Despite global headwinds, corporates in the Middle East are growing more confident, expanding beyond domestic markets and demanding stronger digital, liquidity and sustainability solutions from banks, says Crisil Coalition Greenwich’s Ruchirangad Agarwal, head of corporate banking, Asia and the Middle East, and author of a new report.

GTR: Based on interviews that Crisil Coalition Greenwich conducted with Middle East companies and the report you co-authored recently, how would you describe the overall sentiment among corporates in the region right now, and what factors are shaping that outlook?

Agarwal: Of all the regions where we speak to corporates globally, the Middle East is the one where corporates have consistently been the most optimistic about the near-to-medium-term business outlook. In fact, this optimism has increased in recent years despite the geopolitical and macroeconomic challenges faced globally and within the region. For example, at the end of 2024, 44% of corporates were ‘very positive’ about the business outlook compared to 29% a year previously.

GTR: In what ways are Middle East-based firms responding to the shifting dynamics of global trade?

Agarwal: Despite the global headwinds from trade tariffs, the risk to firms in the Middle East is somewhat mitigated as newer trade corridors into the region strengthen.

One indirect impact of tariffs – not the latest round but those introduced for China during the first Trump administration – along with other factors, was the diversification of supply chains. Companies in China, and more broadly across Asia, expanded their market presence into regions such as Asean, the Middle East and Africa. We now see a very clear and robust trend of companies in Asia increasingly doing, or planning to do, business with the Middle East. Similar trends can be observed in the Europe-to-Middle East trade corridor as well. This has proven to be a significant tailwind for the Middle East’s regional economy.

GTR: How are companies in the region thinking about capital strength and balance sheet resilience in today’s environment?

Agarwal: The main focus for companies in the Middle East today is growth within the region. Many are becoming increasingly ambitious, expanding from a largely single-country footprint to a more regional or GCC presence and beyond.

At the same time, CFOs are paying close attention to balance sheet resilience. Despite top-line growth, the cost of credit remains high compared to what companies have been used to in recent history, making managing the balance sheet a top priority just after revenue growth.

There is also a renewed focus on bringing in discipline in the cash conversion cycle and on efficient liquidity management.

GTR: How are corporate expectations changing when it comes to banks’ digital capabilities, and what are some of the key features they’re looking for in trade finance and cash management solutions?

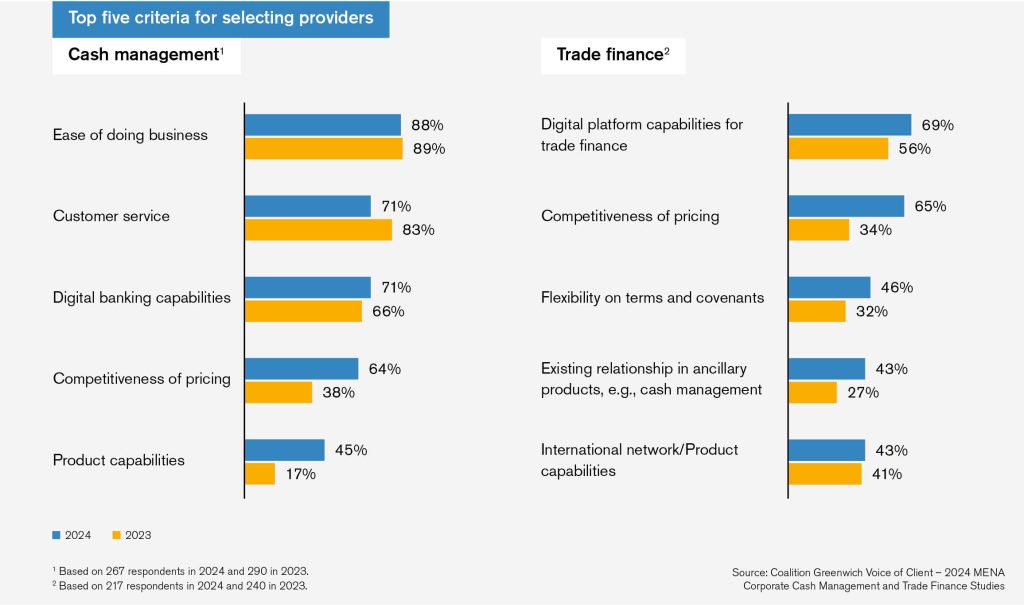

Agarwal: Digitisation remains a major investment focus for corporates in their own operations. They also expect their banking partners to offer top-tier digital capabilities in transaction banking. In fact, 71% of corporates highlighted digital capabilities as a key selection criterion when choosing a cash management provider, and 69% say the same for trade finance.

As we discussed earlier, liquidity management is a key focus area for corporates, especially as they expand internationally and establish subsidiaries in various jurisdictions. This increases the need for robust liquidity management systems. While global banks typically excel in this area, leading local banks are now investing heavily in order to catch up. Real-time or near-real-time cross-border payment capabilities are another priority as a result of the higher velocity of payments from their own customers and the increasingly cross-border focus of many corporates.

In trade finance, the biggest focus is, of course, to make documentary trade less paper-heavy through more digital workflows. Within this, user experience is a particular focus, with close to 25% corporates saying that UI/UX is the most important area of improvement they expect from banks. This is followed by faster processing and lower latency, and the ability to track transaction status in near real time.

GTR: What trends are you seeing across different sectors or markets in the region? Are some industries more bullish or better positioned than others?

Agarwal: Right now, the Middle East is facing tailwinds that are secular in nature. It’s a case of a rising tide lifting most, if not all, boats. We see firms across industries benefit from growing regional economies, increased cross-border trade with Asia and Europe, as well as an influx of global talent as a result of favourable immigration policies in some key countries.

GTR: How should banks and other trade finance providers interpret these findings? What opportunities or risks should they be paying attention to?

Agarwal: While the Middle East is booming, with many international banks entering the fray and increasing competition, as far as trade finance is concerned, there is room for banks to differentiate themselves by bringing their full suite of product offerings available in other markets. Most of the focus for investments by banks in recent times has been on cash management and growing the lending book. Traditional trade is still very manual and more efficiencies and digitisation can be brought in.

Supply chain is the next frontier that needs to be explored further by banks as global supply chains increasingly flow via the Middle East – for example, as a gateway into Africa. The risks that global banks need to be cognisant of are operational risk areas such as anti-money laundering and sanctions risks. Local banks are also increasingly closing the gaps with their international peers on aspects like digital and cross-border capabilities.

GTR: Are there any findings from the study that surprised you, or that you think are particularly important for financial institutions and policymakers to take note of?

Agarwal: One area that was interesting to us was the focus on sustainability that corporates and local policymakers have. Amongst the companies we spoke to in the Middle East, around 55% have formal ESG goals, rising to 70% amongst the larger firms. There is a very conscious push into sustainability as the largest economies of the region, Saudi Arabia and the UAE, diversify away from oil and gas. From a corporate treasury point of view, that commitment manifests mainly in the form of the use of sustainable loans and bonds. Of the companies currently using ESG products from banks, 61% are utilising sustainable loans and bonds.

However, a growing share of companies (44%) is also relying on banks for broader ESG advice and solutions.

These nascent but growing advisory relationships present an opportunity for both companies and banks. Companies are realising that they don’t have to reinvent the wheel and that their banks have existing solutions to help the firms achieve their sustainability targets. So far, global banks have led the way in partnering with companies on sustainability, but there is now increased activity among local Middle Eastern banks as well. They are building out capabilities at a rapid pace and reaching out to large corporates to initiate conversations on sustainability in an effort to increase their wallet share.