Thomas Dunn, chairman at Orbian, provides insight into the working capital benefits of Orbian supply chain finance that can help companies satisfy their corporate ESG agenda.

The Covid-19 pandemic has been the defining event of the past 18 months. As we reflect on the tragic consequences of the pandemic, we might also draw some comfort that there have been outcomes with potential for a long-term more positive impact on the planet and humanity.

The pandemic has shown our adaptability, as individuals and businesses. We redefined the notion of international travel, reinvented the way we work, and importantly, focused our attention on an even more existential crisis: climate change. The pandemic has accelerated the pace of the climate agenda and the imperative need to create business models that offer sustainable initiatives.

The miracle of the vaccine development and rollout has demonstrated that even our greatest challenges can be overcome when humankind applies our collective problem-solving capabilities. The climate problem calls for a similar unified front and the scale of the mobilisation to counter the pandemic must be matched by a sustained commitment to tackling the climate crisis. People and businesses have been required to assess their priorities, and addressing climate change is no longer just a trend to be followed, but rather a fundamental reassessment that must be actioned.

SCF to empower supply chains’ green transition

I was part of a recent panel discussion on the role supply chain finance (SCF) can play in improving sustainability outcomes within supply chains. We opened the session with a poll asking the audience to rank their priorities amongst several options. ‘ESG’ (environmental, social and governance) came third, with ‘working capital management’ and ‘supply chain management’ both ranked as higher priorities.

This reflects a broader principle that we aim to promote at Orbian and that we think is important for all companies as they serve their clients: respect the choices and priorities of those that you serve. We can choose who we serve and strive to incentivise best outcomes, but humility and an absence of judgement need to underpin the respect a successful company has for its customers and other stakeholders.

It is our role as an SCF firm to provide a suite of services that will allow buyers and their suppliers to collaborate in order to meet their mutually established goals. At their core, those goals are increasingly going to involve ESG initiatives. New environmental legislation and regulations across the world are going to become very important and SCF providers can play a decisive role by connecting buyers and their suppliers and providing them with transparent tools of collaboration, allowing facilitation between those supply chains and the communities that they are serving.

At its heart, SCF is about providing suppliers with access to liquidity and funding that enables them to manage their own business on capital terms that are more favourable than they would normally achieve. We can do all of this in a way that does not require a trade-off between working capital and ESG, but instead allows us all to create those sustainable goals and to allow buyers to do what they want to do without ever being accused of being coercive or “going green by being mean”.

We believe supply chains are one of the most important levers for businesses to have a positive impact across a broad ESG agenda.

A sustainable SCF programme typically involves incorporating ESG criteria into funding conditions. Suppliers are rewarded if they perform well against certain criteria, getting access to better rates or to the financing programme. This is a “carrot” approach that uses existing SCF solutions to reward ESG-compliant suppliers. This provides incentives for suppliers who are driving positive changes and disincentives for those who underperform, and does so in a way that has long-term benefits for all parties.

Knowledge is power

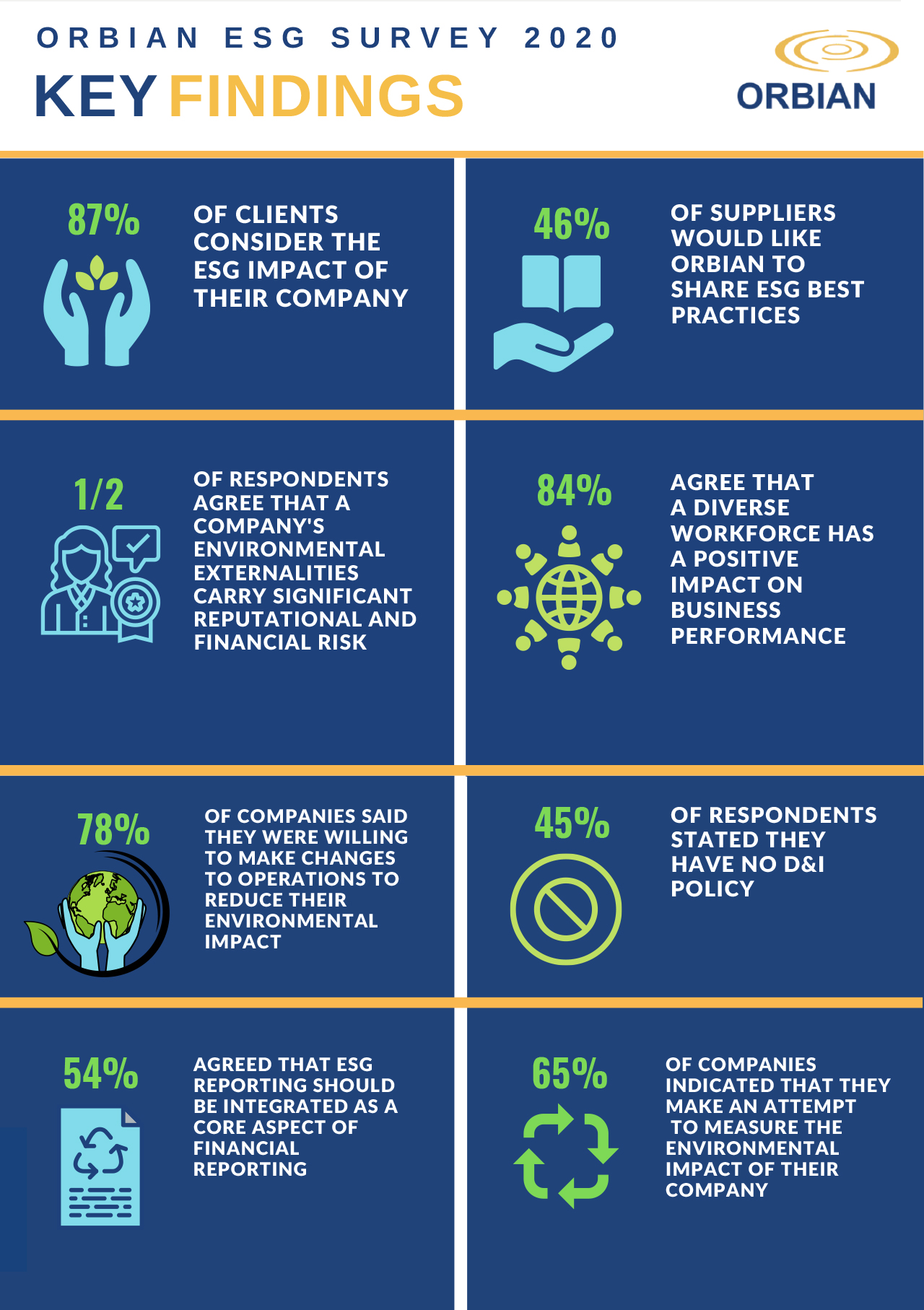

Data is essential to establish goals and measure progress towards achieving them. Orbian released its first ESG eport in March 2021, following a major research initiative we launched in November 2020 to create a profile of our transactions and our suppliers.

This report is divided into two parts. The first part is a review of the current ESG initiatives and perspectives within our client base of 6,000 suppliers. These suppliers are located in over 60 countries and operate in 22 different industries. The second part of the report is an overview of the core mechanisms by which we believe SCF can assist in broader enterprise-wide initiatives designed to advance the ESG agenda for our clients and their suppliers.

Orbian’s ESG report is available for download on our website. Visit https://orbian.com/research-report/