Bank of America is building a digital trade network designed to modernise working capital finance from the ground up. As trade routes and risk profiles evolve, the network offers treasurers a way to stay ahead without overhauling internal systems.

Bank of America (BofA) is taking a bold step to reshape trade and supply chain finance. Through its Digital Trade Network, the bank aims to simplify long-standing pain points in a sector that has struggled to move beyond paper. With Open Account Automation now live and an expanding range of products gaining traction, this multi-phase strategy signals a significant shift for corporate clients.

Digital transformation in the trade finance space is long overdue but various drivers have converged to provide some much-needed momentum.

Madhav Goparaju, head of digital transformation in global trade and supply finance at BofA explains: “Technology is maturing. There’s an ever-growing need to tap into digital data networks and, post-Covid, supply chains themselves have shifted. Corporates are rethinking how they connect to financial services providers.”

Data fragmentation has been one of the critical issues holding back digital transformation in trade. The information needed to assess risk, release payments or make financing decisions often sits in siloed systems. But with the rise of artificial intelligence (AI), application programming interfaces (APIs) and cloud infrastructure, the pieces are finally in place to bring that information together.

“We want access to the history of that data so we can make better credit and financing decisions and technology is maturing to allow this,” says Goparaju.

Structural change is also having an impact. Since the pandemic, supply chains have become more complex, and corporates are taking the opportunity to revisit long-standing workflows. “As they adopt strategies like nearshoring and friend-shoring, they’re also questioning whether legacy trade processes still make sense,” Goparaju adds.

Automation that’s actually game-changing

The starting point of BofA’s Digital Trade Network is Open Account Automation, delivered via CashPro Supply Chain Solutions, handling transactions in which buyer and supplier already trust each other but where the document flow has remained inefficient.

“Pre-modernisation, this is a 100% manual process,” says Goparaju. “Documents are couriered or scanned, then re-keyed manually. The working capital cycle could take three to six months.”

At BofA, that process is now primarily digital. Using a cloud-based platform and smart contract technology, the bank brings buyers, suppliers and logistics providers into a connected Digital Trade Network. Natural language processing (NLP) extracts structured data from scanned documents where needed, while APIs allow for fully automated submission. What used to take many months now takes days.

Resolving discrepancies is no longer a painstaking loop of couriers and email scans. The centralised platform now handles validation, reducing delays and removing the need for repeated document exchange.

The result is a shift from “100% manual to 96-98% digital”, allowing clients to benefit from a seamless digital process.

Importantly, BofA isn’t asking clients to overhaul their operations overnight. For those not yet equipped to connect digitally, the platform uses NLP to extract key data from paper documents and feed it into the workflow. It’s a practical workaround that helps clients move at their own pace.

“We have around 1,000 online suppliers with selected buyer programmes that actively use this solution,” says Goparaju.

From aisles to ICUs: where the momentum is building

Specific sectors have jumped at the chance to use the Digital Trade Network. Retail, where speed and scale are essential, is an early adopter. Healthcare firms are exploring embedded finance as a tool for resilience. At the same time, industrials see value in simplifying guarantees and project-based workflows.

Opportunities exist in dynamic discounting and inventory finance, particularly in volatile environments. What links these sectors is a shared frustration with manual processes and a clear appetite for improvement.

Another driver is the growing impact of tariffs and supply chain realignment. Pricing is becoming more dynamic, particularly within shipping cycles, and customers need tools to keep pace.

The flexibility built into BofA’s open account model supports this need, making it easier to resolve discrepancies as terms evolve.

The networked approach accommodates companies at different stages of digitisation. Even firms without complete digital infrastructure can engage through simple uploads or paper-based feeds processed via NLP. Logistics providers and mid-sized industrials, in particular, value this low-friction setup.

The next digital push

The next development phase focuses on digitising more complex, paper-heavy products. Letters of credit (LCs) are first in line. “Even today, many banks rely on fax, courier and email to move documents between counterparties,” says Goparaju.

The goal is to streamline the process by offering greater visibility. “We’re enabling view-only access to key points in the transaction so that everyone involved – exporter, importer, banks – has clarity,” he adds. “That shrinks the working capital cycle and reduces errors.”

This principle also applies to risk distribution. Banks and investors participating in supply chain finance programmes often rely on spreadsheets and manual letters. BofA replaces this with secure, API-enabled workflows.

Collections are coming next. The bank applies its open account tools for transactions that do not require a bill of lading, and the platform is being adapted to meet regulatory and market needs for those that do.

A network grounded in reality

Several high-profile trade digitisation ecosystems have previously stalled. What sets BofA’s apart is its focus. “We’re not building a network and asking others to come in. We’re starting with our business and our clients and solving our pain points,” says Goparaju.

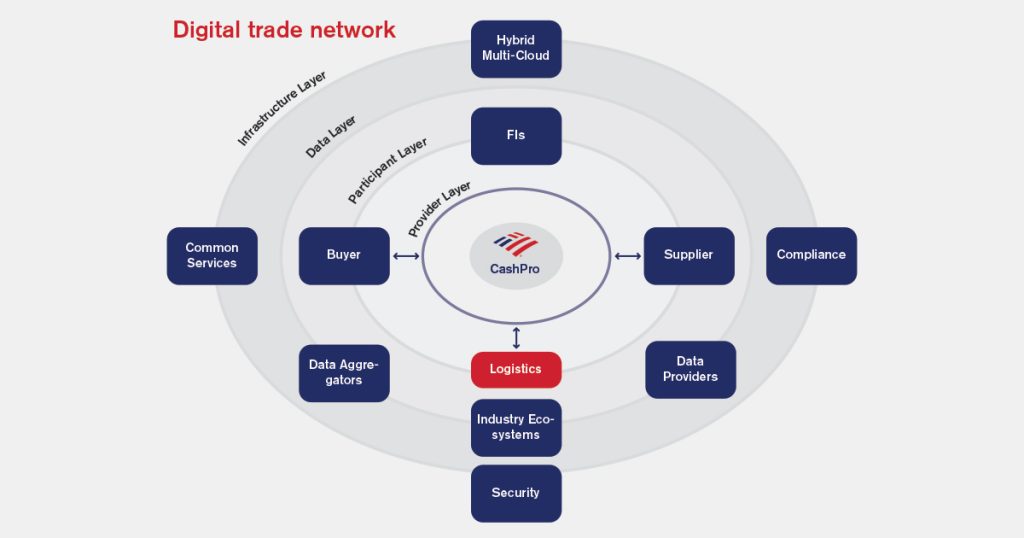

The solution’s infrastructure is layered. There’s a provider tier for technology partners, a participant tier for users, a data layer for aggregation and a core layer handling security, APIs and compliance. Goparaju likens this to an airline alliance, a coordinated network of established players – corporates, financial institutions and other data providers – with aligned goals.

These foundations also position BofA to benefit from the next wave of trade finance innovation. Technologies like AI and machine learning rely on digital data. As long as paper workflows persist, the sector will miss out on predictive insights and automation. The network BofA is building is about unlocking that next level.

Scaling the ambition

Beyond export LCs, risk distribution and collections, the next growth targets of the Digital Trade Network are standbys and guarantees. The structuring of the instruments is still highly manual but ripe for transformation using AI and smart contracts.

There’s also a push to serve the mid-market, where digital-first models could deliver scale without complexity. Healthcare is a current focus, but the ambition is broader.

Further ahead, the aim is to connect trade with payments. Many suppliers already use the bank for payments but lack visibility across the whole transaction. Linking the two offers a more seamless experience.

This expansion also sets the stage for new services: inventory finance, predictive analytics and dynamic onboarding. Crucially, all of this flows from the same principle of a connected network turning fragmented data into real-time intelligence.

Working capital, reconnected

For treasurers and supply chain leaders, the value of faster access to capital, fewer errors and better data is clear. The hybrid model allows engagement at any pace, from fully digital to paper-based.

BofA is also launching a mobile experience through CashPro Supply Chain, offering real-time status updates on documents and transactions. Goparaju compares it to a ride-hailing app for trade where clients can track flows and resolve discrepancies from their phone.

“We’re not just digitising old products,” says Goparaju. “We’re building the platform to unlock what comes next.”

For a market long defined by fragmentation, that may be the biggest breakthrough of all.