Global trade is continually evolving, with a convergence of physical, financial and data value chains. Corporates are central to this, and the world’s dynamic macro forces are requiring their supply chains to be more resilient than ever before. There is a systemic response required to tackle this challenge and Patrick McAvoy, Corporate Banking & Trade Finance UK lead at Accenture, looks at the role that trade finance must play.

What do we mean by “resilience”? A resilient supply chain can be defined by its capacity to resist, avoid and recover from disruption, across several dimensions. Physical interruptions manifest through both internal and external threats, usually relating to Environmental, Social and Governance (ESG), climate and security threats, all of which can prohibit the product flow and cause damage to a company’s bottom line.

Corporates and finance providers face some shared challenges relative to the current environment, including arriving at a clear and common understanding of what it means for a supply chain to be resilient.

The importance of assuring the resilience of “strategic suppliers” – whose inputs are critical to the conduct of trade in a particular supply chain – is increasingly appreciated by senior executives, and was brought into sharp focus during the tragic tsunami in Japan, where disruptions at a single supplier brought an entire supply chain to a halt. Beyond this, the Covid crisis has highlighted the importance of agility and the ability to quickly re-tool, or shift from “brick and mortar” distribution to online sales, and more broadly, to decisively digitise operations and transactions.

Covid-19 has illustrated too that a resilient supply chain can be repurposed in times of crisis, to be responsive to the urgent needs of communities and society. For example, small businesses and global luxury brands have set aside at least some of their sourcing and production capability to manufacture masks and other essential products, for reasons of social responsibility and contribution.

There are concerns that Covid-19 could be the first of a series of pandemics we may face, and at the same time, climate change is commonly cited as an urgent and existential threat, in particular to global freight as sea levels are transformed. Perhaps less intuitively, events over the past five years in particular have shown with striking clarity that it is no longer sufficient for corporates – or their financiers – to think of supply chain resilience as being limited to commercial considerations. Geopolitics such as the US-China trade tensions must enter the discourse around supply chain resilience. Geopolitics and the “national interest” continue to influence company sourcing decisions as well as foreign investment choices. Supplier and country-level concentration risk is now at the heart of supply chain management and financing deliberations, even as practitioners and market observers acknowledge that the outcome will be some form of “re-globalisation” and not a full-scale reversal of globalisation.

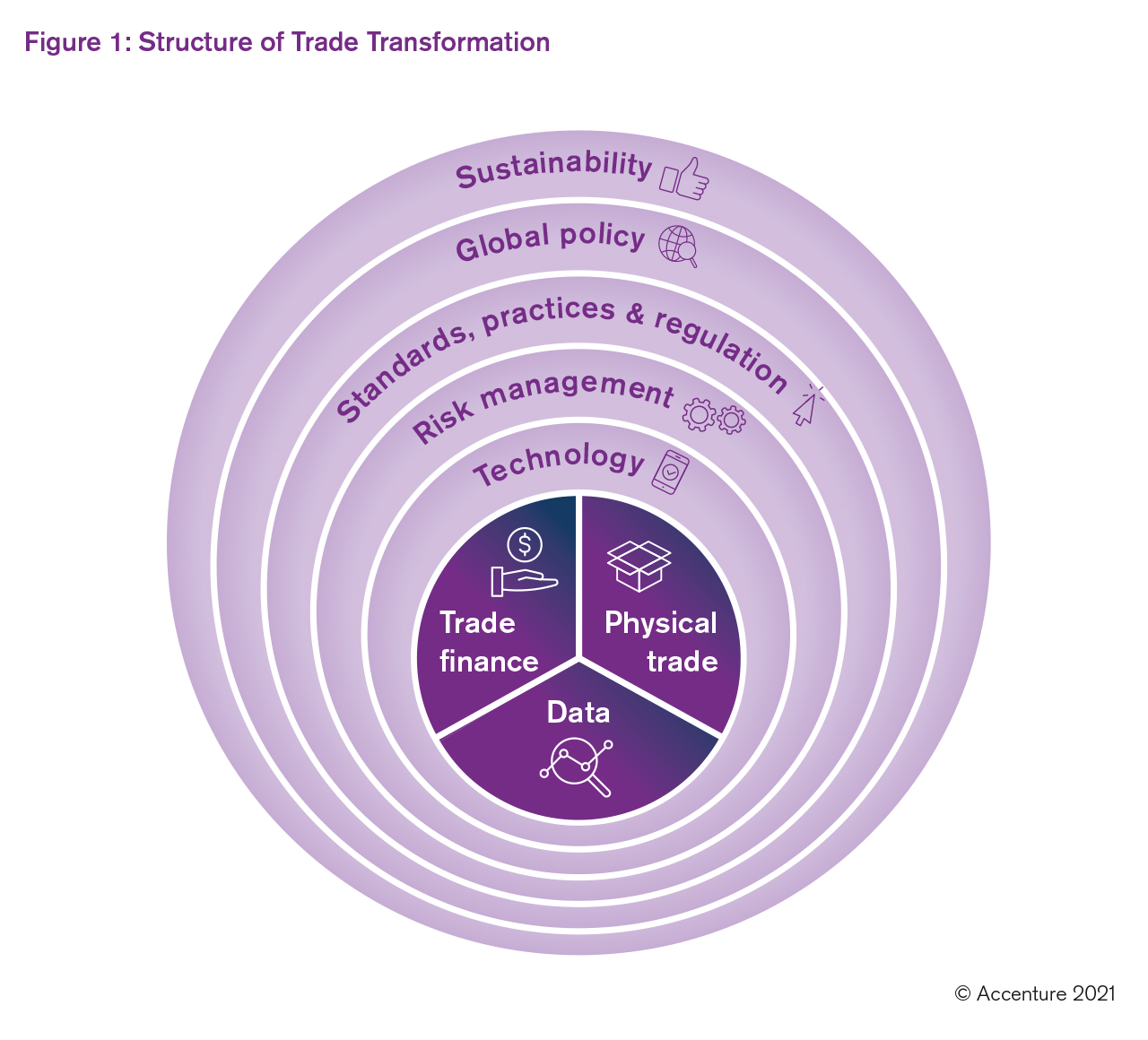

To understand and respond to these and other forces, there are three components at the core of trade: physical trade, trade finance and data – this is illustrated in Figure 1. Whilst the first two are not new, and have been around for centuries, the ability to understand and use data – to inform decision-making across the physical and financial supply chain – is a more recent development.

Data can be viewed as the catalyst to power innovation through a series of transformation layers, namely technology, risk management, standards, practices, global policy and sustainability. This structure can be used to develop a comprehensive understanding of the core elements of resilience, pertinent for global supply chains.

Focusing on the trade finance component, financing and liquidity are now more widely acknowledged as critical to the health of supply chain ecosystems. Perhaps ironically, that same financing will be impacted by multiple “resilience factors” such as the ones noted earlier. Each of these could directly impact threat identification and risk assessment, availability and pricing of financing, and the judgements about the degree (and cost) of risk mitigation measures to be taken by lenders, as well as by corporates themselves. Finance providers (banks, alternative finance providers and fintechs) have a significant part to play in providing corporates and the wider supply chains with the liquidity to be financially resilient. Legacy business models do not lend themselves to providing additional liquidity at speed; usually due to a lack of data to accurately measure the levels of risk.

There is a market shift from a bilateral, buyer-seller view to ecosystem solutions in trade and this shift will be underpinned by significant adaptations to the existing service model, including the convergence of solutions across both physical and financial dimensions, that are powered by data-led and digital technologies and offered by a range of traditional and non-traditional actors.

From a trade finance lens, we expect the service ecosystem model of two to three years’ time to display the following characteristics across the trade lifecycle:

- Deep-tier supply chain financing programmes: Banks will likely incorporate more features into existing supply chain finance programmes that speed up the flow of capital to deep-tier borrowers such as pre-shipment financing terms. Alternatively, solutions that penetrate deeper into supply chain networks such as distributed ledger technology and smart contract-enabled deep-tier financing could be offered at a far greater scale.

- End-to-end digital product fulfilment: Digital credit decisioning and product fulfilment solutions that leverage financial data from third-party applications instead of traditional collateral will slash the cost and time expensed in providing working capital solutions, opening-up the SME lending market for banks and others, either directly to suppliers or via buyer-led programmes.

- Sustainable trade finance offerings: With a green investment boom already upon us and appetite for broader ESG-linked lending set to increase further, trade finance providers will be seeking an edge in terms of their product offerings. The ability to verify the ESG credentials for a given transaction or node within the buyer/supplier network is the critical blocker. Full-service data solutions are unlikely within the next two to three years. However, financial service providers will likely partner with data utilities to digitise industry, sector or region-specific standards and certifications and offer a limited yet differentiated product set.

- Integrated stress-testing: Data elements from banks, logistics organisations, market utilities, third-party service providers and corporates will likely feed models that offer integrated supply chain stress testing solutions across both financial and operational performance measures.

- A collaborative funding ecosystem: An expanded funding ecosystem (including bank-led consortia models) will be critical in narrowing the trade finance gap, with increased activity across the multiple dimensions ranging from corporates self-funding off-balance sheet to buy-side capital markets and development finance participation via secondary market and matching platforms.

- Regulation and financial crime compliance: Trade finance providers will leverage advanced AI and machine learning network solutions to balance the appetite for mid-market and SME lending against the cost of financial crime and sanctions controls that would arise from a broader customer base. In parallel, interoperable digital identity solutions either through specialist technology firms or via bank-led consortia models could finally pave the way for third-party KYC verification and significantly reduce the operational burden.

- Future-proofing the workforce: With technology (particularly in solutions leveraging Artificial Intelligence) expected to take on a growing percentage of operational tasks, finance providers need an upskilling strategy in place to leverage relevant expertise and push it towards higher-value activity.

Trade finance does have a major role to play in addressing the challenge of supply chain resilience, however, as we can see, the full benefits can only be realised with a more collaborative, data-driven systemic approach to global trade.

To find out more about any of the topics or to speak with the Trade Finance team at Accenture, please contact Patrick McAvoy at patrick.mcavoy@accenture.com