Global trade and economic growth are set to slow down due to geopolitical instability, according to the latest iteration of the UN Trade and Development’s (UNCTAD) annual report.

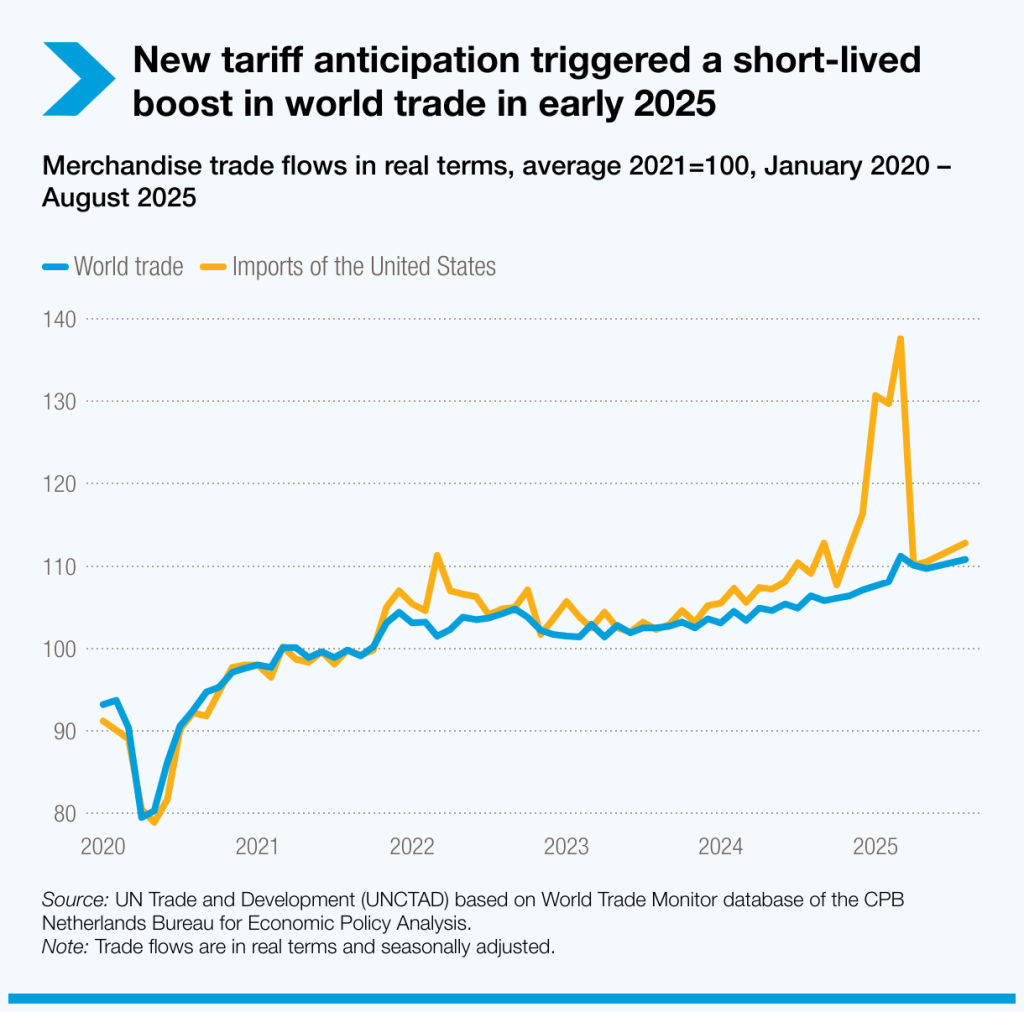

Global trade rose by around 4% early in the year, UNCTAD found in its report published on December 2, driven in part by companies accelerating imports ahead of higher tariffs, increased investment in AI and stronger trade between developing countries.

However, when excluding these factors, underlying trade growth is estimated at between only 2.5-3%, and is expected to ease further, UNCTAD warned.

Total economic growth is also set slow to 2.6% in 2025, down from 2.9% in 2024, as global trade and investment face growing pressure from financial volatility and geopolitical uncertainty, the agency’s research revealed.

This is below the pre-pandemic trend of 3% and far below the 4.4% average growth seen before the 2008-2009 financial crisis, UNCTAD said.

“A projected trade deceleration into late 2025 and 2026 reflects deeper challenges which suggest a cautious outlook for 2026, with trade growth likely to slow further,” the report read.

The findings echo those of the World Trade Organization (WTO) last week, with its latest Goods Trade Barometer showing growth slowed in the second half of 2025 off the back of higher tariffs and lingering trade policy uncertainty.

Low-income economies and small businesses remained the most vulnerable, UNCTAD noted, as “limited access to finance and ongoing uncertainty hinder long-term planning and investment”.

UNCTAD Secretary-General Rebeca Grynspan (pictured) said the findings showed how financial conditions increasingly determine the direction of global trade.

At a press conference in London on the day of the report’s launch, Grynspan – who was recently nominated by her home country of Costa Rica for the UN secretary-general role – said the latest paper emphasised the concept of the “financialisation of trade”.

“When we talk about trade, we really think about goods, not the finance – but if you look at the report, the financial cycle and the trade cycle are totally in sync, more now than ever”, she added.

UNCTAD’s paper also highlighted “90% of trade now depends on finance”, as “banks, payment systems and financial instruments like derivatives increasingly determine who can trade, on what terms and at what cost”.

“Because of this, trade has become more sensitive to financial factors like changes in interest rates and shifts in investor sentiment,” it added.

On the upside, there has been an increased diversification of players across trade, Grynspan noted, with more developing countries emerging as key drivers of growth.

UNCTAD’s research showed trade of goods and services among developing nations – also known as South-South trade – hit US$2.87tn between January and July 2025, an increase of 4.7% on the same period in 2024.

In 2025, South–South trade is projected to outperform global trade growth.

Despite that, developing countries still face higher financing costs, greater exposure to sudden shifts in capital flows and rising climate-related financial risks, the UN agency said.

“The global South accounts for more than 40% of world output, nearly half of global merchandise trade and more than half of global investment inflows, yet its role in global financial markets remains limited,” the report noted.

Grynspan said at the paper’s launch that UNCTAD was “very worried” over the global South’s “limited power” in the financial markets, particularly given those countries were “hit the hardest [by tariffs] in the little manufacturing they have”.

“They will be forced to become more commodity dependent” as “they don’t have the capacity to negotiate” with bigger economies, she argued.

UNCTAD is calling for updated trade rules that are “fit for today’s economy”, including digital trade, climate action and new industrial strategies, as well as for reform of the international monetary system “to limit harmful swings in currencies and capital flows”.

The trade and development group also urged for stronger regional and domestic capital markets so developing countries can raise cheaper long-term finance, and for improved transparency in commodity trading and expanded access to affordable trade finance, especially for small businesses.