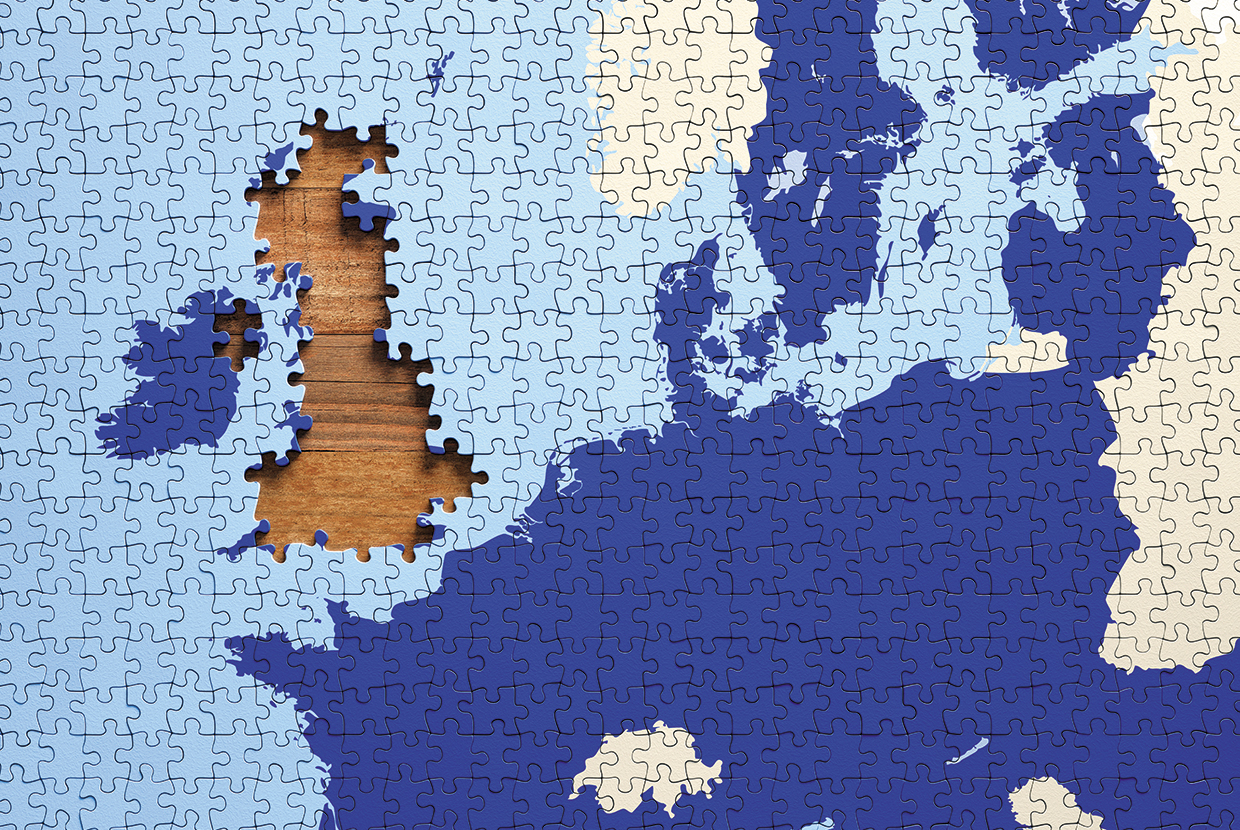

As UK exporters prepare for life outside the EU, there are important questions over the rules for determining whether or not a product can be considered ‘made in Britain’. The UK has pushed an ambitious and creative strategy on rules of origin, but EU negotiators remain unconvinced, leaving exporters in the dark over whether their products will benefit from any free trade agreement (FTA). John Basquill reports.

The automotive sector is the UK’s largest exporter of goods. The Society of Motor Manufacturers and Traders (SMMT) says car and van exports made up a seventh of all goods exports from the country in 2018, carrying a total value of over £44bn.

But where are those vehicles actually from? The final product may have been assembled in the UK, but various components – the battery, rubber for the tyres, brake discs and so on – may have been sourced from suppliers all over the world.

Free trade agreements (FTAs) only allow tariff-free exports if the goods being traded originate within the exporting country. FTAs will generally set a threshold that exports have to meet; a car might have to derive 55% of its value from the UK-sourced parts and processes, for example. Those requirements are known as rules of origin.

Countries can agree to flexibility around rules of origin. It is common within trade agreements for the parties to treat components – known as inputs – that originate within one party as if they originate within the other.

For instance, when negotiating their much-anticipated trade deal, the UK and EU could agree that EU inputs qualify as originating in the UK, and vice versa. That arrangement – known as bilateral cumulation – would make it easier for UK exporters with supply chains in the EU to have their goods deemed sufficiently British.

A greater percentage of their product would be of UK origin, and so would be more likely to qualify for tariff-free exports.

That principle can then be extended to other FTAs. For instance, the UK has made a trade agreement with Japan one of its top priorities post-Brexit, and any deal is expected to closely resemble the existing EU-Japan agreement in effect since February 2019.

The EU-Japan deal already allows for bilateral cumulation, meaning inputs from Japan can be considered to originate in the EU, and inputs from the EU can be considered to originate in Japan.

The UK could seek a similar arrangement with Japan, but expanded further: inputs from the EU could be considered to originate in the UK for exports to Japan, or considered to originate in Japan for exports to the UK. The same would be true of British or Japanese inputs for EU goods. This arrangement is known as diagonal cumulation.

Within the automotive industry, for one, the global nature of supply chains means flexibility around cumulation is vital.

Ian Howells, senior vice-president at Honda Motor Europe, told the UK parliament’s International Trade Committee in July 2020 that being “less restrictive on rules of origin… is a very key area for us”.

Speaking in the context of an FTA with Japan that includes diagonal cumulation, Howells said: “That is where there is a relative weakness in the UK position because certainly, if our experience is anything to go by, only a relatively small amount of componentry can be sourced as genuine UK componentry for finished product.

“You have to add in the EU content to get anywhere near existing rules of origin and even then quite often you are struggling,” Howells added. “Unfortunately… the UK supply chain is not that deep in the manufacturing of automotive.”

However, diagonal cumulation is not a perfect arrangement for UK exporters. Although the EU deal with Japan leaves the door open to such an arrangement, other existing EU FTAs – such as those with South Korea or Canada – would likely have to be amended.

There is little sign that the EU would be open to renegotiating finalised deals simply to help exporters in the UK after Brexit.

It also only works for trade with countries that already have an FTA with the EU, which could dent the British government’s ambition to become a pioneer in trade with other markets.

Acknowledging these issues, the UK has sought an ambitious arrangement on rules of origin, one that goes beyond bilateral or diagonal cumulation.

The problem for UK exporters is that so far, there is little indication that Brussels will agree.

Extended cumulation: negotiations remain fraught

The UK’s negotiating position, set out in a draft FTA published by the government in February 2020, proposes an arrangement known as extended cumulation.

Under its proposals, the UK would agree with an FTA partner that EU inputs are treated as originating in the UK – but would leave it to the EU to decide whether or not to reciprocate.

That would mean – for example – that the UK and South Korea could each agree to treat EU inputs as if they are UK-originating or South Korea-originating. A UK product that derives 30% of its value from British inputs and 30% from European inputs would, from South Korea’s perspective, be considered to have 60% UK origin.

Problematically, in the equivalent document produced by the EU there was “very little, if anything, other than the basic, high-level origin provisions”, says Anna Jerzewska, an independent trade and customs consultant who advises the UN International Trade Centre and the British Chambers of Commerce, among others.

From the EU’s perspective, extended cumulation could give UK exporters an unfair advantage over their European rivals.

In June 2020, after a fourth round of Brexit talks concluded with minimal progress, Michel Barnier – the EU’s chief negotiator – accused his UK counterparts of refusing “to seriously engage with us” over the future trading relationship between the two parties.

Barnier cited concerns over a level playing field as a major stumbling block – along with arrangements over fishing and judicial co-operation – because, in his view, the UK’s approach to rules of origin could leave British exporters with an unfair advantage over the remaining 27 member states.

“Do we really want to take a risk with rules of origin that would allow the UK to become a manufacturing hub for the EU, by allowing it to assemble materials and goods sourced all over the world, and export them to the single market as British goods – tariff and quota-free?” Barnier asked the EU’s Economic and Social Committee in a June 10 speech.

There are also potential downsides from the UK’s perspective. Jerzewska points out that EU manufacturers would not be able to count inputs from the UK towards their origin quota for exports to South Korea “so potentially purchase fewer inputs from the UK”.

“But we can see that this is the UK’s strategy, and it makes sense for the UK. It’s something the UK is definitely trying to pursue,” she says.

Sam Lowe, a senior research fellow at the Centre for European Reform (CER) think tank, says he doubts extended cumulation would actually lead to the UK becoming an offshore manufacturing hub – not least because “there are still many other additional costs that come with producing in the UK, rather than the EU, if you’re selling to the European market”.

“But I think the EU was never going to go for this,” he tells GTR. “The easier you make it for other inputs from other countries to be accounted for as being local, the more you undermine the original premise: the whole reason for the existence of rules of origin.”

There are other possible flaws in the UK’s plan. Jerzewska says that while the EU has integrated extended cumulation into some of its existing trade agreements, the concept has “never been used across the board”.

“It has only been for some products and for a limited period of time,” she says.

Jerzewska adds there are other issues from the EU’s perspective – not least the possibility extended cumulation could be in breach of World Trade Organization (WTO) rules. “I’m sure that’s one reason why the EU is quite hesitant to agree to extended cumulation across the board,” she says.

If all parties involved have trade agreements in place, that is less likely. “That would just be a question of considering rules of origin as equivalent, rather than requiring them to be identical,” she says.

But if extended cumulation is allowed for inputs from any country, it could be interpreted as the UK giving preferential treatment to products from countries it does not have a trade agreement with – potentially opening the door to a challenge in front of the WTO.

The way forward

If extended cumulation proves too ambitious, there are other possibilities open to the UK. As Jerzewska points out, it is “worth noting the EU created, and is heavily invested in, a different type of cumulation in the European regions”.

The system of Pan-Euro-Mediterranean cumulation of origin, known as PEM, covers all EU member states, as well as Switzerland, Norway, Iceland and Liechtenstein, a group of 10 countries in the Middle East and North Africa, a further six across the Balkans, plus Moldova and the Faroe Islands.

“Initially we thought the UK might want to join this agreement,” Jerzewska says. “It would have benefits for a number of UK companies, especially those that are already using PEM while the UK remains a member state.”

However, there is a stumbling block with PEM.

As CER’s Lowe explains, joining the bloc “gives you less scope for tweaking the product-specific rules of origin in the trade agreement between the EU and UK”.

“The PEM rules of origin exist and you have to just take them off the shelf; there’s no flexibility to fiddle around with thresholds or change how you approach individual rules of origin,” he says.

The way forward remains unclear, and the clock is ticking. The UK has already ceased to be an EU member state, but is in a transition period until the end of 2020; at that point, if no trade agreement has been finalised and ratified, trade between the two parties would revert to WTO terms.

There are already suggestions from sources close to negotiators that the UK may give up on its pursuit of extended cumulation. For Lowe, an extensive network of FTAs that allow for bilateral cumulation could be a pragmatic way forward.

“The EU does usually offer bilateral cumulation in its free trade agreements, and that would solve most of the issues for UK exporters that are struggling to meet certain thresholds,” he says. “Just because by virtue of the EU being the UK’s biggest trade partner, inputs in the UK are often from the EU.”