The Covid-19 pandemic resulted in unprecedented supply chain disruptions around the globe, with MSMEs being amongst the hardest hit. Einstein once said that “in the midst of every crisis, lies great opportunity”. But what does that mean for our roadmap to recovery? And to what extent can supply chain finance be leveraged to facilitate it in a sustainable way, asks Steven van der Hooft, CEO of Capital Chains.

Global warming and social injustice were the topics that featured most in news headlines in the days leading up to the Covid crisis in early 2020. Since then, dealing with the pandemic has become the number one priority in every country around the world. To control and prevent further escalation of the outbreak and ensure access to health care, governments introduced a wide variety of measures impacting society and, with it, the global economy.

The pandemic shifted our attention. For the first time in many years the worldwide emission of greenhouse gasses was significantly reduced – albeit only temporarily. While the Covid outbreak and subsequent measures taken revealed the vulnerability of global supply chains,

it also made many people question whether or not the process of globalisation has perhaps been taken a step too far.

With vaccination programmes now being rolled out, many countries are trying to arrive at the so-called “new normal”, whatever that looks like. At the same time, there is a need to rethink our global supply chains, ensure the recovery of the global economy and maintain the sustainability of that revival in the long run. It is time for a renewed approach to integrated supply chains.

Financial supply chain

Even before the global Covid outbreak, MSMEs were struggling to survive and thrive, given their limited access to affordable trade financing. According to the Asian Development Bank back in 2019, the global trade finance gap was estimated to be US$1.5tn. It has been suggested that this figure could double as a result of the pandemic.

To keep the MSME sector afloat during the recent crisis, some countries introduced government support packages and tax breaks, whereas others collaborated with the financial industry to provide advantageous financing terms. Given the temporary nature of these support packages, and despite their best efforts, the financial standing of many of the targeted MSMEs has since deteriorated because of a lack of sales, inability to stock inventory and the requirement to pay for staff as well as fixed expenditures. For MSMEs to restart their businesses and make the necessary investments to adjust to the new reality, much more liquidity will need to be injected into these supply chains. And if these MSMEs are disrupted in their natural cause of business, it will eventually backfire to the end consumer of the anchor’s business.

Supply chain finance could add real value in this situation as it allows the large(r) anchor and its supplier/distributor network to work closer together, thereby significantly increasing the ability of MSMEs to access affordable trade financing. For those supply chains that had not yet looked at SCF, the Covid-related issues in these supply chains will give rise to more demand for all kinds of SCF solutions.

Physical supply chain

Alongside the ever-growing importance of financial supply chain collaboration, regulators and customers alike are demanding more transparency on the achievement of environmental, social and governance (ESG) goals of both the individual anchor as well as its wider ecosystem. Be it on a reduction of the emission of greenhouse gasses or improving the working conditions for workers and guaranteeing them a fair pay, ESG reporting is becoming a critical component of the annual report for both corporates and financial institutions.

With global businesses rethinking their supply chains and business models and anticipating the new normal, delivery reliability, financial collaboration and ESG-related themes are increasing the need for corporate supply chains to invest in data capabilities like never before.

The physical supply chain holds a wealth of data points to work with, and today’s technological developments (machine learning, AI and blockchain solutions) make extensive data analytics and forecasts available to many. This in turn enables an increase in the level of transparency in corporate supply chains and supports the much-needed deliberations of which supply chain partners to include, or exclude, going forward.

The time seems ripe to combine efforts on both ends of the supply chain, by utilising a solution to a problem on one end (financing), to serve as an accelerator for the other (ESG). A serious impact on the sustainability front can be made by anchor corporates and financial institutions by teaming up in the offering of SCF solutions that are either made available only to those MSMEs that meet certain ESG standards, or which are priced and made available to incentivise MSMEs to invest in meeting these ESG standards going forward.

Supply chain finance

While the standard definitions of SCF have been identified and include numerous product variations under the umbrella term, many market participants still equate SCF with payment term extension. With a full spectrum of products covering the pre-shipment, in-transit and post-shipment stages in the supply chain, SCF could provide financing solutions in the end-to-end supply chain. And despite recent coverage of controversial usage, and the bankruptcy of a leading SCF provider, demand for SCF is growing. Leveraging the latest technological developments and increased availability of real-time supply chain data, SCF is the most logical financial product to finance inventory, purchase orders, payables and receivables, and even entire distribution chains. All with the aim of strengthening the reliability of the supply chain, while meeting expectations on both a product and/or service level, as well as the environmental impact.

Challenges for SCF

Since the origins of SCF, there have been some well-known hurdles for implementing and scaling SCF programmes, such as the difficulties onboarding supply chain partners, the adoption of technology, and uncertainties about regulations and disclosure requirements.

A critical success factor for the SCF industry will be its combined effort in providing education and raising the awareness of the use cases for SCF. Not just at the corporate level, but even more so at the mid-corporate and MSME level and in regions currently underserved by the SCF market. The key challenge for the providers of supply chain solutions, and especially those that are new to the industry, is their ability to support corporates in their end-to-end journey: from idea to implementation and roll-out. The most important question to ask here is: are you ready?

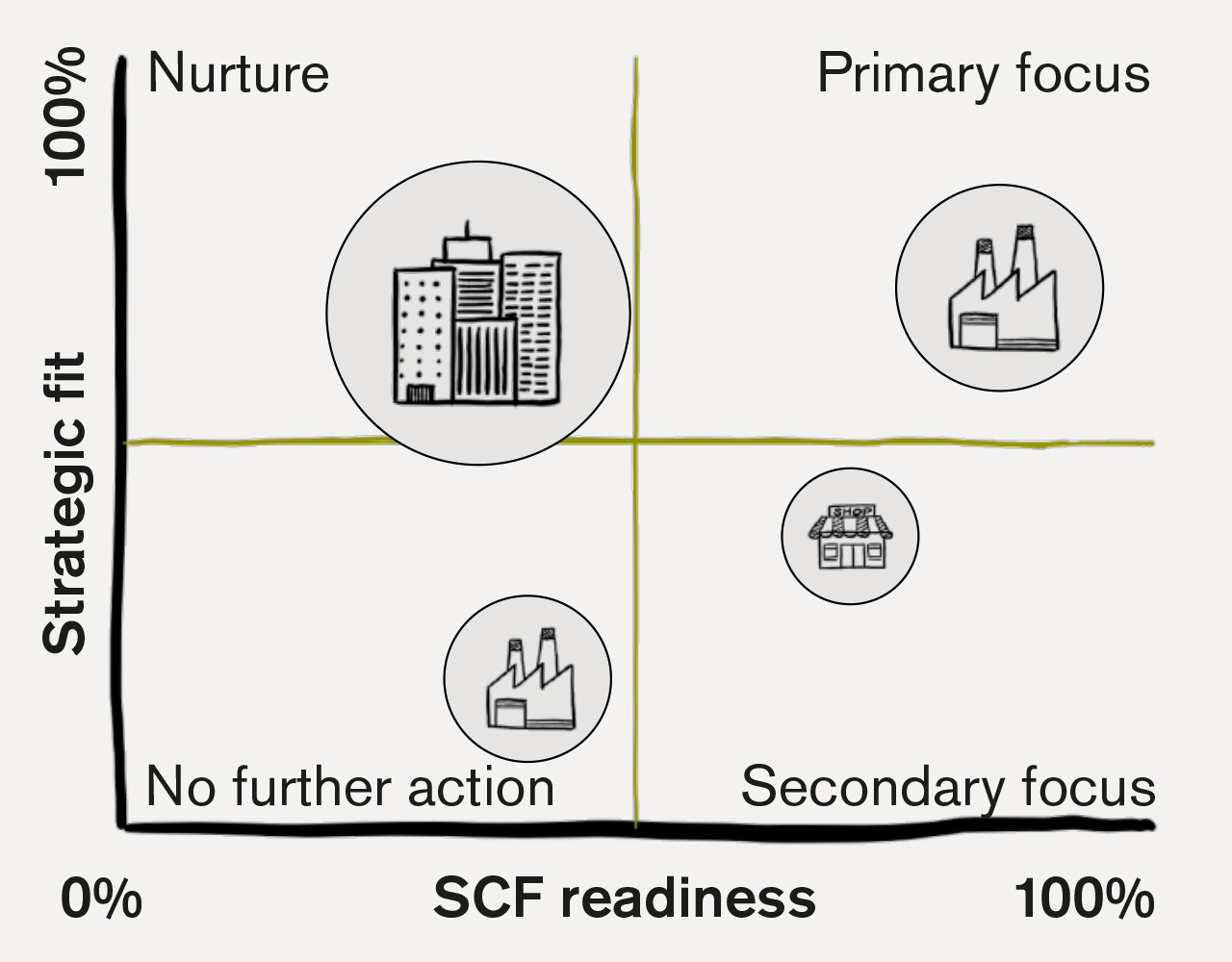

For SCF to enjoy accelerated adoption rates, providers of SCF need to reduce their sales cycle. For large(r) corporates this can easily be 12-18 months, and much focus is still placed on the potential deal size. More importance should be given to the anchor’s ability to start, and its readiness for the implementation of a SCF programme on different levels.

At Capital Chains, we have made it our business to support the market in defining that readiness, based on a structured approach covering six overall parameters, each consisting of multiple sub-categories/questions to score an anchor:

- SCF strategy: what is the SCF objective and is there a strategic fit?

- Internal alignment: are the key stakeholders fully aligned on the SCF strategy?

- P2P/O2C process: lead times of the current P2P/O2C process

- IT: impact on the current IT infrastructure

- KPIs: are the right KPIs in place to support an SCF roll-out?

- Partner segmentation: ability to segment?

Based on the relative readiness of the portfolio of clients, both current and prospective, and the strategic fit with the overall targets of the offering, SCF providers should not be focusing on the size of the bubble, but on the ability to capture that bubble. And for those clients that are not ready, providers need to support them in becoming ready over time.

Focusing on the right clients is key; are you doing this yet?

For more information, visit www.capitalchains.com