Chris Hall, Senior Underwriter, Financial Risk Solutions at Liberty Specialty Markets and Consortium Manager at London Credit Consortium, sheds light on Toredo, the new underwriting platform bringing digital efficiency to trade credit and political risk insurance.

Trade finance has long been an asset class of great interest to insurers; it is critical to a functioning economy, with the working capital support it provides being the lifeblood of importers and exporters. The importance of trade finance to corporates and by extension their banks, makes it a vital business for all areas of financial services to support.

Transactions in the trade finance industry exceeded US$9tn in 2017, despite which there is a well-established trade finance funding gap. The Asian Development Bank’s survey estimates this at US$1.5tn as of 2016. Much of this impacts the small to medium-sized enterprise end of the market. So whilst there is already lots of potential for all market participants, there remains a considerable upside if this funding gap can be addressed adequately.

Allied to the importance of trade finance are the extremely low loss ratios associated with this type of business. According to the International Chamber of Commerce, Export Letters of Credit between 2008 and 2016 have an exposure-weighted default rate of 0.03% and an expected loss of 0.01% (c. US$150mn out of US$1.49tn), while Loans for Import/Export have a default rate of 0.22% and expected loss of 0.07% on the same basis. On a rhetorical note, why would banks not want to support their clients with this business and consequently why would an insurer not want to support their banks and corporate clients?

Having established that trade finance is an asset class that many insurers wish to support, we then have to look at the ease of access to the underlying transactions. Between 2008 and 2016, there were in excess of 20 million transactions across trade finance products. Being able to handle volume such as this would normally necessitate sizeable operations teams, as demonstrated by the middle and back-office operations of our banking and corporate clients. Given that most insurers still adopt the traditional method of offline underwriting, negotiating face to face with their clients or their brokers, a consequence of this volume is that if insurers wish to be involved in this market there is an opportunity cost of doing so.

The digital solution

Efficiencies linked to digitalisation are estimated by BCG to drop the costs of doing trade finance business by US$6bn over a three to five-year time horizon and drive up trade finance revenues by 10%. In the same paper, BCG also estimates that documentary trade alone generates 4 billion pages of documentation annually.

Digitalisation efficiencies such as these can make trade finance much more accessible for insurers. At Liberty, trade finance is an asset class that, due to the aforementioned volumes, we have traditionally found challenging to support. In isolation, underwriting huge volumes of short-term trade finance business is time consuming and inefficient, particularly in circumstances where we look to react to each individual deal that clients put in front of us on a case-by-case basis.

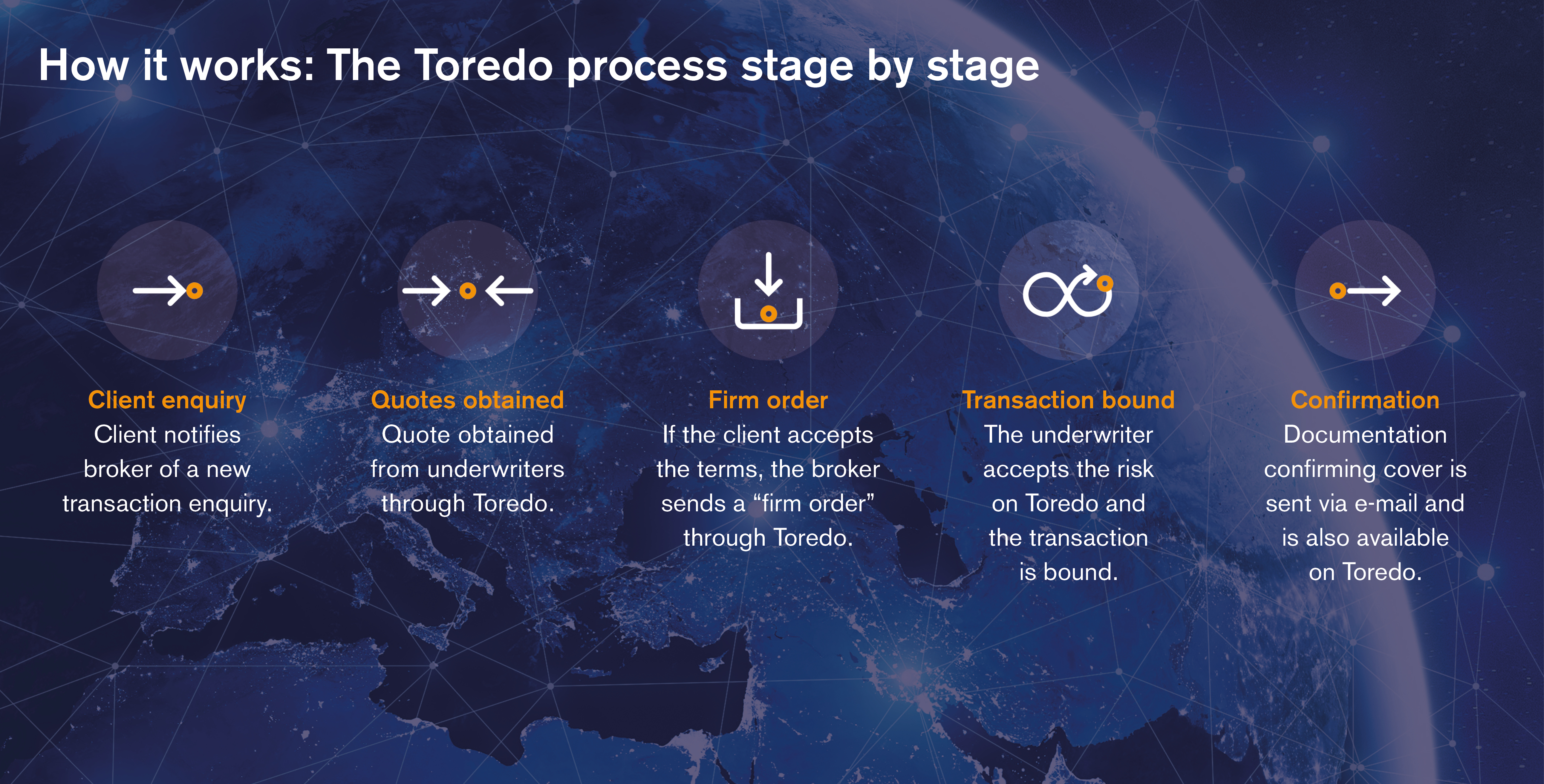

So in an effort to solve this problem, in March 2018, Liberty announced the launch of our Toredo underwriting platform. Toredo is available online through an internet browser and is the ‘shop window’ thorough which we can bring our insurance capacity for trade finance to the market, provide quotes and bind insurance against enquiries from our clients and brokers.

Insurance capacity is currently provided to Toredo by the London Credit Consortium (LCC), which is a partnership between Liberty Specialty Markets, Canopius and The Channel Syndicate. LCC has assessed bank and corporate obligors and uploaded a significant amount of capacity onto the system. Toredo also provides pricing for these obligors, bringing transparency to the market in a new and innovative way.

Brokers and clients are able to input transaction information in to Toredo and the system will provide an instant quote, which the client can request to bind immediately. The LCC underwriting team will then assess the transaction, accept it and bind cover, which is evidenced by the provision of an electronic declaration.

By providing pre-approved limits on a wide range of obligors and uploading that capacity to the platform, Toredo enables us to efficiently handle a large volume of transactions. The transparency the system provides on capacity availability makes for a far better experience for brokers and clients, but in case any questions come up during the binding process we also have a team of underwriters available for brokers and clients to access as they need.

We gain, and can share, further efficiencies through our binding process. By agreeing a master policy with our client and then binding through declarations attaching to that master policy, we remove much of the paperwork from the process, whilst at the same time being able to bind most transactions in minutes.

The future

The Toredo platform solves the volume and appetite paradox by allowing us to better support our clients with their requirements in this short-term business, whilst retaining our underwriting rigour and discipline, irrespective of the number of transactions we are asked to cover.

Future development plans for Toredo are varied. Toredo could be used, for example, to handle a trade facilitation programme for a client, where a number of other insurers join up with capacity alongside Liberty. Outside of trade finance within the political and credit risk market, the system could be used to bind insurance on more complex structures, which have been agreed offline.

With all these opportunities, it is the efficiency that Toredo can bring to the binding of transactions that sets it apart from the market. As the platform becomes more widely adopted we will undoubtedly find many more ways in which it can help our clients and brokers and we can bring an increasing level of automation to the insurance market of the future.

Benefits of Toredo

- Easy access to trade credit capacity for both brokers and clients.

- Obtain a competitive quote on Toredo within seconds.

- Underwriters can bind cover entirely on Toredo, speeding up the process and making it more efficient for all parties.

- Toredo provides an efficient mechanism for registered users to access the market in a new and innovative way.

- Underwriter capacity is already uploaded to the platform, streamlining the enquiry-to-bind process.

- Toredo is a secure system, which protects users’ data at all times.

- Whilst risks can be bound online, an underwriter is available for brokers and clients to access if required.

- Transparency on capacity availability makes for a better experience for brokers and clients.