our clients take advantage of this.

New products for a broader range of financiers

Over the last decade, the market’s trade-related origins have evolved to incorporate the insurance of banks and Export Credit Agencies (ECAs). Once considered too unconventional or risky to underwrite, today the reinsurance of ECAs and the cover provided under bank-to-bank business has developed the product and ultimately moved the market forward dramatically. The London insurance sector and Lloyd’s in particular is well known for the innovative approach its underwriters have towards diversifying their portfolios as well as meeting the needs of their clients.

We have confidence that as capacity levels remain high, competition will continue to drive product innovation. Brokers have an important role to play in working with their clients to identify areas for product development, supporting their clients in achieving their strategic objectives. As structures that once occupied the top-end of the risk curve become the norm, Arthur J. Gallagher anticipates the market moving towards developing highly specialised offerings for the insurance of Private Equity players, and Alternative Debt Financing, both on a transactional and a portfolio basis.

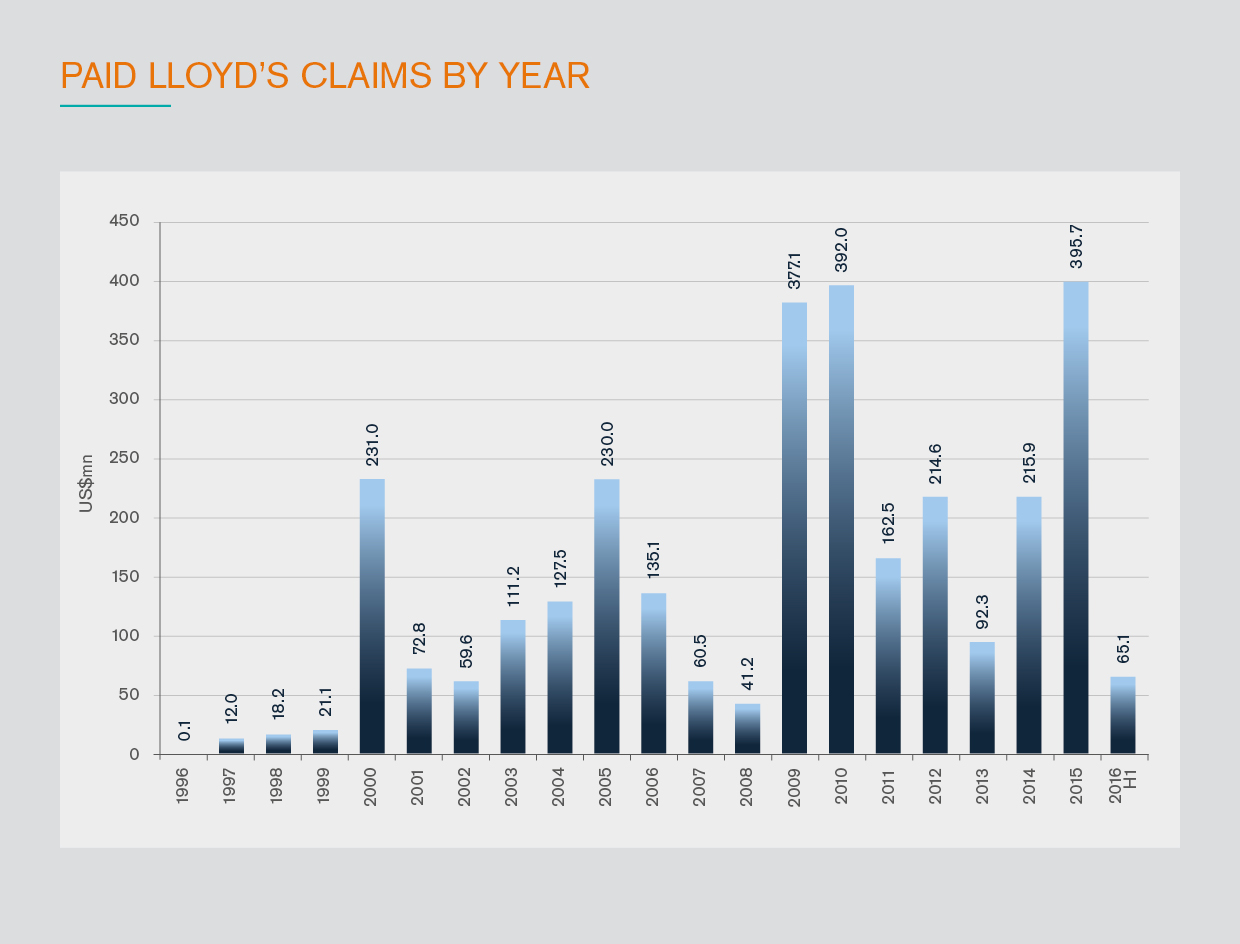

Market strength in the face of claims

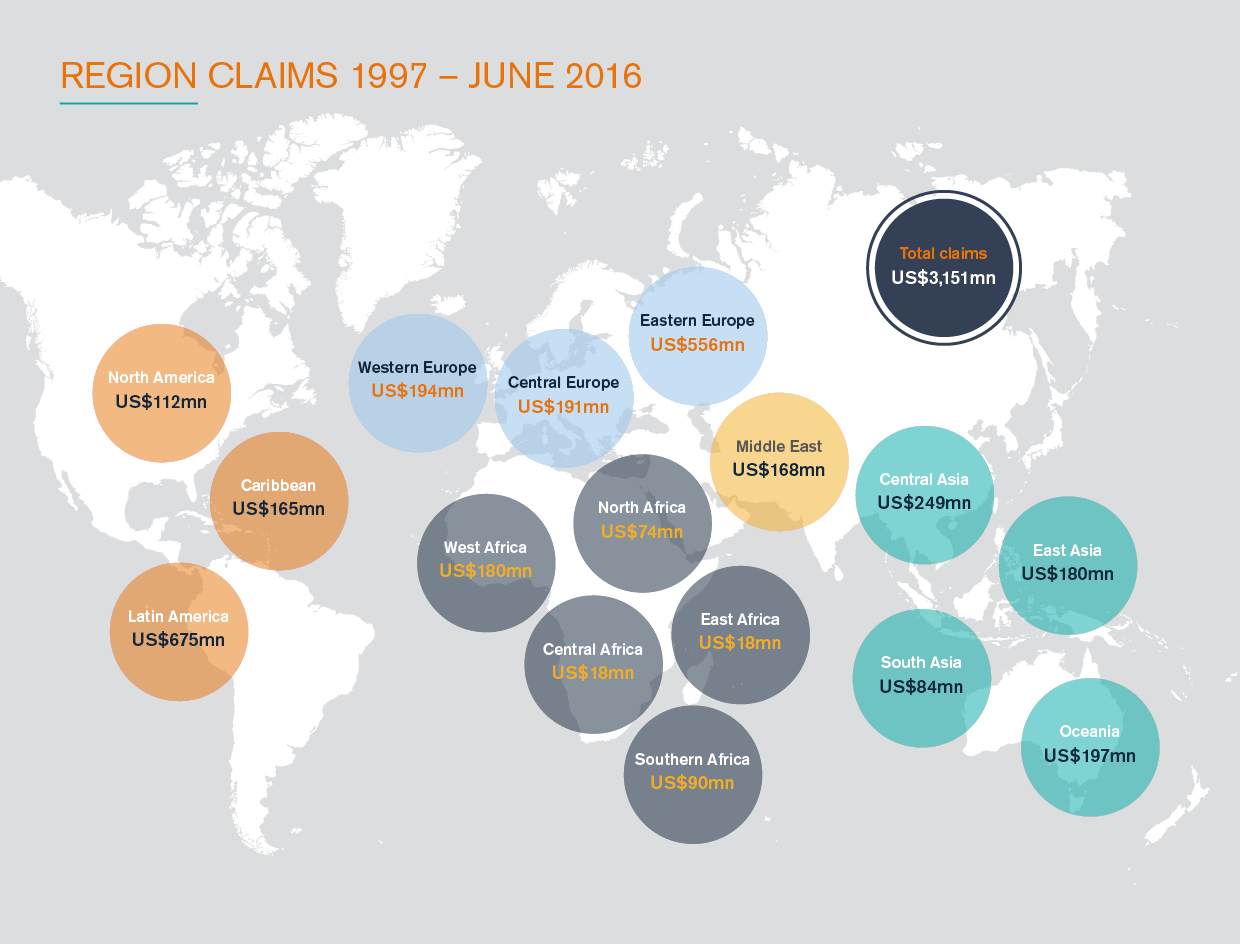

It is reassuring for buyers that, despite the wide range in tenors and risks underwritten in this class, the credit and political risk market remains resilient. The Lloyd’s claims figures make for interesting reading; the figures illustrate how the Lloyd’s market continues to indemnify losses experienced by its clients as they trade and invest internationally.

As one would expect, the products are deployed most frequently in geographies where there are elevated levels of country or counterparty risk. As per the Lloyd’s Paid Political Risk Claims data (by Xchanging), Latin America and Eastern Europe remain the leading geographical sources of claims, by some margin. Furthermore the private company risk code (CR) as shown by the data, is the top risk code resulting in claims.

Different businesses have different drivers for utilising the insurance market, but knowing that a policy will perform in the event of a claim is paramount. Arthur J. Gallagher has successfully collected US$0.5bn of claims over the last three years.

Longer tenors mean more options for insureds

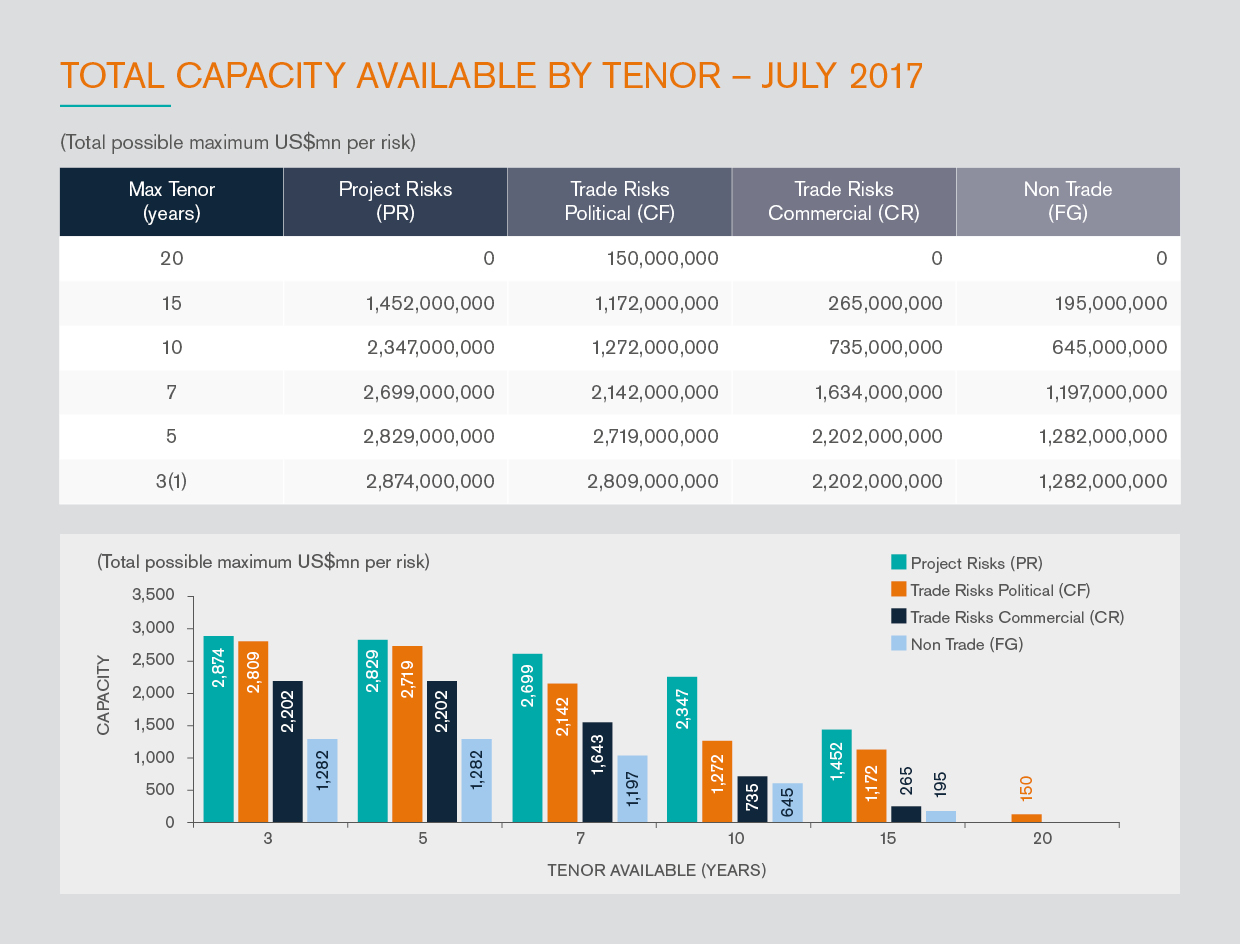

Capacity is available over a number of different tenors, with the majority of the market, particularly Lloyd’s, able to offer up to 7 years’ cover. However an increasing number of insurers, across both Lloyd’s and company markets, are writing business on a much longer term basis and utilising tenors of up to 15 years. A handful can even provide cover for secured aviation financing and ECA/multilateral-backed business with tenors of up to 20 years. Again, the market’s ability to evolve and develop greater flexibility to support clients across a range of industries continues at pace.

More capacity means more competition, leading to innovation

With interest rates remaining low, the Lloyd’s market continues to represent an attractive opportunity for investors looking for returns on capital investments. There is a substantial amount of capacity available within the Lloyd’s and the company insurance markets across all of the risk codes, with capacity across the market effectively doubling in the last four years. The increase has been most keenly felt in the short to medium-term CF and PR markets.

Given the typical reinsurance cycle that the majority of insurers follow (1/1, 1/4 or similar), marginal changes in numbers are to be expected. The notable increase in FG capacity is a trend that we expect to be maintained for some time to come. For buyers, the main point to remember is that as new inflows of capacity enter the market, pricing remains competitive and may not be as prohibitive as in the past. Now is the time to test the market, and to see how it can be utilised to support strategic commercial objectives, be it revenue generation, opening new markets or securing or growing market share.