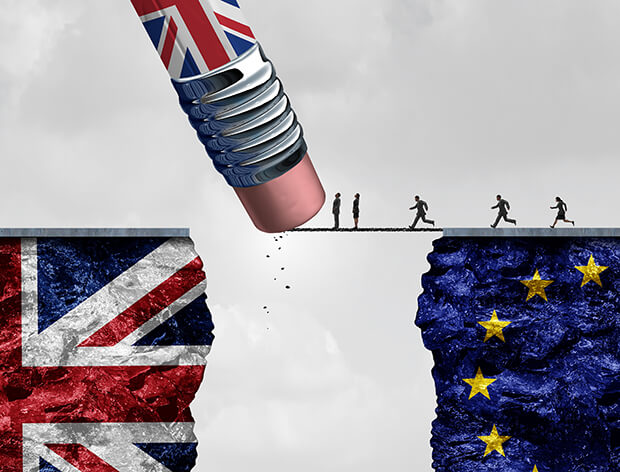

UK exporters are facing at least another six months of turmoil on top of what has already been more than two years of doubt around their future trading arrangements with the EU and global partners. For smaller businesses with narrow margins and supply chains weaving in and out of Europe, operating in such an environment closes off opportunities to plan long term and exposes them to increased risks of delays to goods they – and their end customers – need.

The EU represents 49.5% of the UK’s total trade, while a further 11% is through EU trade deals with global partners, according to the UK’s department for international trade (DIT). Brexit could throw a major spanner in the works if increased tariffs and border-checks are implemented after the latest Article 50 deadline of October 31, as would be the case under a no-deal scenario.

Recent industry research paints a bleak picture of the major upheaval Brexit has already wrought on British businesses and their foreign partners. A survey of 1,749 supply chain managers from the UK and EU in February by the Chartered Institute of Procurement & Supply shows that a one-day delay at the border would see 20% of EU businesses surveyed push their UK suppliers for a discount on their order, while – faced with the same delay – 11% of UK exporters would expect to have their contract cancelled altogether.

At the same time, a solution to the lack of financing options that could mitigate some of these issues still eludes most SMEs. Although alternative financing channels are opening, and a few traditional banks are setting aside more funds to help, many businesses are still left to fend for themselves.

GTR speaks to two SME exporters to discuss their thoughts on how Brexit is impacting their business.

Tim Brownstone, founder and CEO of Kymira, a UK-based smart textiles company

GTR: Where are your current export markets, and do you see these changing?

Brownstone: We have customers on every continent around the world but our primary channels for exporting are the US and Europe. We are getting a lot of interest from Asia, but we don’t currently have the resources to pursue this fully without representation in the region. In Japan for example, with the Rugby World Cup this year and the Olympics in 2020, it’s going to be centre stage for world sport for the next two years at least.

GTR: How does Brexit affect your exports?

Brownstone: We are trying to take a pragmatic approach as ultimately there’s very little we can do to influence things, other than by being a part of programmes such as techUK. So far, the two main detrimental things we’ve seen are a small drop-off in perceptions of the UK in Europe, but because we’re a small brand it hasn’t been too damaging. The other main thing for us is the issue of whether we will be paying import tariffs for goods from our two European factories. Our cyclewear comes from Spain and our socks are made in Italy. Everything else is manufactured in the UK. We’re not currently looking to move away from those factories but it could add 12% to costs if the same tariffs are applied for what you currently get on goods from outside the EU.

That said, there have been opportunities as well. For example, while the pound has been so weak against the dollar it gave us a chance to open some new accounts in the US. At the same time, tariffs may be reduced on our imports of fabric from Asia. Ultimately, we need to carry on with what we’re trying to deliver, which in our case is helping people. If we stop and get scared because of Brexit then that flies in the face of what the company is here to do.

GTR: How much interaction have you had with government bodies that exist to help UK businesses?

Brownstone: DIT has been quite helpful and we’ve had two trade advisors that have been quite knowledgeable about our field. My only gripe would be that as we’re based in Reading, not in the London tech cluster, our advisor hadn’t heard of some of the trendy events such as ‘South by Southwest’, but if you go 10 miles up the road to London then all of a sudden they have tickets and grants available for it.

Otherwise, DIT has been an invaluable resource in terms of direct advice and connecting us with government consulates around the world where we need insight. For example, in South Africa there’s a 45% import tariff on our goods, but through DIT and the local government we found out that as we are a UK manufacturer we can apply to halve that.

More recently, DIT has teamed up with Innovate UK and the EU’s Joint Research Council to fund trade missions. To date, I’ve been on one to Israel and my CTO has been to Canada. I’ll also be flying to Texas in May as part of a medical device-related mission. This is very useful for us as it’s a very curated trip and they open up opportunities we wouldn’t be able to take otherwise. This is all coming about because of Brexit as there’s a big push to expand the UK’s trade outside of Europe, and we’ve certainly benefitted from that.

GTR: Do you receive any trade or export finance from banks?

Brownstone: So far we haven’t needed any export finance as we have large enough capital reserves. I’ve had some initial conversations with banks who say they will re-assess at the time, but preliminarily it’s a ‘yes’. The conditions relate to what we want specifically in terms of payment – within 60 or 90 days, for example – and what our relationships with our clients are, as well as what our financial foundation is in the meantime.

We’re a small company starting to increase our exports and there’s risk management required on the bank’s end in making sure that we have the infrastructure in place to handle our orders.

Chris Walker, CEO and director of Diamond Hard Surfaces, a UK-based materials technology company

GTR: Where are your current export markets?

Walker: We export to 22 countries around the globe. Typically export sales represent 50-60% of our annual turnover. Our key markets are in the US, Europe and the Middle East.

GTR: As a UK-based exporter, what’s the biggest challenge you face today?

Walker: Understanding and dealing with export regulations and paperwork is extremely time consuming. Restrictions by the UK government on temporary inward processing relief are also causing us issues with carriers who fail to implement instructions. SMEs are disadvantaged by the amount and complexity of regulations set out by the government. This inhibits our export ambition.

GTR: Have you spoken to the UK government regarding possible changes to exporting rules caused by the various Brexit scenarios?

Walker: We have examined scenarios but until a decision is made as to the type of Brexit (or not) we will have we cannot take any meaningful action without wasting our precious resources. We already have an economic operator registration and identification (EORI) number because we export outside the EU and we are undertaking customs procedure training with the government grants through PwC.

GTR: What trade finance-related support do you require from banks or other financing institutions?

Walker: It would be helpful to have any UK banks or financial institutions which were interested in supporting SMEs to grow their businesses through export activity.

GTR: What about financial support from the government?

Walker: UK Export Finance’s (UKEF) offerings are mostly in the form of guarantees offered to the five large UK banks. Unfortunately, these banks have their own rules on engagements and support of export initiatives for SMEs. At least two of the five banks have restrictions which mean that they are not interested in supporting businesses with a turnover of less than £2mn or £5mn, which means that the ambitions of small, fast-growing exporters are restricted if they use these banks. UKEF is aware of these issues but has failed to address them to date.

GTR: Does the lengthy delay to Brexit affect your exporting business in any way?

Walker: No, except that the uncertainty is impacting our customers’ plans as they tend to be large blue-chip companies in aerospace, oil and gas and electronics and they make their decisions on a global basis.