Despite global uncertainties, credit and political risk insurance remains a vital tool, offering resilience, adapting to ESG trends and supporting banks and multilateral development institutions, writes Harry McIndoe, director at BPL Global.

The credit and political risk insurance (CPRI) market plays a crucial role in the global financing ecosystem, and there is widening recognition of CPRI as a core risk and capital management tool for financial institutions. Ranked as the second most important distribution tool for banks in the International Association of Credit Portfolio Manager’s (IACPM) 2021 survey (just below secondary sales), CPRI supports upwards of US$500bn of ongoing trade and investment at any given time. The market continues to enjoy robust financial health, with twice as many credit rating upgrades as downgrades since 2008, amongst a sample of 45 company market insurers. Importantly, no insurer rating has fallen below S&P A-.

The market at large is made up of extremely well-diversified property and casualty (P&C) insurers, whose claims payment ability is practically unparalleled. Simply put, these insurers don’t make promises they cannot keep. With annual non-life insurance market premiums totalling more than US$2.5tn, the industry expects to pay out multiple catastrophe losses each year that individually cost the industry billions in claims. Indeed, the industry is quite regularly called on to pay out more than US$100bn, only to wager a similar “bet” the following year.

However, after several years of “soft” market conditions, the increasing frequency and severity of natural catastrophes – coupled with stubbornly high inflation, which has increased the value of insured assets – has caused a shift towards harder market conditions. In fact, premiums in some classes have reached 20-year highs. Unsurprisingly, this has also resulted in a shrinking risk appetite in the wider market. For example, many reinsurers have reduced their activity in the property market, with some withdrawing completely. In turn, rising prices and tighter terms and conditions are being imposed on clients.

Resilience in the face of adversity

The good news for CPRI market clients is that this segment has remained relatively insulated. Widespread concerns that a wave of post-Covid insolvencies would inundate the market with claims have so far failed to materialise. The impact of Russia’s ongoing invasion of Ukraine has also been considerably less than anticipated, with CPRI market losses set to fall well below initial estimates due to clients working to reduce exposures. Similarly, as long as current events in Israel and Palestine do not spread materially in the region, any loss to the market will likely be negligible.

With major losses and claims inflation elsewhere, the resilience of CPRI is reinforcing its appeal, and it is seen as a useful diversifier for insurers, particularly in the context of Solvency II, where “speciality” classes can provide a capital benefit. This positions CPRI as an increasingly important segment for insurers.

Diversification driving a bright outlook

All the pointers suggest that conditions in the CPRI market are balanced, with supply and demand finding a happy equilibrium. It is rare that a deal cannot be placed, and pricing remains constant relative to insureds’ own risk margins. Certainly, we see a market very much in growth mode, with clients expanding their use in a truly holistic fashion, and insurers relishing exposure to a diverse range of opportunities.

Using BPL’s portfolio as a proxy for the wider market, enquiry volumes increased by 15% in 2022. Aggregate insured exposure has increased by 65% since 2020, reflecting a widening of usage by existing mature market clients across a broader range of deal types, as well as increased new business volumes from newer market entrants. A big driver here has been the capital relief benefit for banks. But the general heightened perception of risk cannot be ignored.

Alongside the increased demand, we have seen a significant broadening of appetite from the market, with the number of asset classes covered increasing by 60% in the past five years (from 11 in 2018 to 18 in 2023).

In addition to broadening diversity, CPRI insurers’ portfolios are becoming increasingly ESG-favourable. With their exposure to catastrophe risk, P&C insurers are commercially on the front line for climate change impact, and this sensitivity permeates down to their CPRI teams. With hydrocarbons historically constituting over 50% of many insurers’ portfolios, ESG-favourable client selection is the main insurer strategy, supporting major CPRI purchasers who are taking a lead position in corporate responsibility. However, a lack of standardisation means that approaches differ among insurers, with those at the forefront targeting a reduction to around 10% carbon-positive exposures in the next few years.

And, whereas five years ago the bulk of exposure constituted African medium to long-term payment risk – largely oil and gas related – the market today isn’t such a close reflection of commodity markets. Indeed, at 47%, nearly half of BPL’s portfolio currently comprises of Europe and the Americas.

These days, average credit ratings hover around the BBB- to BB+ mark, and appetite and expertise in areas such as infrastructure, telecoms, fund finance and capital markets have escalated. This all contributes to much stabler, varied insured portfolios, serving to protect the market’s long-term viability. It would be inaccurate to call this a pure “flight to quality”; it is more a diversifying of appetite, while still remaining faithful to the more traditional contract frustration exposures in trickier countries, which were historically the market’s mainstay. A core group of insurers still make this their primary focus, and it should not be ignored how profitable African nonpayment risk in particular has been for the market over the years, with historically strong pricing and above-average recovery rates.

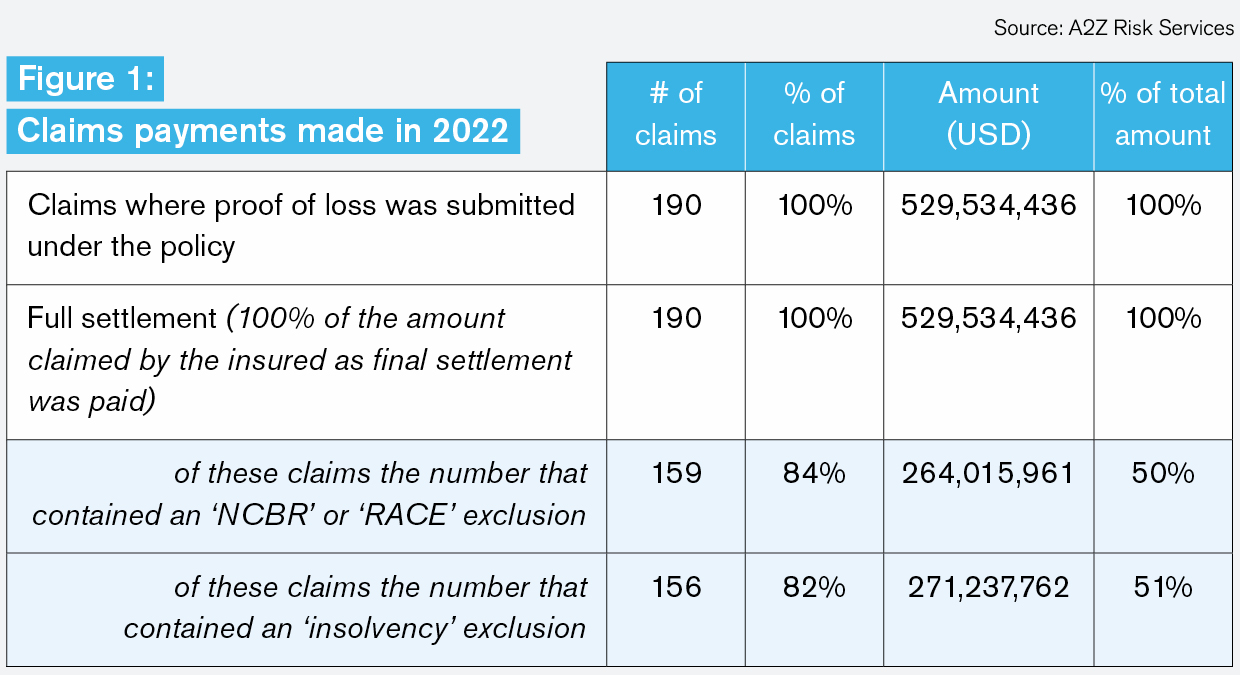

Against this backdrop of growth and broadening appetite on the placement side, it shouldn’t be forgotten that collecting claims is arguably the most important part of a broker’s job. While the market will be called upon to pay up in places such as Russia, Zambia, Ghana and Lebanon, insurers are well placed to rise to the challenge, and the claims payment record confirms this. For a market with a premium income of around US$4bn per annum, annual claims in the high hundreds of millions of dollars are not uncommon.

Using 2022 as a snapshot, over US$500mn of claims were paid to regulated financial institutions alone, reflecting a 100% success ratio (see Figure 1).

Supporting evolving needs and trends

Commercial banks continue to form a mainstay of the CPRI market, and much work goes into bringing new banks to market and developing services to enhance their experience. For instance, to meet client demand, we have established a dedicated Portfolio and Structured Solutions team as an increasingly efficient way for clients to manage regulatory capital, distribute risk and access fresh sources of capital. With tens of thousands of single-risk CPRI policies placed annually, bundling risks into homogenous portfolios is vastly more efficient. Insuring portfolios has traditionally been the preserve of the reinsurance (and trade credit) market(s), but we also see a growing number of direct players developing the actuarial capability to analyse and structure pools of exposures, including ones that qualify for the (unfunded) significant risk transfer categorisation.

And in a changing world, clients are increasingly seeking ways to reduce insurance costs and access new markets by establishing captives. Clients with good track records and the ability to retain more risk in-house are rewarded with increased capacity and are able to build reserves against future losses. It is a clear growth area and one where BPL has been able to respond to client demand and invest in providing the capabilities in-house.

Another area BPL is focusing on is multilateral development institutions, which are gaining an increasingly receptive market audience. Recognising the key role played by these institutions in addressing the estimated global infrastructure gap of around US$350bn a year, and with more institutions coming to market, a handful of insurers are reserving much of their emerging market risk appetite for this client segment, which constitutes up to one-third of some insurers’ premium income flows. The perceived “halo effect” is key in helping crowd in private sector capital and is now being shown to work for newer multilaterals, supporting greater funding, flexibility and innovation.

The commercial nature of the insurance market means that it is continually evolving and innovating to stay relevant and attract customers. To look at the CPRI market in 2023 vs 2008 is to see a market very similar in many core respects, but a world apart in others.

By virtue of BPL’s employee ownership structure, we can focus exactly on advancing capabilities and solutions that support clients’ needs. As a result, we have been at the forefront of many of the CPRI market’s innovations since our inception, 40 years ago this year – and remain steadfast in supporting our clients in this way.