Russ Grazier, Head of Export Finance at Barclays, discusses how the bank is working with the UK government to bring clients access to export finance facilities more quickly and efficiently.

Entering overseas markets can bring secure, long-term growth for many UK businesses. Indeed, the Department for International Trade’s research finds that 85% of companies believe that exporting has led to a level of growth not otherwise possible.

Why then isn’t every business in the UK exporting? Well, many businesses with ambitions to sell overseas or to expand existing export business experience, struggle with the strain that this places on their cashflow. This pressure is often coupled with difficulties in accessing the right type of working capital financing. In cases where financing is less of a concern, the appetite for new sales is sometimes outweighed by the fear of new overseas buyers not paying on time, or not paying at all.

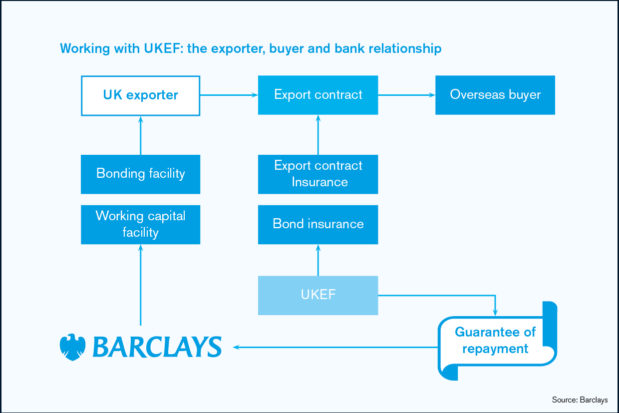

A prime responsibility of UK Export Finance (UKEF) – the UK government’s export credit agency – is to help UK businesses by removing these barriers. It does so by offering insurance to exporters, attractive financing terms to overseas buyers of UK goods and services, and guarantees to lending banks. UKEF plays a crucial role in helping reduce the risks posed by overseas trade, and is an institution that Barclays is proud to have been collaborating with since the 1920s.

A vital tool

Export finance has long been a crucial tool for UK businesses looking to sell overseas. UKEF support is arguably even more important today than in the past, as businesses look to drive secure, long-term growth in a period of domestic economic and political uncertainty.

The funding requirements of businesses can on occasion exceed the risk appetite of their funding provider. Where this happens, UKEF can step in and offer guarantees to banks, to share the risks of providing export finance. For example, a UKEF guarantee to a bank can remove the need for a UK exporter to post cash collateral to support bonding facilities needed to secure an export contract. This can free up vital cash that can be put to use elsewhere by the business.

There are numerous ways that the funding can be arranged and utilised by UK businesses.

A popular way is through creating a ‘facility line’ with UKEF. This offers flexibility as, once established, it can be drawn on as and when needed, to meet bonding or working capital needs.

UKEF does have some eligibility criteria that must be met. Most crucially, at least 20% of the export must be comprised goods or services from the UK.

A new era of partnership

Barclays’ partnership with UKEF has and continues to benefit our business clients in many different and important ways. A number of companies are using this funding to be more competitive when selling overseas, by offering bonds or extended payment terms to their buyers. Others use it to fund their working capital needs to ensure that all orders are fulfilled in a timely fashion.

In July 2017, Barclays, along with four other UK lenders, signed an agreement with UKEF designed to improve the quality of support offered to UK exporters. The agreement provided banks like Barclays with delegated authority to directly deploy UKEF’s guarantees, when our clients meet pre-agreed criteria. This change is expected to streamline the UKEF support process, enabling our clients to access export finance facilities in a quicker fashion.

Furthermore, the degree of support provided by UKEF has expanded to cover a wider class of UK businesses, enabling finance to now be offered to UK companies that supply goods or services to UK exporters. These enhancements in cover are now delivered through a brand new digital platform, which further supports UKEF’s aim of ensuring, alongside the banks it works with, that no export fails due to the lack of financing.