In Hong Kong today, a leading economist spelled out the “nightmare” that awaits China should Donald Trump become President of the United States.

Kevin Lai of Daiwa Capital Markets – dubbed the “Yuan Bear” because of his prescient warnings on China’s currency – told journalists that if Trump carries out his promised anti-China trade policies to their full effect, it will cost China almost 5% of its GDP.

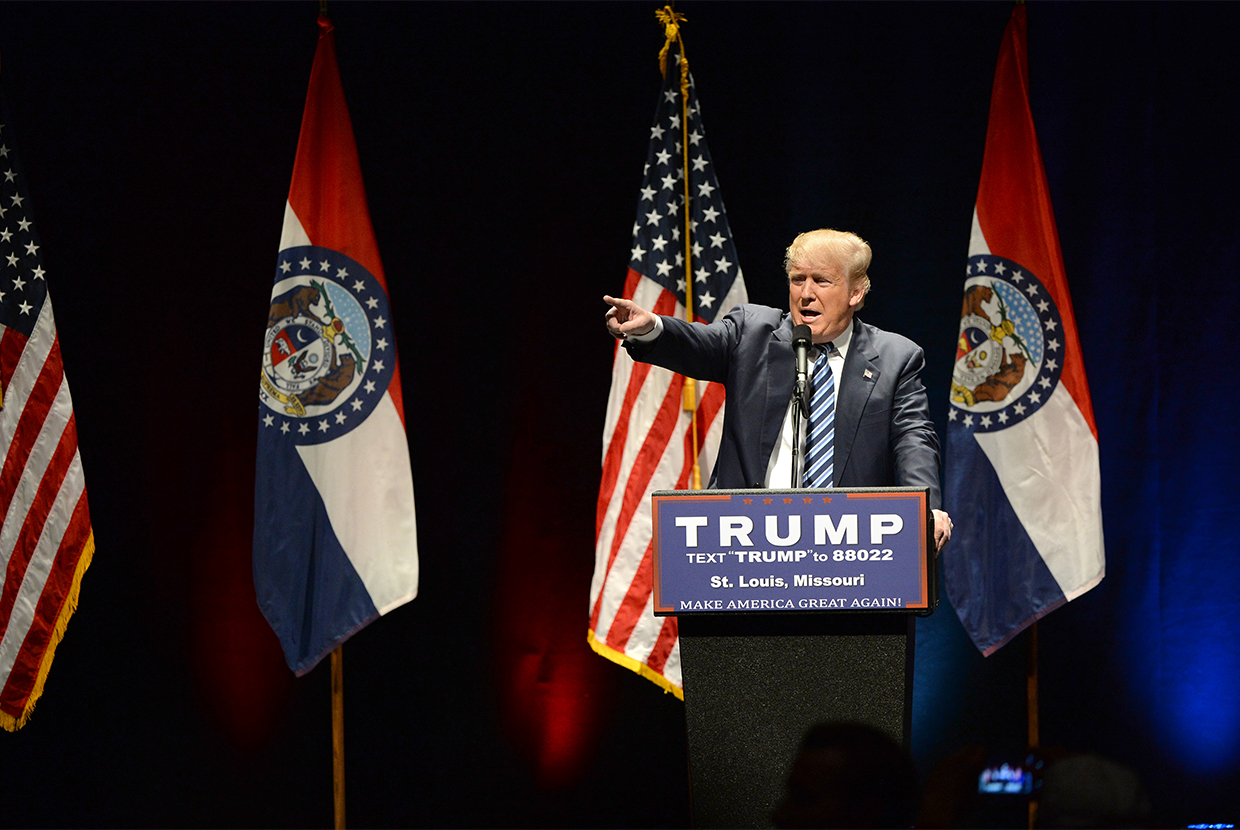

Trump has vowed to impose a 45% tariff on Chinese goods in response to perceived currency manipulation and in a bit to “reclaim millions of American jobs and revive American manufacturing by putting an end to China’s illegal export subsidies and lax labour and environmental standards”.

Lai, along with fellow Daiwa economist Olivia Xia, has estimated that a 45% tariff on China would result in a US$420bn drop in Chinese exports to the US – 87% of the total export. Taking into account that the average domestic content in China’s exports basket is about 68%, this translates to 2.6% of GDP.

However, the total decrease in GDP could be 4.8% once the “multiplier effect” – the knock-on effect on other industries – is accounted for.

“In conclusion, a Trump presidency could be a nightmare for China,” the findings read – with Lai saying that Trump’s pledge to also slap tariffs on China’s trading neighbours in Asia will make it more difficult to source new export markets, given the radical impact those sanctions would have on their respective economies.

In short, for the Asia Pacific region, these policies would be disastrous. Lai describes it as a “huge black swan scenario” comparable to Brexit – “a low probability but high-impact event”. The fallout, however, would be far more severe.

There is a question mark over just how much of the policy Trump will be able to implement, given the fact that it would require congressional approval, but the analysts sound an ominous warning on that note.

“Fundamentally, we don’t think Trump’s view on China is a minority opinion in America. If it is a minority, it must be growing and growing rapidly,” Kevin Lai, Daiwa Capital Markets

“Fundamentally, we don’t think Trump’s view on China is a minority opinion in America. If it is a minority, it must be growing and growing rapidly. It is the result of long-held scepticism and deep-seated mistrust between the two countries. The Obama and Bush administrations have tried to make things work with China, but American constituencies look to be running out of patience,” Lai says.

In what would further damage the Chinese economy, Trump’s isolationist policies would undoubtedly lead to an exodus of US investment from China. If you manufacture in China, you will automatically be subject to those same tariffs and most likely seek a new home for production.

In 2015, the US held US$2.8tn in Chinese stock. Under the 45% scenario, Daiwa estimates that the FDI repatriation would suck 3.91% from China’s GDP.

Despite coasting to the Republican nomination, the prospect of a Trump presidency seemed unlikely just a couple of months ago. Now, however, polls are narrowing and after coming through an omnishambles of a summer, questions over Hillary Clinton’s health have helped Trump to 41% in the national polling average, with Clinton on 43%.

Trump has made opposition to China a cornerstone of his foreign and economic policies. He argues that the US has not received a fair deal since China joined the WTO in 2000.

He has vowed to “declare it a currency manipulator” which, under a new bill passed into US law last year, would allow the president to impose sanctions upon the offending nations.

He has vowed to force China to uphold intellectual property laws and bolster the US military presence in the South China Sea to “discourage Chinese adventurism”.

These policies would leave China with no choice but to introduce retaliatory sanctions, but given the fact that US exports to China are worth a quarter of China’s to the US, China would come off much worse.

If Trump’s aim is to force China to inflate the renminbi (Rmb), it is unlikely to succeed. With the overseas market evaporating, producers would have to sell domestically. More supply will lower prices, exacerbating serious overcapacity issues that already exist.

Lai says: “A decline in the current account surplus and FDI repatriation would be negative for China’s balance of payments, leading to more downward pressure on the Rmb and creating a deflationary tendency. This would add more pressure on the People’s Bank of China (PBOC) to implement aggressive monetary policy, which in turn would put more downward pressure on the Rmb.”

The US is by far China’s biggest export market and any change in relevant policy would add ripples to its economy. Something as draconian as those promoted by Trump would be catastrophic for China and all of Asia Pacific.