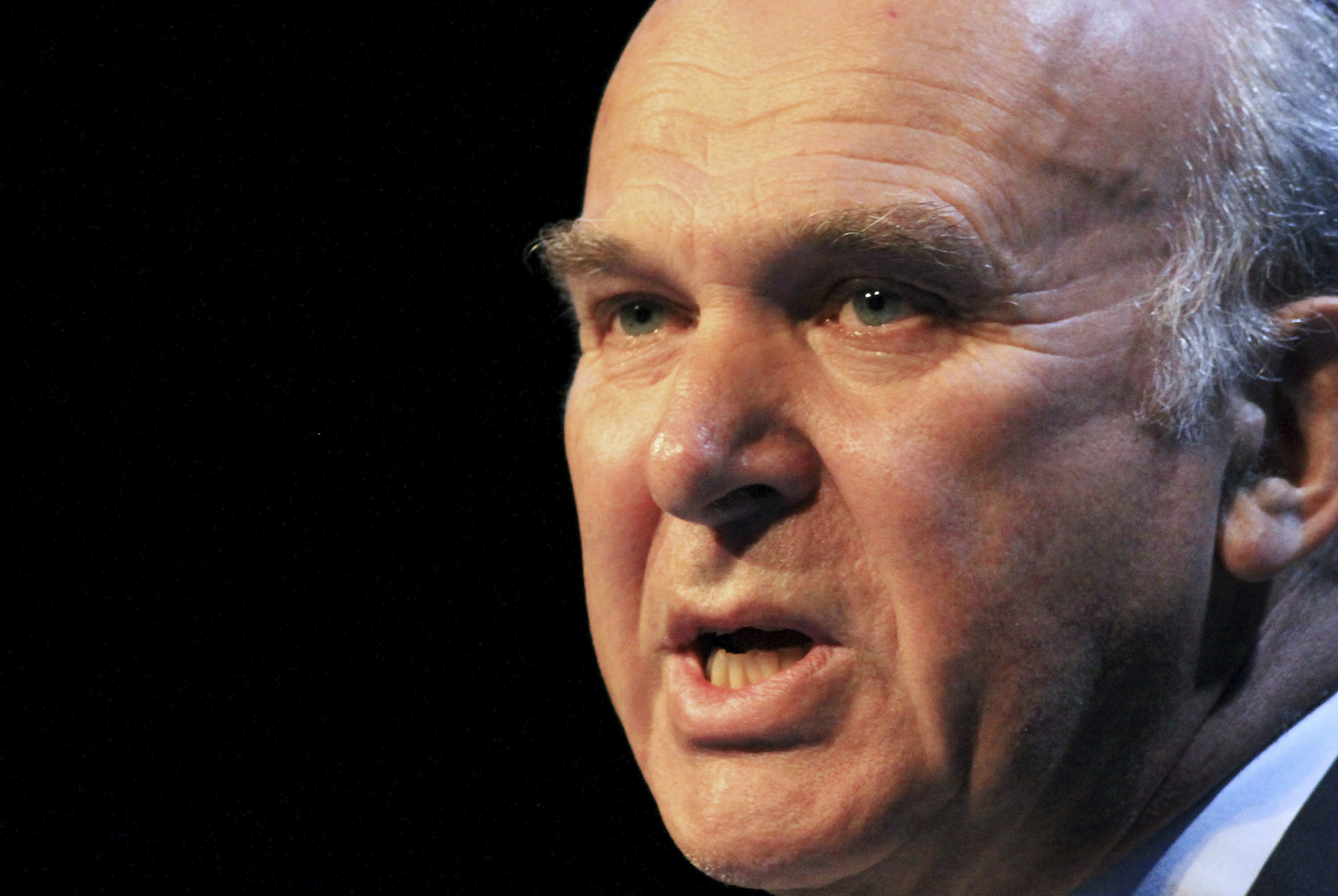

The UK’s business secretary Vince Cable has told a London conference that big banks have “turned their backs” on small businesses, exporters and manufacturers in Britain.

GTR was in the audience as Cable added that banks have become more risk averse, and that such a trend has attributed to growing inequality in the UK’s business sector. Banks, he said, have responded to the financial crisis through “disengagement”.

Cable, however, spoke of his hope that non-mainstream financial channels may be able to fill the gap in funding “within five years”. Alternative lenders, such as P2P financiers and the Post Office are not included in official lending statistics, and the secretary of state said that he hoped they would become more prominent on the funding markets.

He earmarked non-high street banks such as Aldermore, which has increased trade lending to small businesses, for special praise, but also reserved a mention for traditional banks Lloyds and Santander, which are both attempting to “become more expansive” in the SME lending space.

This month (March), Lloyds announced an extra £1bn in small business lending for the UK and also announced plans to decentralise decision making over lending, giving regional managers more authority.

The Bank of England’s latest Trends in Lending report, released in January, showed that in the 12 months to December 2013, bank lending to UK businesses fell by 3.4%. Over a three month basis, the slump was 4.2%.

The report said: “Data covering lending by all UK-resident banks and building societies indicated that the stock of lending to UK businesses contracted by £4.3 billion in the three months to November.”

New syndicated lending facilities were slightly up to £67bn in 2013 from £65bn in 2012. However, these were mostly refinancing facilities and are well down on the average volume from 2003 to 2008 of £100bn.

Cable has long been a stern critic of perceived excess in the banking sector. He has, this year again, slammed banks’ bonus payments, saying: “”I don’t understand why people need a million quid a year,” a remark which was greeted with disdain from the British Bankers Association.