Ugur Bitiren, global head of sales and advisory, receivables and supply chain finance (RSF), and Stephane Barret, global head of private capital group fund coverage and fund services and global head of TMT (telecom media technology) sector coverage, at Crédit Agricole CIB, share their views on how the decentralisation of the technology supply chain has triggered an acceleration of the sector’s ESG transformation.

Since the pandemic, tech hardware and semiconductor production sites have been undergoing a process of decentralisation, resulting in a more complex supply chain landscape and a surge in demand for working capital and capital expenditure. The technology sector has been revolutionised by these new greenfield projects, which were established with a strong focus on environmental, social and governance (ESG) criteria from their inception, triggering a new wave of ESG transformation.

Third-party manufacturers

A large portion of computers and other hardware devices are produced by a handful of third-party manufacturers (TPMs), traditionally concentrated in the Asia Pacific region.

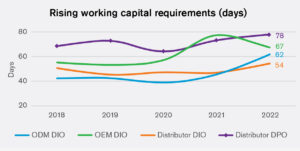

Between 2020 and 2022, a cluster of TPM companies, namely Wistron, Compal, Quanta, Pegatron, Inventec and Flex, experienced a significant increase in net working capital, attributed to prolonged inventory holding periods, as calculated by the days inventory outstanding (DIO) ratio. The upswing was mainly driven by a surge in demand for computers during the pandemic; however, this trend began to reverse in 2022. For instance, Gartner Research has reported a sharp 30% drop in computer deliveries between Q1 2022 and Q1 2023, signifying the beginning of the sector’s slowdown.

To cope with their heightened working capital requirements, many TPMs have resorted to discounting receivables owed by original equipment manufacturers (OEMs) to secure necessary financing. Crédit Agricole CIB has historically been a strong player in the receivables financing space, arranging many discounting deals for these flows. Since 2021, there has been a growing demand for receivables financing programmes, in some cases for large tickets requiring distribution to other banks to accompany the growing working capital needs.

The diversification of production sites of TPMs in less traditional geographies for their new manufacturing facilities, such as Pegatron in India and Quanta in Southeast Asia, has increased financing needs further. Many of these large OEMs have been more selective about which TPMs they work with, putting in place stringent upstream ESG screening requirements to continue doing business.

Original equipment manufacturers

During 2021, the major computer OEMs, including Lenovo, HPI, Dell, Asus and Acer, experienced a notable increase in their inventory holding periods. However, they managed to recover from this situation in 2022.

One of the key advantages these OEM firms possess is their integration with hardware distributors. These distributors purchase inventories in bulk and resell them to end clients. For instance, HPI had approximately 52% of its receivables owed by 10 distributors and resellers, with notable concentrations on TD Synnex and Ingram Micro, according to their 2022 10-K report.

As a result of these hardware distributors handling these working capital requirements, they rely heavily on the OEMs to provide extended payment terms through distributor financing programmes. HPI mentions this objective in its 2022 10-K report: “HP utilizes certain third-party arrangements in the normal course of business as part of HP’s cash and liquidity management and also to provide liquidity to certain partners to facilitate their working capital requirements.”

Dell has similar programmes in place, as mentioned in its 2022 10-K report: “We also facilitate access to third-party financing to help our channel partners manage their working capital.”

Hardware distributors

With OEMs extending their sales terms to these distributors, the effect on distributors’ financial metrics has been a rise in average payment terms, calculated by the days payables outstanding (DPO) ratio. It is important to note that these extended payment terms provided by OEMs do not necessarily increase their average collection terms, as these distributor financing programmes allow for receivables discounting.

Over the past two years, Crédit Agricole CIB has closed or participated in many of these facilities, contributing positively to financing the working capital flows during periods of persistent supply chain volatility. Downstream ESG requirements from OEMs are being explored to transform these existing programmes into sustainability-linked initiatives.

Semiconductors

Alongside the supply chain shocks in the hardware space, there have also been persistent challenges in semiconductor supply chains. A recent study by Bain has shown that semiconductor lead times grew substantially during the pandemic, peaking in 2022, and although they have started to decrease recently, they remain high.

Many of these semiconductor firms sell to TPMs or OEMs for the manufacturing of their products. The surge in demand for semiconductors during the 2020 hardware boom led to the diversion of raw materials and fabrication capacity away from producing other types of chips, exacerbating the existing shortage.

To cope with the situation, semiconductor companies have been rapidly expanding their production capacity.

Key players such as Intel, GlobalFoundries, TSMC and Samsung are making significant investments in new semiconductor fabs. Similarly, like hardware TPMs, these companies have been decentralising fab sites, with the European Union and the US competing to attract these new facilities to their respective territories.

Government subsidies and long-term supply arrangements (customer prepayments) have provided some of the financial support needed for these new facilities. Nonetheless, decentralisation has made the physical supply flows and associated semiconductor supply chains more complex, with the cash and physical flows becoming even more global than they were previously. These developments will require both immediate financing solutions, such as financing for capital expenditure during the construction phase, as well as working capital financing once these new facilities are operational.

ESG

Many large players in the technology space have taken the lead in prioritising decarbonisation and social responsibility within their value chains, encompassing both suppliers and sales partners. This trend has even influenced traditionally non-ESG-focused firms, such as TPMs, to place a greater emphasis on responsible sourcing, human rights and gender equality to avoid the risk of losing business.

The semiconductor space has also experienced a recent shift towards ESG practices, especially related to the procurement and sourcing of raw materials with historically high environmental impacts. There have been recent discussions with top OEMs regarding sustainability-linked supply chain finance programmes for their suppliers in Asia, allowing these suppliers to access capital at a lower cost of funding, facilitating their working capital needs, but also accelerating their ESG transformation thanks to financial incentives based on their performance against sustainability-related key performance indicators.

Furthermore, the greenfield capital expenditure requirements of semiconductor and hardware firms have often been accompanied by sustainability ambitions, such as on-site renewable electricity generation. Many of the associated working capital flows related to procurement, sales and capital expenditure are being enhanced with ESG initiatives.

Conclusion

The technology sector has experienced a significant shift towards supply chain decentralisation, prompting a stronger emphasis on ESG principles and a heightened need for working capital solutions. This has resulted in a substantial increase in demand for Crédit Agricole CIB’s working capital solutions, which are sought after not only for their financial benefits but also for their positive impact on the ESG transformation within the technology sector.