Joon Kim, Global Head of Trade Finance Product and Portfolio Management at BNY Mellon Treasury Services, provides an outline of the results of the bank’s recent global survey on the trade finance gap.

Trade has dominated many headlines across the world of late, with protectionism and the risk of a US-China trade war hanging over the landscape. With trade experiencing such challenges, it is all the more important that trade finance – the fuel that enables the wheels of trade to turn, and upon which up to 90% of trade activity directly relies – is accessible and robust. However, certain geographies and sectors are facing considerable hurdles when it comes to accessing funding, which could have a detrimental effect on the health of global trade.

The global trade finance gap, which represents the discrepancy between supply and demand for trade finance, stands at a staggering US$1.5tn, according to latest figures. And, to compound matters further, for many institutions, trade finance rejections are in fact increasing. A new global report from BNY Mellon, “Overcoming the Trade Finance Gap: Root Causes and Remedies”, has found that trade finance rejection rates are rising in a third of the institutions surveyed.

Certainly, for many businesses – most notably those in emerging markets – accessing financial support has become a considerable challenge. Barriers to finance can significantly impede global commerce as a whole, and it is in the interests of the wider industry to help bridge the gap, enabling businesses in emerging economies to connect to international value chains, and ensure trade opportunities can be realised.

The voice of the industry

Our survey, conducted with the support of the International Chamber of Commerce (ICC), set out to help determine what, in the views of global industry participants, could be the most effective means of plugging the gap. With compliance constraints – due to tightened regulatory requirements driving up the costs of onboarding new clients – already established as a primary, albeit inadvertent, cause of the gap, it is unsurprising that the solutions identified align with addressing regulatory challenges.

Two approaches were viewed equally – by 30% of participants – as the most important: technological innovation and regulatory revision.

Technology has significant potential to help fill the gap by addressing associated compliance challenges. Specifically, it was thought that sharing data through centralised know your customer (KYC) databases could be particularly effective. Such pools of data, which would be available for use by trusted user groups, could help to eradicate unnecessary replication and costs by removing the need for multiple banks to undertake due diligence processes on the same companies. This would enable a far more efficient, streamlined, cost-effective approach to KYC.

The Legal Entity Identifier (LEI) is an example of one such initiative already underway. An LEI is a unique code that stores information on registered companies worldwide, enabling banks to access – via application programming interfaces (APIs) – the details needed to automate KYC checks.

Importantly, widespread adoption is needed for such concepts to be truly effective. But, with the industry seemingly getting behind the power of technology and centralised databases, they hold a great deal of promise if they are promoted effectively and gain traction. Indeed, it is estimated that if the LEI initiative was to achieve critical mass, it could collectively save banks issuing letters of credit (LCs) upwards of US$250mn annually.

Equally, regulatory revision was viewed as key to closing the gap. Certainly, robust regulations serve a vital purpose. But striking a greater balance between effective due diligence and improving the bankability of transactions could be a direct means of helping to reduce collateral, operational and compliance costs – without the need for investment into technology innovation. By creating richer dialogue and greater alignment regarding the needs of banks and regulators, it could be possible to shape regulation to more effectively meet the needs of all.

The role of banks in particular in helping to drive regulatory change was acknowledged: 55% viewed greater collaboration between banks and regulators as the most valuable strategy. This highlights that banks are regarded as having a pivotal role to play in helping the industry to tackle the gap – as established, trusted figures, and importantly, as an industry collective. Indeed, the power of collaboration is becoming increasingly recognised within the finance space, and it is by coming together for this common cause that banks could most effectively help to influence the development of the regulatory landscape. In this role, banks can act as ambassadors for trade, including communicating the needs of clients and the wider market.

Partnerships a key ingredient for trade

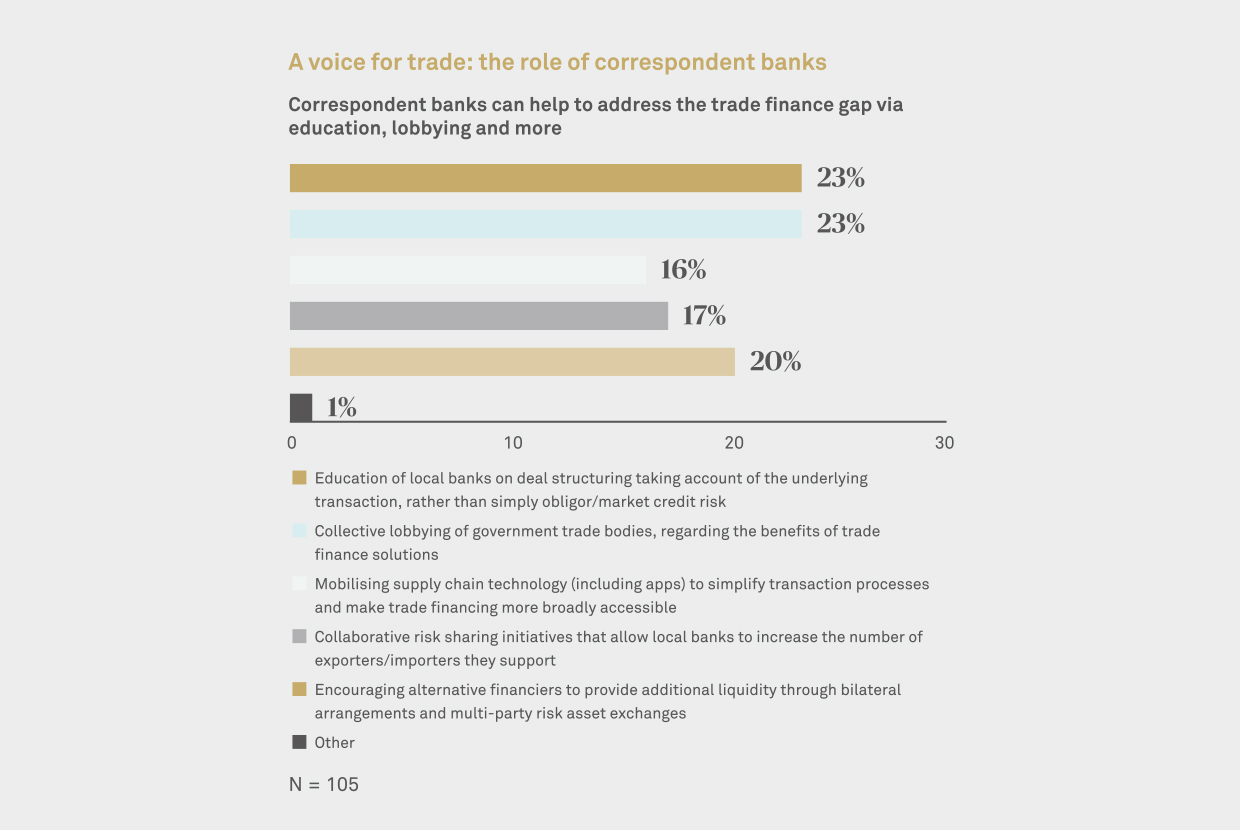

The importance of banks and collaboration in helping to maintain a robust global trade system was a theme echoed elsewhere within the survey. For example, risk sharing partnerships with global banks was ranked highest for creating additional financing capacity, demonstrating that correspondent banking partnerships continue to be fundamental in delivering trade finance solutions and facilitating trade growth.

Correspondent banks’ value goes beyond that of sharing risk. Respondents cited the most important roles for correspondent banks in addressing the trade finance gap as lobbying government trade bodies on the value of promoting trade finance – which reinforces the importance of the voice of banks – and providing support and guidance to local banks to help facilitate business growth. Certainly, correspondent banking is a powerful means for local and global banks to share expertise and capabilities. And a key component of this is global banks acting as educators and communicators. For example, helping local banks fully understand areas such as deal structuring (taking account of the underlying transaction, rather than simply obligor/market credit risk), to ensure that as a partnership, they are best positioned to provide exceptional trade service for clients.

Through our survey, we hope to spark conversation regarding the next steps that need to be taken to help plug the gap. Crucially, collective agreement on the course of action to take is required for effecting positive change.

Closing the mammoth trade finance gap is a daunting prospect, but it is a challenge that must be addressed if global trade is to reach its full potential. Whether it is through regulatory revision, technological innovation, correspondent banking partnerships or a combination of these approaches, it is only with cooperation across the industry – including banks, alternative providers, regulators, corporates, and industry and government bodies – that we can strategically tackle the barriers to trade finance and allow global trade to prosper.

The views expressed herein are those of the author only and may not reflect the views of BNY Mellon. This does not constitute Treasury Services advice, or any other business or legal advice, and it should not be relied upon as such.