Trade finance has a new superpower: it’s the fastest way to influence the ESG performance of every organisation in the supply chain, writes Peter Jameson, Head of Trade and Supply Chain Finance, Asia Pacific, Global Transaction Services at Bank of America.

It’s a rare company these days that doesn’t claim to be committed to being a better corporate citizen. In annual reports, on corporate websites and in media presentations, businesses are keen to state their credentials on environmental, social, and governance (ESG) issues.

The times when issues such as sustainability could be left to a specialist department to manage – and largely ignored by the rest of the business – are long gone. Today, corporations are being measured on their ESG performance as never before. Investors and shareholders are certainly looking at this area in assessing a business, but so too are lenders such as banks, and also employees and customers. Many of those entering the workforce would put a company’s ESG credentials ahead of more traditional criteria when looking for the right company to join.

For these reasons, ESG has moved from a topic that’s regarded as a ‘nice to do’ to something that is critical to the future success of any business.

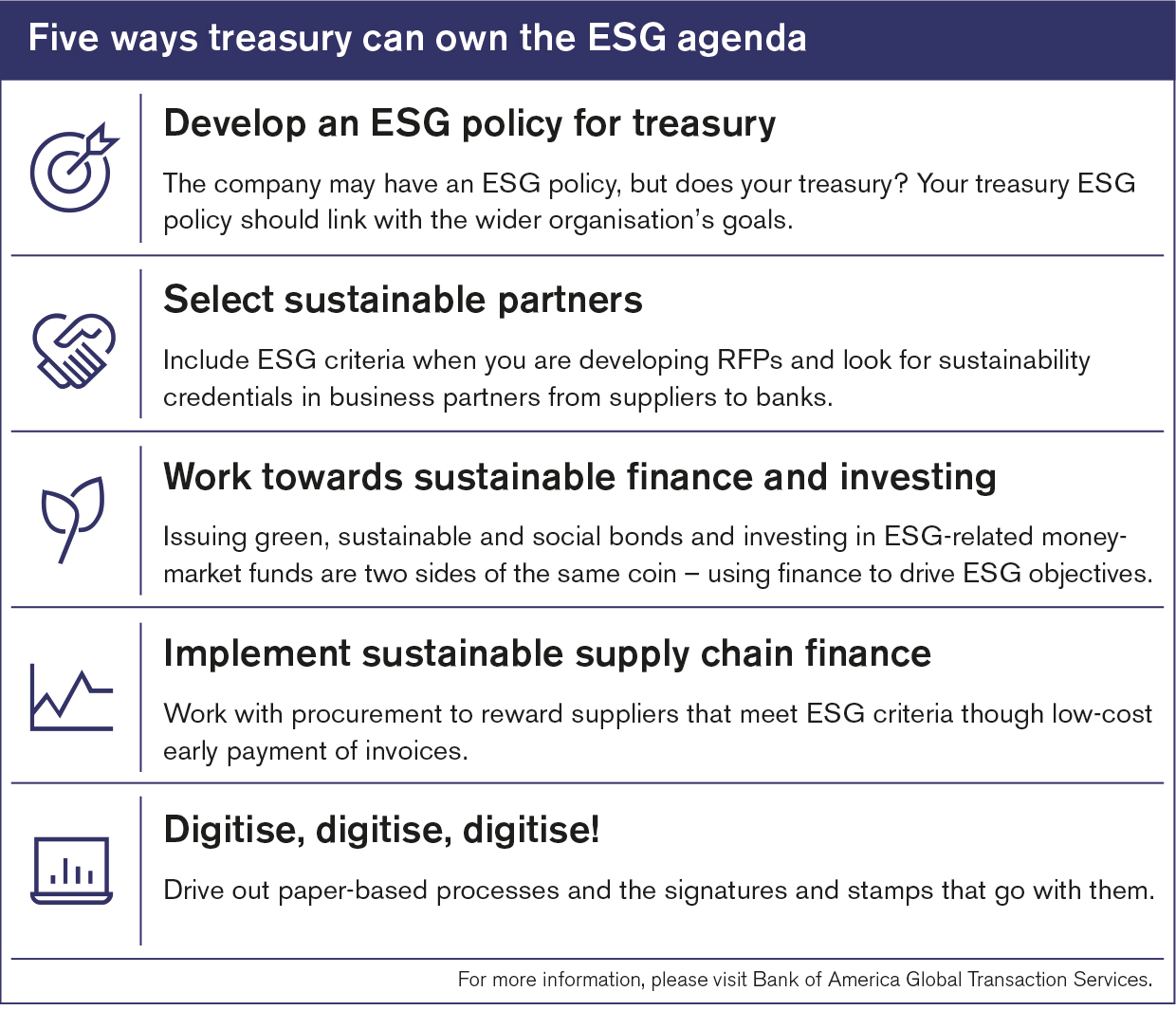

Many different parts of an organisation are being asked to contribute to improving performance in this area – including treasury and procurement who, it turns out, have at their disposal one of the most powerful tools for influencing ESG metrics: oversight of the company’s supply chain.

We are already seeing significant changes in the way international supply chains are managed and financed, and the growing influence of ESG on decision-making is emerging across the industry. In Asia, where so much of the world’s manufacturing has been concentrated, these changes will be felt especially keenly.

Let’s look at the three most important drivers of change in this area.

Shifting supply chains

First, there is a continuing shift in supply chains. Where once corporations thought nothing of supply chains that moved raw materials, parts and finished goods from one side of the world to the other, recent years have seen a move to bring manufacturing closer to home markets. For the most part, this has been due to issues such as labour costs and political risk but, more recently, there’s no doubt that improving sustainability has been part of the decision-making mix.

This isn’t surprising when research data indicates that only somewhere between 10% and 30% of a company’s carbon footprint is within its own organisation – the rest lies within its downstream supply chain. Companies are being held accountable, not just for their own environmental performance, but also for that of all of their suppliers.1

The same is true of the ‘S’ and the ‘G’ of ESG – there is a significant reputational risk to a modern corporation if any of its suppliers don’t hold themselves to similarly high standards on issues such as employment practices, corruption or business ethics.

In an era when supply chain data is more accessible than ever, it’s easier to uncover malpractice and harder for a corporation to claim it had no idea what was going on.

Enter SCF

Against this background, it’s clearly a good idea to ensure that your suppliers, even the smallest of them, have the funding they need to operate, while at the same time ensuring that working practices, environmental impact and compliance with regulations are as they should be.

That’s why supply chain finance (SCF) in itself can be such a positive contributor to a company’s ESG objectives. By providing cost-effective financing to participate in the supply chain, a well-structured SCF programme can play to a corporation’s wider social objectives – by supporting minority-owned businesses, for example. At the same time, it is increasing resilience and sustainability by reducing the chances of key suppliers experiencing a cash crisis and disrupting the broader supply chain. This has been especially noticeable during the pandemic when SCF has provided a lifeline to many suppliers who might have otherwise faced serious difficulties during a time of economic and liquidity stress.

Today, as well as providing those wider benefits, supply chain finance programmes are being used to support ESG objectives more directly. At Bank of America, we offer sustainable SCF solutions that do this by providing differentiated financing rates to suppliers who meet ESG criteria and align with the buyer’s own sustainability objectives.

Across the Asia Pacific region, we are seeing growing use of supply chain finance – and increasing interest in how it can contribute to the ESG agenda. More and more, ESG is at the heart of any discussion around setting up an SCF programme.

Exit paper

The digitisation of trade flows has a clear environmental benefit. Despite the cost and speed advantages of digital trade finance over paper-based processes, the industry has struggled to achieve a wholesale move away from paper processes.

The pandemic has been the catalyst for the much faster adoption of digital trade and trade finance. Forced to work from home, companies that had relied on paper, wet signatures, company stamps, and the manual presentation of paperwork were forced to accelerate their adoption of digital technologies.

As well as reducing the environmental footprint of those companies, the digitisation of trade has another ESG benefit. Where processes are manual, labour-intensive and complex, there’s a real barrier to entry for smaller companies to gain access to supply chains. Digitisation brings with it transparency and simplicity, giving smaller firms access to a global supplier or customer base.

The small retailer in Seoul can now sell to customers across the world.

It’s all about the data

The single element that ties together the three trends I have outlined here is data. The flow of information about trade and trade finance is greater than ever before, and businesses that can use that data to optimise their supply chains have a genuine competitive advantage in the context of ESG.

The availability of granular data on supply chain activity also allows companies to fully understand all elements of their supply chains. The transparency that these providers to other interested parties to monitor ESG performance will act as a further catalyst for companies to drive their ESG agenda.

That interest is focused, not only on the performance of companies within the supply chain, but on how supply chains are financed – increasingly companies are not only exploring ESG-oriented financing, but are also seeking assurances that the financing itself is funded from sustainable sources.

A good example of this is Bank of America’s launch last year of the Equality, Progress, Sustainability Bond, raising US$2bn to provide funding – including through SCF programmes – to advance racial equality, economic opportunity and environmental sustainability.

Making a difference

Treasury and procurement teams have the power to enable real change in the ESG performance, not just of their own businesses, but throughout their supply chains. Their position at the centre of financial flows within the organisation, along with new tools and techniques, are making it easier than ever before to use financial incentives to promote ESG practices.

Now it’s up to treasury and procurement leaders to engage across their organisation to ensure it’s clear the critical role that they will play in future in supporting the ESG agenda of the wider corporation.

References

- Starting at the source: Sustainability in supply chains, McKinsey, 2016