Rebecca Harding, CEO of Coriolis Technologies, discusses Sub-Saharan Africa’s trade performance, its projected growth and developments around intra-Africa trade.

GTR: What impact will the Covid-19 pandemic have on Africa’s trade and how will the continent cope?

Harding: The global economic collapse caused by the Covid-19 pandemic will not leave Africa unscathed. At the time of writing, the data on infections for the region was at best patchy, and the human cost may never be known.

In contrast, the economic and trade costs will be obvious, if difficult to quantify precisely at this stage. The World Trade Organization (WTO) predicts anything between a 13% and a 32% drop in world trade.1 This is a broad range, but as the WTO points out, the impact of the trade conflict between the US and China, general global geopolitical uncertainties and lower levels of investment were already causing trade growth to slow in 2019. The Coriolis Technologies forecast in March 2020 for global trade growth in value terms for 2020 was a modest 3.7% which, given inflation rates of 3.5%, equated to a near-zero level of growth in volume terms.

For Africa, we were expecting growth of just 3.2% in export values and 0.2% in import values. The low value for import growth – the second lowest in the world after the Middle East North Africa (Mena) region – underscored the fragility of any demand-led growth for Africa, and suggests that the region was already under some pressure economically.

In October 2019, the International Monetary Fund (IMF) predicted GDP growth for Sub-Saharan Africa of 3.6% in 2020, compared to 3.2% in 2019. This reinforced the point that despite substantial efforts to reform national economies, overall the outlook even prior to Covid-19 was poor. It has now revised its forecasts for Sub-Saharan African growth in 2020 to -1.6%.2

Accurate data on the effects of Covid-19 on the region’s trade will not be available from public sources until long after the pandemic, so any attempts to assess the impact have to be based on an analysis of previous crises. There are two obvious benchmarks: the global financial crisis and the oil price collapse between 2014 and 2016.

What is common to both these events is the near simultaneous drop in oil prices, financial markets and global trade with a particularly severe impact on Africa because of the high correlation – at over 60% – between its trade and the price of oil (Figure 1). Hard commodities, oil and gas make up nearly 55% of all Africa’s exports, so this dependency on the oil price is not surprising.

It is the impact on the oil price rather than Covid-19 that is currently affecting Africa’s trade outlook.

However, what will make the longer-term impact of the crisis materially different is that it has been policy driven too – that is, it has been created by the fact that governments across the world, including in Africa, have almost simultaneously shut down production. This has created shortages in inventories and disrupted supply chains, but also had an immediate impact on consumer demand because people have been unable to work. Africa is likely to be very severely affected over a longer period of time because, as Figure 1 shows, the peak after the global financial crisis was short-lived in Africa and recovery after 2016 was proportionate to the oil price.

Based on this, the estimates for 2020 and beyond assume that the immediate impact in value terms will be at best similar to that of the global financial crisis and take a longer time to work through into a recovery for Africa than for the world as a whole (Figure 2).

The length of that recovery will depend on a number of other factors too: Africa as a continent does not have the income outside of oil and commodities to be able to afford a long lockdown. In April 2020, for example, Nigeria was urging its farmers back to work because it could not afford imports of food. Indeed, Nigeria, Uganda, South Africa and Kenya’s multi-billion-dollar cash injections all include subsistence cash support to their poorest communities.3 Against this backdrop, the region’s trade position is at best vulnerable in the future, and based on vulnerability that was already evident before the pandemic.

Several factors have driven Africa’s trade over the past few years. The oil price dominates these, of course, but the reduction in the value of trade between Africa and its largest trading partners outside of Mena between 2013 and 2018 was marked too. For example, trade with the US fell at an annualised rate of 9% during that period.

This reduction in trade with the rest of the world has made Africa increasingly reliant on internal trade. However, the infrastructure for intra-African trade is underdeveloped and this restricts the speed at which intra-regional trade has grown, and will grow, to help the continent out of the Covid-19 crisis.

As has already been said, in the end, many of the patterns and trends that were evident before the pandemic will make the region more vulnerable both during and after it. Africa is largely dependent on outside factors, such as the oil price and the trade policies and strategies of other countries. As an example, the levels of investment in China’s Belt and Road Initiative will undoubtedly be affected by the pandemic and broader geo-strategic concerns and, as the world will need time to adjust to the ‘new normal’ of post-Covid-19 trade patterns, there are manifest uncertainties that will disproportionately affect Africa.4

In the end, it will be the resilience of the region and its capacity to regenerate through intra-regional growth that will determine whether or not Africa will cope and recover. Structures like the African Continental Free Trade Area (AfCFTA) will need to flourish despite a global tendency towards greater protectionism and economic nationalism that has become evident through the pandemic. Given the difficulties that are inherent to multilateralism across the region, however, this serves only to illustrate the point that Africa’s trade and development is in the hands of agencies outside of the trade and trade finance community. If the continent is to recover, then this is no longer viable.

GTR: Has Africa’s trade ever recovered from the 2014-16 drop in oil prices and what does this tell us about how the continent might recover now?

Harding: Nowhere is the dependency on outside factors clearer than in Africa’s exports. In 2018 they were 27% lower than their value in 2008 before the financial crisis and this is due, at least in part, to the collapse of oil prices between 2014 and 2016. While African imports did not drop as much either in 2009 or between 2014 and 2016, this is because there was still relatively strong demand for infrastructure goods, real estate and the products associated with inward investment, particularly from China, as we’ll discuss later. In contrast, exports fared substantially worse than the world average. The oil price collapse caused a drop in world export values across the world of 16%; in Africa the equivalent figure was nearly 42%.

However, the huge drop should not be explained solely in terms of lower oil prices. At the same time, Africa’s trade with many of the countries with whom it had built strong trading relations fell back, including that with the US, Germany, France and the UK (Figure 3).

The picture of a region struggling to recover is painted clearly in Figure 3. Exports grew over the period predominantly to the UAE and Belgium, and, to a lesser extent, to India and the Republic of Korea. What is interesting about this is the fact that the UAE and Belgium are both similar ‘trade hub’ nations – they have large ports and do not consume anything more than a small proportion of the goods that they import. The region’s largest export sector to both destinations was precious metals and stones (largely gold, silver and diamonds), rather than oil. These commodities have been less prone to price fluctuations in the past few years, which may explain why they have done relatively well, albeit not well enough to shield the region from collapsing oil prices or to protect exports to Switzerland – another major destination for precious metals.

In terms of imports, the only growth has been with China and the UAE. Imports from China are in electronics, machinery and equipment and automotives, and from the UAE are predominantly in mineral fuels with electronics and automobiles also top sectors. In neither case have imports reached their pre-2014 levels and this presents a more worrying picture for the region: if imports from outside of the region are not growing quickly it suggests that demand has not recovered to the level it was at immediately before the oil price collapse, in spite of efforts by individual governments to reform their economies.

There are two issues that present real risks to the region from this. First, the immediate growth in Africa after the financial crisis was driven by strong interests from the US and Europe in terms of the potential of Africa as well as high oil prices. The geopolitics of trade have shifted significantly in the last five years and global priorities, particularly those of the US, do not rest in trade with Africa at this time. The fact that the US has fallen back as an export and import partner serves to highlight this point and helps explain why Africa has increasingly looked to the Middle East and China as trade partners. Second, persistent weak demand is a major concern for any recovery beyond Covid-19. This rests on effective reform strategies by national governments to bolster communities and local and national economies through a period of recovery, the duration of which cannot be known because of its dependence on finding a cure or a vaccine.

GTR: Are there any differences in intra and extra-regional trade trends?

Harding: Intra-regional trade in Africa is roughly one-tenth of the size of extra-regional trade, and recovered less quickly than extra-regional trade after both the financial crisis and the oil price collapse (Figure 4). Using similar patterns for trade as those in previous crises to project the likely momentum of global trade, it looks likely that intra-African trade will be more affected than extra-regional trade and take longer to recover post-Covid-19.

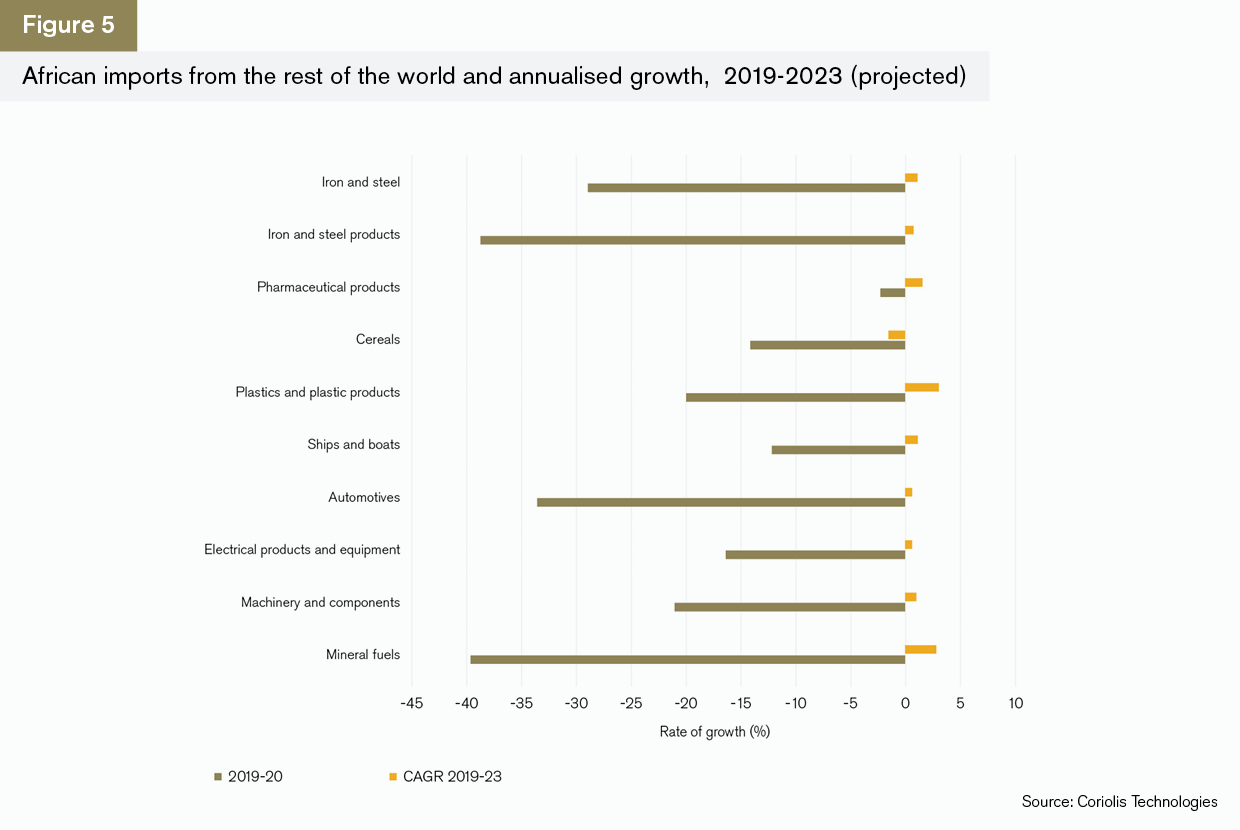

The reasons for the more sluggish recovery of intra-regional trade are largely to do with the core difference between intra and extra-African trade. Unsurprisingly, Coriolis Technologies projects a significant drop in imports across the board, but particularly severely in iron and steel products, mineral fuels and automotives between 2019 and 2020. Most of these sectors relate to trade and infrastructure in some form, but we are nevertheless expecting a very modest recovery over the next five years. This could mean that infrastructure projects within Africa that are reliant on external trade take longer to be built (Figure 5).

Similarly, we are expecting Africa’s exports to be affected severely by the Covid-19 crisis during the course of 2020, but to recover, albeit gradually, over the next five years (Figure 6). The two sectors which do not show signs of recovery over the coming period are iron and steel and mineral fuels, but as we are expecting the drop in intra-African trade this year to be less severe for these sectors (Figure 7), this is perhaps a contributory factor.

This is an intuitive conclusion. Quite apart from the fact that oil prices have dropped this year, the global flows of trade around the world have been deeply affected by port delays and cancellations, including blank sailings.5 As capital flows out of emerging economies and high levels of indebtedness continue, the effects of these cancellations will serve to damage the external positions of many African economies. This will inevitably mean that there is more dependency on internal trade, as it is less vulnerable to marine trade in particular.

GTR: In the wake of Covid-19, how important is it that the region ramps up its infrastructure development and reduces its dependencies on hard and soft commodity trade?

Harding: There is little question that Africa’s reliance on the exports of hard and soft commodities increases the dependency that the region has, not just on financial markets and commodity prices, but also on the geopolitical priorities of other countries. Trade professionals have expressed frustration with the lack of infrastructure for seaborne and airborne freight as well as for road haulage for many years and argue that this affects both intra and extra-regional trade.6

Imports of ships and boats are set to fall by 12% during the course of 2020 (Figure 5), and, although not shown in the chart because it is outside the top 10 sectors, railway infrastructure imports may fall by as much as 25% this year. Within Africa, and again outside the top 20 trade products, we expect ships and boats trade to fall by 18% over the next five years and trade in railway equipment to fall by nearly 11% over the same period. Building the infrastructure to support intra-regional trade has to be a priority of the AfCFTA if these forecasts are to become more positive, since trade between countries within the region is essential.

GTR: What role will China play in the emerging ‘new normal’?

Harding: China has played an important role in Africa’s development for many years. Much of this recently has been focused around the Belt and Road Initiative. Its investments over the years have been heavily oriented towards infrastructure, while Africa’s exports to China suggest that it plays an important role in China’s energy and supply route security.

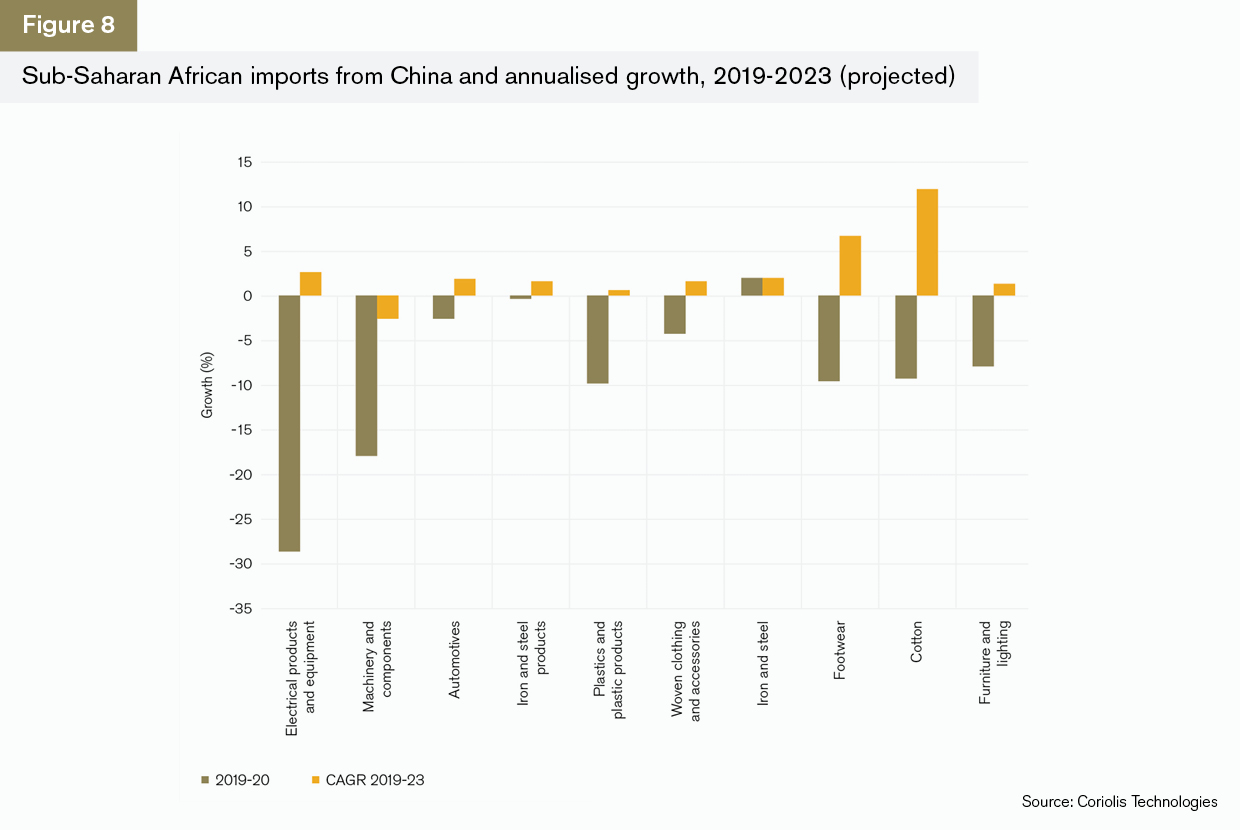

Like every other trade corridor at present, the 2019-20 picture is masked by the effects of Covid-19 and the projected slowdown in economic growth, although many of these patterns were actually visible before the full effects of the pandemic started to become evident. The projections by sectors suggest that imports of electrical products and equipment, as well as machinery and components, will be particularly severely hit as a result of the crisis, and these are potentially products that are keeping communications infrastructure running, since machinery and components includes computers. However, it appears that infrastructure construction, proxied through iron and steel products, plastics and automobiles (which includes trucks) will be less affected and recover more quickly. This may mean that, in spite of dire global economic conditions, Africa will still play a strategic role in China’s Belt and Road infrastructure construction, particularly with regard to routes through to the Middle East. The comparison of China’s investments in Sub-Saharan Africa and Mena serves to highlight this point.

Meanwhile, however, exports show that Sub-Saharan Africa’s importance to China is in the form of its economic and energy security (Figure 9).

Mineral fuels (oil and gas) is the largest export sector from Sub-Saharan Africa to China, accounting for some US$45bn of trade in 2019. Precious metals and stones (largely gold and diamonds) was a much smaller sector at some US$16bn in 2019, but it is set to grow substantially, even in the current climate. Mineral fuels are set to recover as prices improve over the medium term, while export values of precious metals and stones are set to fall.

This may suggest that China sees Africa as an important source of mineral fuels and that its trade volumes over time may return to their pre-Covid-19 levels. Figure 9 also suggests that copper exports will grow during the course of the year against the broader trend and as this is important in manufacturing processes, it points to the role that African commodity trade plays in securing raw material supplies for China.

The role of Sub-Saharan Africa’s trade in China’s overall Belt and Road strategy is underscored by the level and types of inward investment that China has undertaken in the region over the past 15 years (Figure 10).

What is interesting about Figure 10 is that it shows how China’s investment in Sub-Saharan Africa grew very rapidly immediately after the financial crisis and, despite a dip in 2016 when oil prices were low, remained relatively high up to the end of 2018 – although has since fallen off. In contrast, investments in the Mena region grew steadily to 2018 and were at a very similar level to those in Sub-Saharan Africa in 2019, although also falling back somewhat.

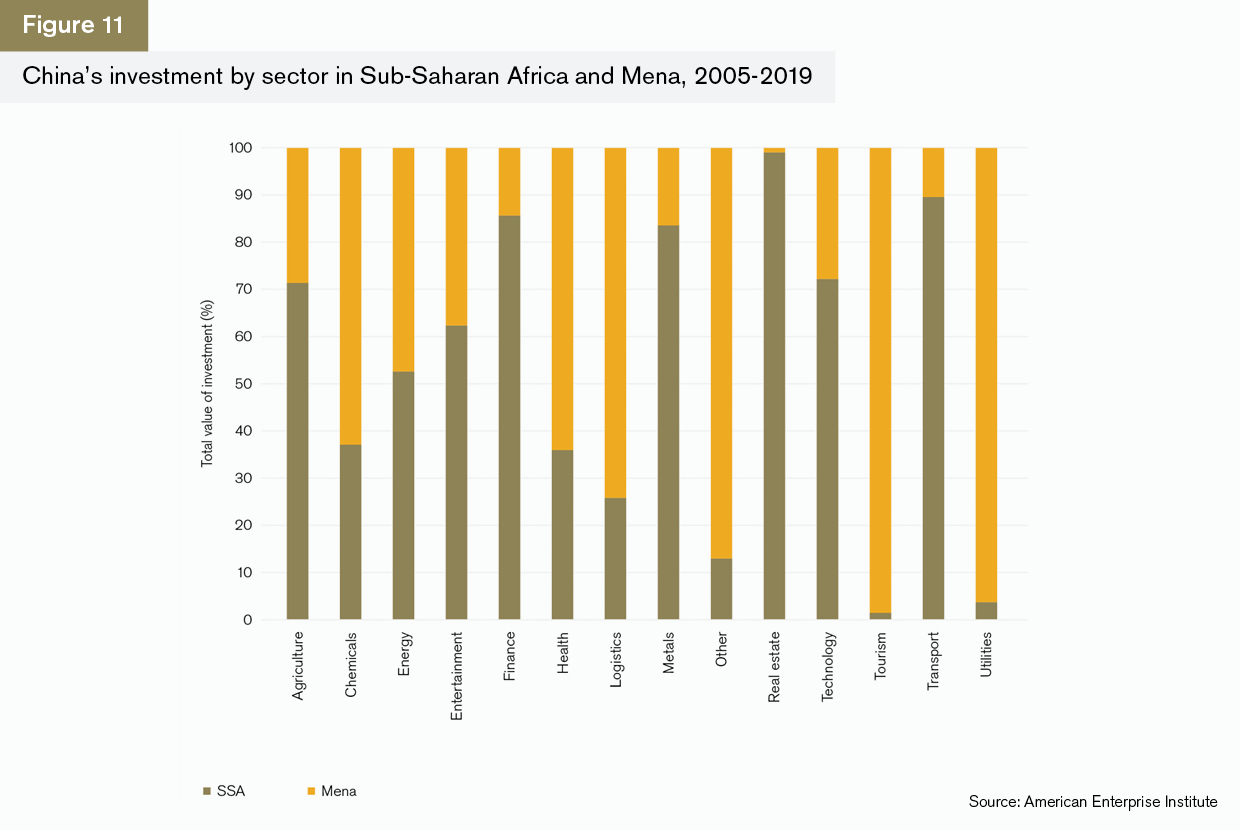

This matters in the context of a discussion about China’s strategic priorities. The sectors in which investments were made during this time indicate a very clear approach to building up Sub-Saharan Africa’s infrastructure to enable greater movement of trade through the region into Mena (Figure 11). China’s inward investment into Sub-Saharan Africa over the period has been greater in agriculture, energy, transport, metals and real estate, while investment in the Mena region has been predominantly in health, logistics and utilities.

There is talk now about the future of the Belt and Road Initiative (BRI) in the wake of the Covid-19 crisis and it is unwise to speculate about whether or not investments are likely to continue at the rate they were up to the end of 2017. China has responded only moderately to the crisis to create a fiscal stimulus and boost the Chinese economy with packages focused around greater support to SMEs and banks, but no direct support to individuals.7

Many economists suggest that China will have to do more, but it may be that the major investments in the BRI may stall while the country’s policymakers focus on more domestic issues. This could well impact some of the smaller countries, and countries not directly in the BRI, including those in Africa, in the short term.8 The duration of the impact will be determined by how quickly China can return to the BRI as a means of driving its strategic reach across the former Silk Road countries.

GTR: Will trade with any other regions in particular become more important as Sub-Saharan Africa emerges from the crisis?

Harding: Right now it is impossible to say how trade will settle across the world, how supply chains will be redistributed and where the strongest growth is likely to be. One thing is clear though: trade is unlikely to be the same after the crisis. Supply chains will be more evenly distributed across regions to avoid dependency on one source and, because of the resurgence of nationalism, individual countries are likely to want to build their own, more local, supply chains to ensure continued supply.

For this reason, it is only possible to look at where Sub-Saharan Africa’s emerging corridors have been in the past in order to identify where regional growth might come from in the future (Figure 12).

One thing is immediately obvious from Figure 12: trade with Europe, North America and South America has been declining in import and export terms since 2013. This has driven the region’s trade lower, quite apart from the impact of oil prices during that time, and has resulted in China being its largest single trading partner.

But it is the Asean region where growth has been the most significant. For example, exports of oil and gas rose by 7% annually between Sub-Saharan Africa and Indonesia over the same period. Trade with Vietnam increased by 16.4%, predominantly in fruit and nuts which grew exponentially during that time. Trade with Malaysia grew annually by 4.4%, largely in cocoa and chocolate. Growth in fruit and nuts with Asean as a whole grew by over 20% annually.

Growth in exports to the Mena region between 2013 and 2018 was accounted for mainly by a 5.9% annual growth in exports of precious metals and stones to the UAE.

These were strong trends before the crisis and, if the patterns restore themselves, then there is every reason to suggest that they will continue. The Asean region in particular was growing quickly, and the trade patterns suggest that Africa could meet an increased demand for food products there.

However, the big risk is that these trade corridors are not restored to growth, simply because the region itself needs the food and resources that it is currently exporting.

As many as 95 countries across the world, and 10 in Sub-Saharan Africa, have imposed restrictions on exports of products that may affect their health or food security.9 As the Covid-19 crisis deepens, the tendency will be towards greater protectionism in more sectors. This is not a positive development for a region which has already seen so much of its trade fall back over the past few years.

GTR: Political risks have always been high in the region – has Covid-19 reduced or increased those risks?

Harding: The inherent danger of any economic hardship is that it will cause conflict and internal instability as people struggle for basic necessities. However, within Africa, the risks of broader conflict associated with geopolitics (particularly borders and disputes over resources) and terrorism give it the highest risk scores in the Coriolis Technologies political risk index. In particular, several countries have very high corruption scores which are correlated with the irregular and hidden nature of much of the reporting of African trade, in particular unclassified partners such as ‘areas not elsewhere specified’ and unclassified sectors such as ‘commodities not elsewhere specified’.

Coriolis Technologies remains concerned about the Sahel region of West Africa, which is experiencing a rapid deterioration in its security situation. In 2019, the United Nations (UN) stated that an unprecedented rise in the level of violence had killed an estimated 4,000 people. Despite French military intervention and the UN multidimensional integrated stabilisation mission (Minusma) in Mali, widespread poverty, unemployment and poor political infrastructure has provided a breeding ground for extremists. Since the war in Mali in 2012, violent jihadist groups have increased in terms of number, capabilities and ambition, with thousands of people killed and millions displaced in countries including Nigeria, Niger, Burkina Faso, Mali and Cameroon. Covid-19 will not help this situation.

GTR: Given that Covid-19 places such an emphasis on a co-ordinated approach to recovery, what role can the AfCFTA play in future development?

Harding: The retreat to nationalism that has typified the onset of Covid-19 will do untold damage to trade in Africa as a region, not just because of the impact on external trade, but because it could have used the crisis as an opportunity to build stronger intra-regional trade through the AfCFTA. The AfCFTA was agreed relatively quickly but is likely to struggle with implementation of its ambitious programme because it does not have the full coverage that it needs to create an alignment across the continent.10

Africa’s individual nations are likely to emerge from the crisis with external trade substantially lower than beforehand because of the drop in oil prices. Intra-regional trade already makes up just 18% of all exports and will suffer unduly if there is greater competition within the region for scarce resources as budgets tighten. The likelihood of greater internal and external conflict is very real, undoing a lot of the good that has been done by individual nations.

Yet it is this multilateralism that in the end will be the means of ensuring Africa’s future is built through the shared objective of trade, particularly export-led growth. The current crisis should be a wake-up call to the region’s leaders to accelerate this process. However, this will be difficult at a time when global multilateral trade organisations like the WTO are struggling to protect themselves against an onslaught of nationalism. What is clear is that size matters in global trade negotiations and, with a united front through the AfCFTA, the region finally has the potential both to be a significant player globally and to solve many of its issues of intra-regional trade.

1 WTO, May 2020: https://www.wto.org/english/news_e/pres20_e/pr855_e.htm

2 https://www.imf.org/en/Publications/WEO/Issues/2020/04/14/weo-april-2020

3 https://www.bbc.co.uk/news/world-africa-52426040

4 https://thediplomat.com/2020/04/the-belt-and-road-after-covid-19/

7 https://www.nytimes.com/2020/04/09/business/economy/coronavirus-china-economy-stimulus.html

9 https://www.macmap.org/en/covid19

10 https://www.chathamhouse.org/expert/comment/african-continental-free-trade-area-could-boost-african-agency-international-trade