Reshoring has shot up the trade lexicon as ties with China, the ‘factory of the world’, become more unsettled and the pandemic pummels global supply chains. A growing number of executives say they want to diversify away from the Asian giant and make supply chains more resilient. But as Jacob Atkins reports, many businesses find reshoring is far from straightforward.

When a worker at a Thuan Phuong Group factory in Ho Chi Minh City became a suspected coronavirus case in early June this year, the company didn’t send most of the facility’s workers home. Instead, around 1,000 spent the next two weeks quarantining – at work.

Trucks were dispatched to collect hundreds of toothbrushes, shampoo and eating utensils, while part of the factory floor was hastily transformed into living quarters, according to an account in the VN Express newspaper.

The company – which supplies the likes of Levi’s, Walmart and Nike – is not alone in crafting ways to keep production lines rolling during the turbulence of the pandemic.

Ever-growing labour costs in China and Beijing’s increasingly tense trading relationships are pushing overseas businesses to reconsider the country’s position at the crux of many global supply chains, accelerating a pre-pandemic trend, according to surveys and consultants.

Vietnam and others in the neighbourhood, such as Thailand, Malaysia, Indonesia and Taiwan, are clamouring to pick up the contracts of those eyeing supply chain relocations.

Supply chain weaknesses exposed by the pandemic, and further strained by ongoing supply crunches, have also pushed supply resilience up the agenda of trade-focused firms and their governments. The disruptions rippling through supply chains have underscored how dependent so many businesses, and nations, are on Chinese production.

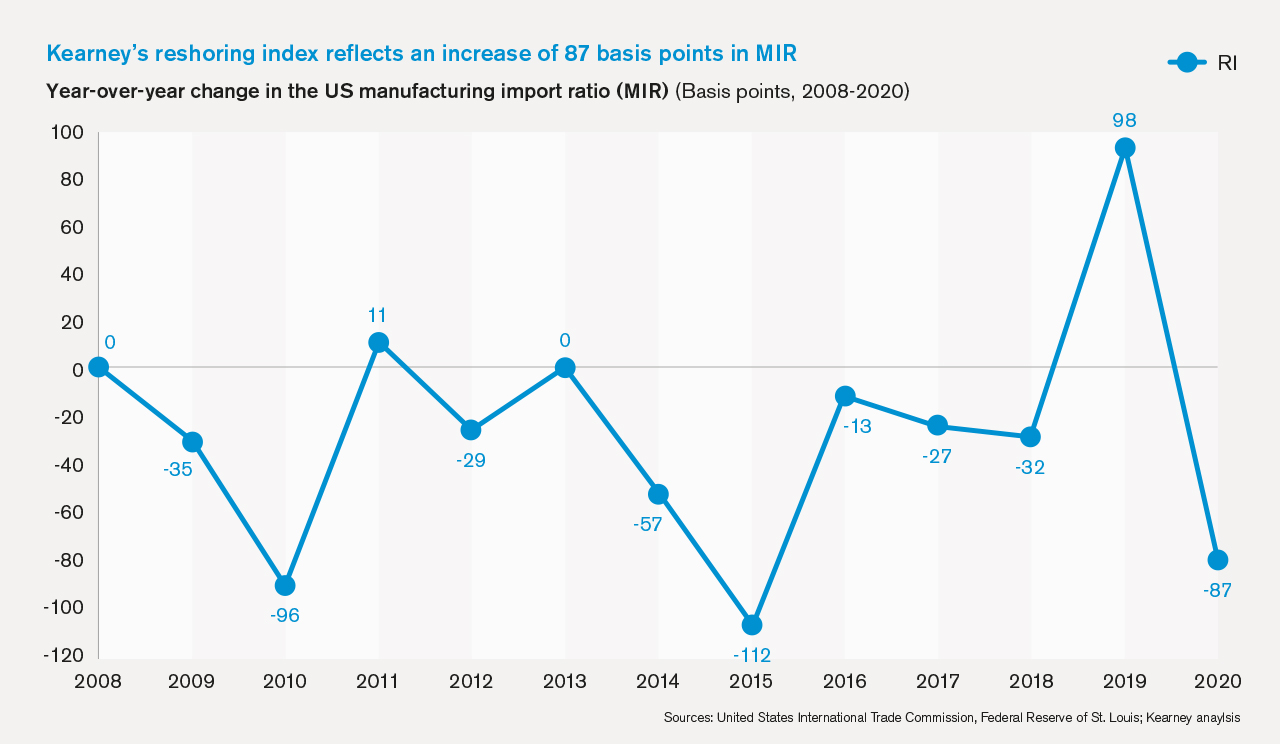

A reshoring index created by consulting firm Kearney, which tracks how much US businesses are sourcing domestically versus through imports, plummeted to an all-time low in 2020 after soaring to a record high the previous year. A high number indicates net reshoring, while a lower number points to increased offshoring.

But in Kearney’s accompanying survey of 120 US manufacturing executives, conducted in March this year, 41% said their firms had reshored at least some manufacturing to the US during the last three years, and around a quarter said they planned to do so.

Almost half said their firm will “strive to diversify its supply chain over the next three years to reduce dependence on a single country source or manufacturing location”, with 41% specifying a desire to reduce dependence on China.

Similarly, almost three quarters of Asia Pacific business executives surveyed by law firm Baker McKenzie earlier this year said they were diversifying the geography of their supply chains.

Recent high-profile examples of supply chain shifts include Nike and Adidas’s relocation of most manufacturing from China to Vietnam. Samsung and Hasbro also shifted part of their production away from China and into Vietnam and India in 2019.

But executives in North America and Europe are finding that while the logic of reshoring – or nearshoring, for example to Mexico or Canada – stacks up, the practicalities of shifting production can be a nightmare and the best of intentions are sometimes on a collision course with the bottom line.

“What was once largely a binary choice – the logistical convenience of manufacturing domestically versus the cost savings to be gained by offshoring – has evolved into a more complex and nuanced set of decisions,” says Kearney’s 2020 reshoring index, published in April this year.

“Since we first published our annual reshoring index report in 2013, these statements from businesses regarding considering reshoring didn’t translate very often into meaningful shifts, as our index proved year after year,” Patrick van den Bossche, a Kearney partner, tells GTR.

But the US-China trade war and outbreak of the pandemic in early 2020 have this time pushed businesses into gear, he says.

While some firms that are reliant on China and other low-cost Asian manufacturing hubs have shifted some production to, or at least nearby, the US, the overall picture is more complicated.

“We’re also seeing clients that were already primarily manufacturing in the US, now pursuing options in Asia or Mexico, to spread the risk and overcome labour and raw material shortages that have been plaguing US manufacturing,” he tells GTR.

“So what we’re seeing is a push towards regional diversification that results in ‘and’ versus ‘either/or’ decisions regarding where to manufacture or source products.”

China’s share of low-cost manufacturing imports into the US has dropped from around two thirds in 2016 to 56% today. Van den Bossche expects that decline to continue but doesn’t see it falling below 50% due to China’s ongoing advantages and scale that cannot be matched by any single competitor.

“Given the scale of the concentration of manufacturing in China, it is extremely challenging for firms to unwind their entire supply chains due to the established reliance on the region,” says Oliver Chapman, chief executive of London-based OCI, a supply chain procurement advisor with a focus on Asia.

The ease of supply chain shifts also depends partly on the specifics of each industry. China has built deep reservoirs of knowledge in high-tech manufacturing, for example, that are yet to be matched in competitors such as Vietnam.

Relocation within China is also an option for those motivated mainly by cost rather than fear of reliance on the world’s second largest economy. Costs are lower in the industrialised northwest of the country than in the southeast, which remains a manufacturing powerhouse but where incomes are rising more sharply.

“I don’t think I’ve had one supply chain relocation type matter yet where you’ve been able to lift all the operations out of one jurisdiction and set up in another,” says Anne Petterd, Asia Pacific head of international commercial and trade for Baker McKenzie.

“There are always things that need to be done in different ways, particularly when you’ve got a complex supply chain,” she tells GTR.

Executives may also be prepared to put up with anxiety over supply chain risks when presented with the costs involved in moving production or sourcing domestically.

“It’s one thing to say ‘I’m going to put a manufacturing plant next to my distribution centre, which is really close to my customers’, but that doesn’t necessarily always work – because you still need to be profitable,” says Olaf Schatteman, a supply chain expert with consultants Bain & Company.

It also doesn’t totally foreclose supply chain risks. An Australian company with a factory in Sydney is still at risk of a pandemic-related shutdown as one with a factory in Shanghai, he points out.

If not China, where?

As the Vietnamese workers bedding in on factory floors can attest, the contest to be runner-up Asian manufacturing hub is in full flight.

Vietnam, the Philippines, Cambodia, Thailand, India, Sri Lanka and Bangladesh and Malaysia are frequently cited as the countries that are most likely to gain from any decline in China’s manufacturing status.

Asia Pacific states offer a wide array of incentives to woo foreign investment, many of which pre-date the current supply chain disruption and concerns about China. The 15-member Regional Comprehensive Economic Partnership, a trade deal signed last year, also promised to knock down intra-Asia trade barriers.

Many countries in the Association of Southeast Asian Nations (Asean) offer generous tax concessions of between 5-10%. In others, cash grants or region-specific incentives are available.

“Countries like Vietnam and Thailand have so far been the winners of the US-China trade war,” says Schatteman. “They offer a similar level of cost. In fact, China is not even the lowest cost country anymore.”

A survey of European businesses published in June by Standard Chartered found that there is strong interest in Malaysia and Thailand as both production and sales markets, but of all Asean states, Vietnam attracts most interest.

“With regards to manufacturing products, there is a clear winner – Vietnam,” says OCI’s Chapman.

Van den Bossche says Vietnam has benefited from a surge in investment by manufacturers, including those in China, over the last five years. The communist government has also ramped up spending on infrastructure such as ports.

“As Vietnam’s manufacturing came up to speed just as the previous US administration started the US-China trade war, they didn’t have to resort to major incentive schemes to attract companies since they became a ‘natural’ alternative and were able to reap the benefits of these infrastructure investments,” he says.

Still, he points out Vietnam’s 96 million people are not even a tenth of China’s population, putting “a bit of a ceiling on how much more Vietnam can pick up”.

But everyone expects China to maintain its primacy for a long time yet. It continues to incentivise new manufacturing, with a range of subsidies and other inducements on offer in various cities and regions. “Building a presence in mainland China is now becoming much easier,” says Derrick Chen, a tax partner with EY, in a March paper.

China’s enormous domestic market, unmatchable even by the fastest-growing Asian tigers, is also a strong pull factor.

Rising labour costs can also be neutered by the bane of factory workers the world over: robots. “If you walk around in many, recently started, Chinese manufacturing plants, you’ll actually see more automation than in many manufacturing plants in the US, where investments in automated equipment have been relatively tepid over the last decade or so,” van den Bossche points out.

And a keenness to diversify supply chains in Asia may also come into conflict with environmental and social welfare issues that are a growing source of anxiety for trade-exposed companies, especially those in rich nations.

Companies concerned about pollution from supply chains and issues such as working conditions and forced labour will have to tread carefully in Southeast Asia, where standards vary markedly by jurisdiction, despite the common Asean link.

Bangladesh and India are deemed to be “extreme risk” states for modern slavery by consultancy Verisk Maplecroft, while Vietnam and Cambodia are categorised as high risk. In June the US government added Malaysia to its list of worst offenders in its annual human trafficking report, alongside countries such as North Korea, Eritrea – and China.

“Particularly for consumer facing goods, more and more there is pressure on businesses to have looked at these ESG issues across their supply chain,” says Petterd. “That is a particular inhibitor in moving to some jurisdictions, just because they might be low cost.”

Resilience with profits

Interest in relocating supply chains has also been spurred by resilience worries. Spiralling shipping costs – the Drewry World Container Index was at press time up more than 300% on last year – and the shutdowns and shortages that featured during the pandemic have focused the minds of importers.

In the Baker McKenzie survey, 91% of respondents said they “are building in greater flexibility and contingencies to switch supply lines if needed”.

Governments, too, are looking closely at countrywide vulnerabilities that can be so severe they threaten critical supplies. Facing trade hostilities from China, the Australian government announced grants in July of up to A$2mn to businesses that are trying to create domestic production capacity for medicines and agricultural chemicals. A government commission found earlier this year the country was dependent on China for some critical imports in those sectors.

Japan, Australia and India have also formed a “supply chain resilience initiative” that is designed to boost trade between them while curbing reliance on China. India’s commerce and industry minister, Shri Piyush Goyal, said in a June 30 speech that “India will be playing a much greater role in the post-pandemic world in creating resilient supply chains”.

For companies, the first step to boost resilience comes from understanding their supply chains, says Baker McKenzie’s Petterd. Until recently, many firms did not thoroughly study their own supply lines if they were mainly outsourced and running smoothly, she says.

Investing in supply chain transparency, and geographically distributing supply chains, are other key steps, says van den Bossche. A strategy known as “China plus one”, to integrate an additional country to reduce dependency on China, is gaining popularity, according to the surveys. But if stronger supply chains mean higher costs, some businesses’ commitment may wobble.

Schatteman says that when once supply chain and procurement managers who went to their board would have been bombarded with questions about costs, they are now being quizzed “around risk, and resilience and exposure to environmental impact”.

“Resilience has definitely gained in importance but many companies still struggle to convert that into dollars and cents that can be used in an investment case that justifies moving manufacturing back to the US.”

He says that approach is short-sighted, and that lower unit costs won’t translate into profits “because you can get hit by low resilience in your supply chain”.

“You might have nine months of really cheap input materials, but all of a sudden, you get a hiccup in the supply chain, and you lose all that profit in three months.”