Blockchain-based payments network Ripple has dismissed the improved offering of rival provider Swift, claiming that its global payments innovation (gpi) service is “just a marginal improvement” on “very old architecture”.

Swift’s gpi, which does not use blockchain, has reduced payment time to less than 30 minutes in almost 50% of the times it has been used. Almost 100% have been credited within 24 hours.

Swift, whose payments messaging service is the industry standard in payments, this week announced that the gpi will be rolled out to all 10,000 banks on its global network for cross-border payments.

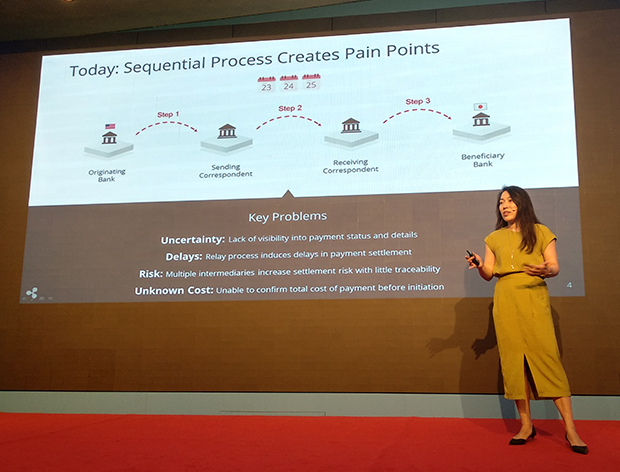

Speaking at an event in Hong Kong today (June 27), however, Ripple’s director of joint venture partnership, Emi Yoshikawa, claimed that the innovation cannot compete with the fintech company’s “near real-time” settlements.

“Swift was built 40 or 50 years ago, before the internet was created. So their architecture is very old. They realise that this is a big problem and they consider us a big competitor. They’re also trying to make a big improvement based on the existing architecture, called Swift gpi. We consider it just a marginal improvement of their existing architecture,” she told the audience at EmTech Hong Kong, an event organised by MIT Technology Review.

She added that the “problem we’re talking about [meaning payment speed and efficiency] cannot be fundamentally solved unless you change the whole infrastructure layer”, implying that the use of blockchain technology is essential.

Swift has experimented with blockchain in the past, launching a proof of concept in April 2017, the results of which it said were “encouraging”, but not wholly convincing. At the time, Swift’s head of research and development in its innovation lab told GTR that because the technology is in its infancy, his team is keeping an open mind about using it in the future.

Ripple, meanwhile, is still a marginal player in trade payments. It is working with a number of top-tier trade banks, including Bank of America Merrill Lynch, MUFG Bank, Standard Chartered and Westpac, but its share of the market is small.

A number of banks in Asia are experimenting with a closed version of Ripple, RippleNet, where they can use the blockchain-based software in a closed network according to pre-determined rules and standards.

A RippleNet pilot was launched in May by Standard Chartered, MUFG Bank and its Thai subsidiary, Bank of Ayudhya. Standard Chartered’s global head of correspondent banking products, Shirish Wadivkar, told GTR that the bank sees real value in the project.

“It’s a weird way in a world which is coming to instant push notifications, that we have to work with billions of dollars moving across, without clear indication of when it was delivered, who has it, or what the charge is for. Certainty is possible on Ripple because the payment exchange goes into phases,” he said.

At the Hong Kong event, Yoshikawa outlined her vision of a payments future in which multiple blockchain-based payments companies would talk to each other and be interoperable.

“In order to realise the internet of value, Ripple alone can’t make that happen. We have to work with governments around the world, financial institutions, many different companies,” she said.

When asked by GTR if she could foresee a time when Ripple and Swift would work together, Yoshikawa added: “We believe Swift could be part of this broader open network. We want to invite them to be part of this. Some existing networks tend to be a little more close-minded and try to be on their own. But Ripple technology is meant for open systems, so they can be part of that system, that network.”

Swift didn’t respond to GTR‘s request for a comment on its gpi rollout, but its head of gpi, Wim Raymaekers, has previously told GTR that the company decided to build the gpi service without blockchain because it wanted to deliver immediate value to its clients.

He also emphasised that the goal for Swift isn’t to settle in real time, but rather to create certainty for businesses. “Corporates are not asking for instant payments as such, because there is no payment that leaves a corporate without an invoice, so they know when to make the payment in advance,” Raymaekers stated. “But when the payment needs to be made they want more certainty. That’s why the same-day promise is important for corporates; to better schedule their payments.”