A strong local economy, expanding trade flows and an influx of commodity merchants are fuelling growth in the UAE’s trade finance market. Most local banks are seeing steady increases in lending and fee income. But the demand for credit is attracting new market entrants, intensifying competition and putting pressure on margins. Jacob Atkins reports.

Trade finance in the UAE is booming.

The construction of skyscrapers, roads and public and commercial buildings across the country’s desert metropolises is drawing in imports of steel, aluminium and cement from around the world.

Exports are also ramping up, according to government data, as years-long efforts to diversify the country’s economy away from its oil-dominated base begin to bear fruit.

And not all trade businesses are directly involved in UAE-bound imports or exports. Dozens of free trade zones scattered across the country house thousands of companies that use the UAE’s strategic location to buy goods from one country and sell them to buyers in another. Trade between Asia and Africa, especially, is often routed via the UAE.

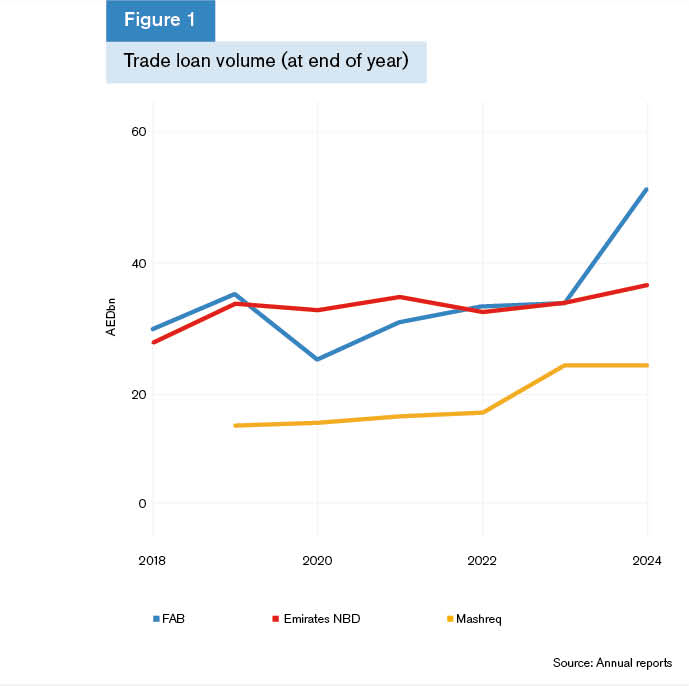

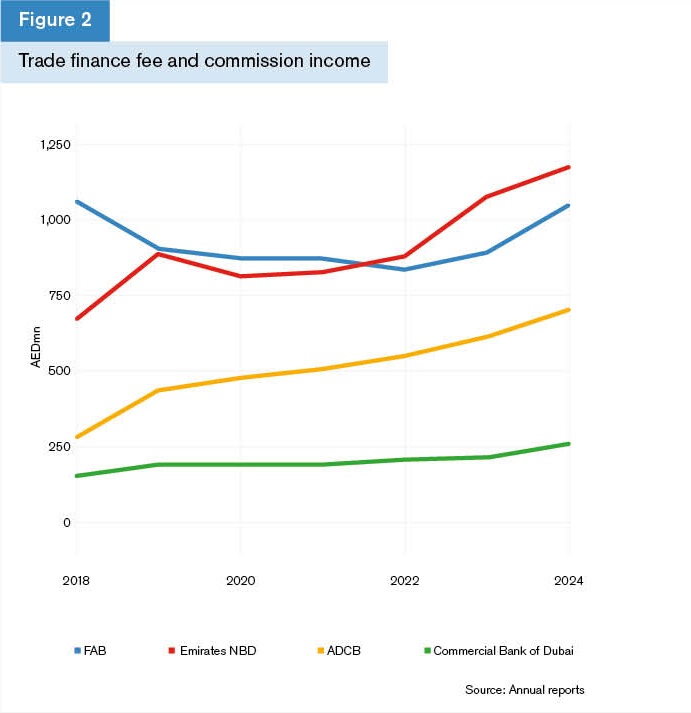

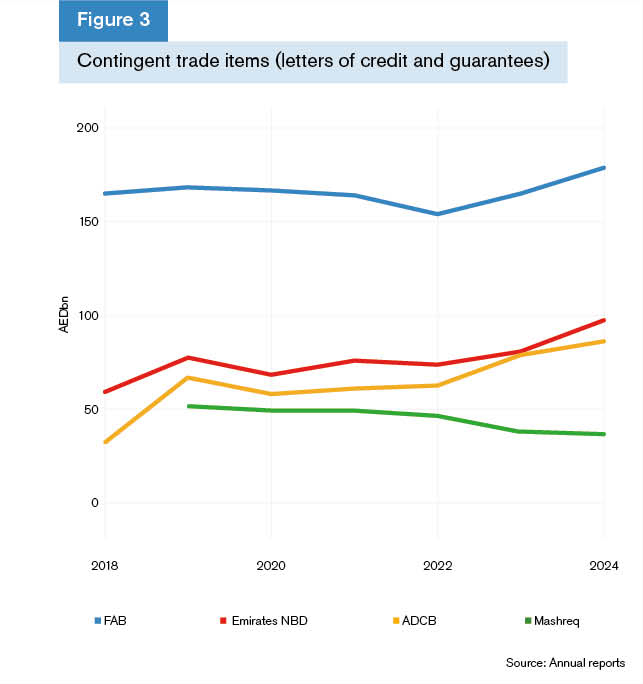

Banks are riding the wave. Lenders across the UAE have reported a near-universal uptick in trade loan volumes, fee and commission income, and off-balance sheet trade products like letters of credit (LCs) and guarantees. Islamic trade financing is also proving popular.

The Middle East, and specifically the Gulf Co-operation Council countries, “is the best performing sub-region across the globe” for trade finance, says Crisil Coalition Greenwich’s Avinash Bhatia, adding that the UAE is the engine of that growth.

First Abu Dhabi Bank (FAB), the UAE’s largest lender by assets, grew trade loan volumes by AED12.77bn (US$3.47bn) in the first three months of this year, its April quarterly report shows. The bank’s trade loan volume of AED63.26bn, as of March, is almost double the AED32.19bn it reported at the end of 2020.

The “key driver” in the expansion of FAB’s corporate and financial institutions trade loans books has been a “thriving” supply chain and receivables finance business delivering high double-digit annual growth, says Anirudha Panse, the bank’s head of trade finance product innovation.

New products have helped the performance of the commodities desk, Panse tells GTR. Reserve-based lending, financing secured by oil and gas assets, “has been instrumental in leading some large and complex deals for our clients”, he says, adding that distribution has also helped fuel growth.

FAB’s trade contingencies, which include LCs and bank guarantees, reached AED177.95bn at the end of last year.

This was well ahead of second-place Emirates NBD, whose trade contingencies stood at AED97.14bn, and have seen an almost constant uptick since the end of the Covid-19 pandemic.

At Abu Dhabi Commercial Bank (ADCB), the UAE’s third-largest bank by assets, according to The Banker, LCs and guarantees swelled from almost AED34bn in 2018 to AED86.3bn at the end of last year.

The fees and commissions banks earn from trade finance activity are accelerating too, albeit not at the same pace as volume. Of the banks that disclose the metric, Emirates NBD surpassed AED1bn in fee and commission income in 2023 and grew the stream by another AED100mn last year. FAB took in AED1bn in fees last year, a 17.3% jump over 2023.

ADCB and the Commercial Bank of Dubai (CBD) have also improved their fee and commission intake every year since the pandemic.

Economic growth in the UAE is not a recent phenomenon, but the constant investment in stimulating parts of the economy unrelated to its massive oil reserves is yielding results, according to Hamayoun Khan, head of transaction banking at CBD.

He says that many of the tens of thousands of new companies that have been set up in the country “have graduated to a certain scale” and are contributing more to GDP and goods flows.

Khan also cites government initiatives such as the comprehensive trade deals the UAE has signed with the likes of India, Indonesia and Turkey as sources of growth, as well as a plan by the government of Dubai – one of the UAE’s seven emirates – to double its GDP by 2033.

“It is all stepping up and up, yielding the sort of [trade] volumes that we have seen. The requirement for trade financing, which is largely being contributed by the banks, is an outcome of this entire drive.”

LCs still dominate the trade finance product mix, Khan says. Demand from the construction industry in particular means there has been a “huge opportunity for guarantees”.

The trade opportunities on offer in the UAE and the wider region are attracting more and more overseas banks to the country.

The number of banks servicing the trade corridor between the UAE and Asia in particular is growing, says Ruchirangad Agarwal, head of corporate banking for Asia and the Middle East at Coalition Greenwich. The organisation’s surveys show that corporates are upping the average number of banks they use to conduct Asia-UAE trade, Agarwal says, with Chinese and Japanese lenders among those most cited by corporates.

While long-standing trade banks such as HSBC and Standard Chartered have been active in Dubai and Abu Dhabi for decades, Agarwal says expanding trade corridors are also enticing lenders from regions such as Latin America and Canada.

Overseas financial institutions with branches or entities in the UAE include most of the largest Chinese, European, Japanese and US banks, as well as the likes of Maybank, The Access Bank, the State Bank of India and Malta’s Fimbank.

As overseas banks expand their headcounts and seek out new business, and incumbent lenders try to bolster their product suite, competition is building.

“Just to grab the pie, they are either pumping in cheap liquidity or offering a lot of fee waivers so that they can win that relationship,” Bhatia says of recent entrants.

CBD’s Khan tells GTR the market is “very, very competitive. There are a good number of banks which are chasing the same wallet for the large corporate and institutional base that we have in the country.”

Margin pressure?

Competition for business among lenders may please their customers, but it could be dampening earnings.

“The volumes are growing at a very fast rate, but the revenues obviously are not growing at the same pace,” says Bhatia. “Because of all the new entrants that are coming into the market, there is tremendous margin pressure.”

FAB’s Panse says that “increased market competition is indicative of a healthy, expanding economy, creating opportunities for all players”. But he warns: “Entering the market solely with a strategy of reducing margins is a short-term approach that does not foster sustainable growth.”

“We have been able to grow our trade business in spite of pressure on margins,” he says.

None of the major UAE banks surveyed by GTR report interest income from trade separately, but it is likely to comprise at least half of total trade finance revenue at most institutions.

Coalition Greenwich’s Agarwal says the competitive landscape is being made tougher due to a “convergence” in the roles of local versus foreign lenders. Historically, “it was very clear local banks had their niche, the international banks had their niche”, he says.

Local banks tended to be relationship-focused and corporates would score them highly on the quality of those relationships. International banks may have had a greater product range, but would be more hemmed in by policies and processes dictated by head office.

Very recently, Agarwal says, corporates have described those differences as becoming less pronounced. Local banks have enhanced their products and digital capabilities, but are also stricter with policies and rules. At the same time, foreign banks are becoming more flexible.

Local lenders are “concerned now that there is increased competition from the foreign banks in the region, and that is where they are trying to improve their service or invest in digitisation so that they can retain that market share and not lose to the foreign banks”, Bhatia says.

Corporates see effective digital platforms as an important consideration when selecting their banks. “Banks that bring that nice and shiny platform to them will definitely tend to win a lot more trade business,” says Agarwal.

Lenders in the UAE are investing in digital interfaces for their trade customers. ADCB says in its most recent annual report that almost two-thirds of its trade finance transactions were carried out on ProTrade, a proprietary platform it launched at the end of 2018. FAB says it is migrating corporate customers to its FABeAccess platform, which includes access to trade solutions.

Commodities hub

In recent years, the UAE has consolidated its position as one of the world’s main hubs for commodities trading, alongside the likes of Singapore and Geneva.

The Dubai Multi Commodities Centre, a commodity trading free zone housed in the 68-storey Almas Tower in Dubai, says it is home to more than 25,000 companies.

UAE lenders have frequently featured in syndicated deals for major commodity traders, such as Gunvor, Trafigura and BB Energy.

Earlier this year, FAB and ADCB played leading roles in a US$232.5mn facility for commodity trader BGN, in which smaller UAE banks such as the National Bank of Fujairah and the National Bank of Ras Al Khaimah also participated. The deal was supported by the Abu Dhabi Exports Office, which is tasked with boosting the country’s non-oil exports.

But financing these commodity flows is still an area where foreign lenders and non-bank finance providers appear to retain an edge over their local counterparts.

“UAE banks have become more active and participate in more deals than before,” says independent commodity trade finance analyst Walter Vollebregt. But he adds that “they seem to focus mostly on the large traders where they can participate in a revolving credit facility, term loan and sometimes a borrowing base facility”.

Rebekah Fajemirokun, head of trade finance at ASTR Trading, an Africa-focused commodity trader launched this year, says UAE banks tend to have little interest in financing individual or occasional trades.

“UAE banks are still largely balance sheet lenders. For commodity traders without a net worth north of US$500mn, the chances of securing transactional financing are slim – even when the trade itself is well-structured and the counterparty risk is low,” she tells GTR.

“That’s the key frustration: the risk assessment is driven more by your financials than by the actual transaction. Just because a trader has a smaller balance sheet doesn’t mean the deal carries more risk – especially when it’s backed by performance history, secured receivables or trade credit insurance,” she adds.

While the so-called “flight to quality” of banks away from mid-size or smaller commodity traders is a worldwide reality, Fajemirokun says that in the UAE, it is also partly due to a commodity trade finance “knowledge gap” compared to more established hubs such as Switzerland. Although she believes the disparity is narrowing as the commodity finance market in the country grows.

UAE banks are useful for financing exports through products such as LC discounting and confirmation for countries where it can be difficult to obtain financing, such as Pakistan, she says.

But for import LCs, banks will often require 100% cash collateral for import LCs. From a trader’s perspective, Fajemirokun says: “You start asking: why not just use your own cash and prepay the supplier, particularly if they’re better rated than you in terms of balance sheet and performance history? Trust is clearly a pivotal factor in such a decision.”

As a result, many traders turn to trade finance funds active in the country, which typically have a bolder risk appetite or specialism in commodities, but charge higher premiums.

But Fajemirokun says that as more traders move their base to the UAE “we’re seeing a slow shift. But it will take time – the mindset is still very much conservative, and transaction-based financing remains the exception, not the norm.”

As in many markets, medium-sized trade businesses are more likely than smaller SMEs to win banking services.

Khan, of CBD, says that due to fierce competition for large, institutional clients, banks may increasingly view SMEs as an “engine of growth”. However, he cautions that any expansion into this segment will depend on whether that business can provide better returns on a risk-adjusted basis.

“There is a variance between small businesses and medium enterprises’ abilities to access cheaper finance, but I still believe that there is an ample opportunity for small business. But yes, at a higher cost as compared to the middle market client base,” he says.