US authorities have taken enforcement action against Australia-headquartered freight forwarding company Toll, following accusations it facilitated payments worth over US$48mn linked to sanctioned entities in Iran, Syria and North Korea.

The Office of Foreign Assets Control (OFAC) says Toll has agreed to pay US$6.1mn to settle nearly 3,000 alleged violations of US sanctions controls between January 2013 and February 2019.

Toll originated or received payments through the US financial system involving sanctioned jurisdictions and persons, in connection with sea, air and rail shipments of goods, OFAC says. The payments were processed through at least four US-based financial institutions or their overseas branches.

The authority says 424 payments involved Iran’s Mahan Airlines. The airline has been subject to sanctions since at least 2016, and was described by then-Treasury Secretary Steven Mnuchin as a tool used by the Iranian regime to support terrorist groups in the Middle East.

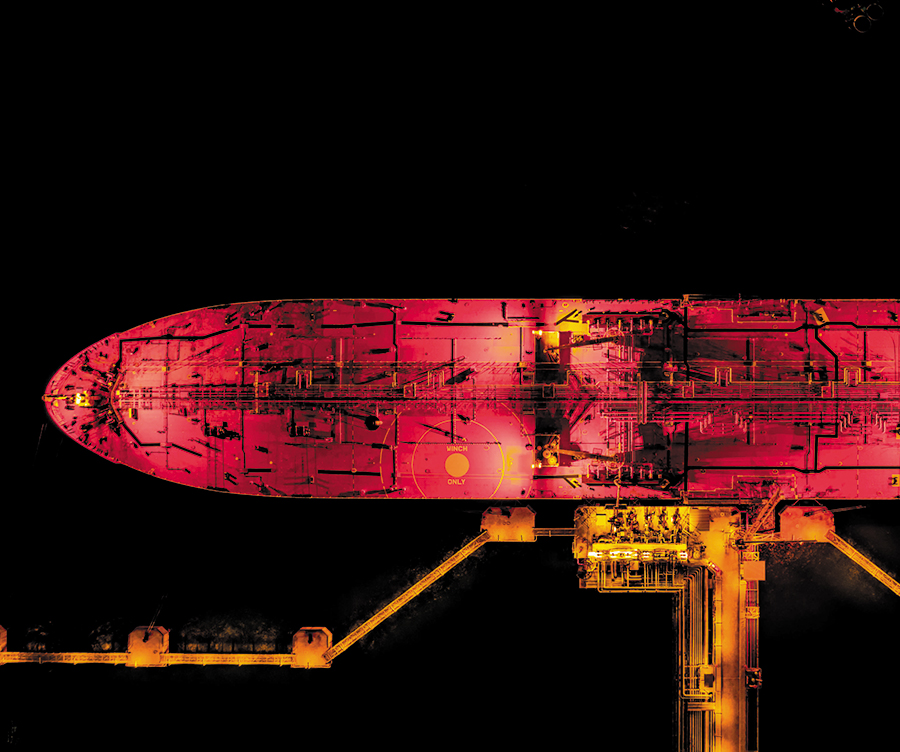

A further 97 transactions involved Iran-based Hafiz Darya Shipping Lines Company, it says. More than 2,500 transfers involved shipments or ship-to-ship transfers linked to Iran, Syria or North Korea.

According to OFAC, around 14% of the transactions involved entities blocked due to concerns over terrorism or weapons of mass destruction.

The authority says Toll employees had reason to know that payments were potentially in breach of US sanctions, after one of its banks identified a US dollar-denominated transaction involving Syria and restricted use of its account.

“Concerned that the inclusion of this Syrian-related payment would disrupt a separate, large impending internal transfer, a Toll employee at its headquarters’ treasury office sent an email instructing employees in Toll’s United Arab Emirates and South Korea affiliates to avoid including the names of sanctioned jurisdictions on invoices going forward,” the authority says.

Although that incident occurred around May 2015, the authority says it was not until February 2017 that Toll introduced “hard controls” to block all business involving ports or cities in sanctioned countries.

All but 105 payments took place before those controls were implemented. The initial failures in part stemmed from Toll’s “rapid expansion… without a requisite increase in compliance resources” from 2007 onwards.

Thomas Knudsen, Toll Group managing director, says the company is pleased to have resolved the matter having voluntarily disclosed the potential breaches to OFAC.

“Regrettably, this situation occurred because of a misunderstanding about regulations regarding payments through the US financial system related to otherwise permissible shipments,” he tells GTR.

“We take compliance seriously and have acted to keep this from happening again, instituting rigorous control systems and enhanced training and accountability. None of the individuals involved in the transactions at issue are employed any longer by Toll Group.”

OFAC cites Toll’s disclosure of the potential failings as a mitigating factor, and notes it has taken “extensive actions to identify the root causes of the compliance lapses”.

The authority warns, however, that the case “highlights that foreign companies who use the U.S. financial system to engage in commercial activity must take care to avoid transactions with OFAC-sanctioned countries and persons”.

It says companies involved in complex payment and invoicing arrangements are exposed to sanctions risks, particularly when connections to sanctioned entities are obscured.

“Entities should also respond promptly and fully to address compliance weaknesses when issues first arise, identify their full extent and causes, and implement necessary changes to their compliance programs, practices, and procedures,” the authority adds.

The announcement marks the fifth enforcement action taken by OFAC this year. In January, Japanese trading conglomerate Sojitz was fined US$5.2mn after wayward employees secretly traded Iranian-origin goods.

Last year, French trade finance bank Union de Banques Arabes et Françaises agreed to pay US$8.5mn to settle allegations it processed 127 transactions linked to financial institutions in Syria.