Nick Pachnev, Chief Executive Officer of GlobalTrade Corporation, discusses latest trends and practical approaches for evaluating and implementing a corporate solution for managing of letters of credit, bank guarantees and sureties.

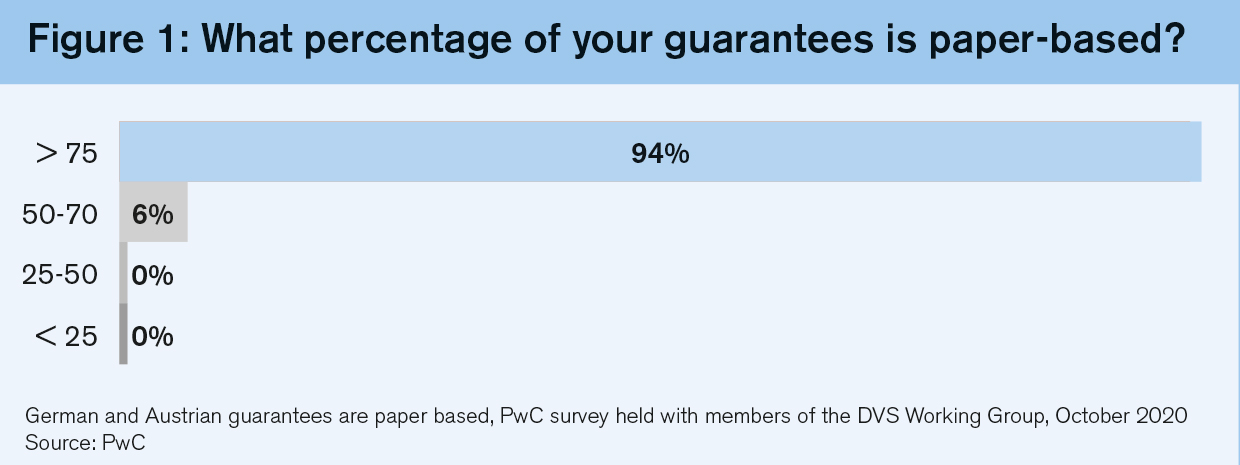

Corporates are facing progressively complex compliance and reporting requirements while dealing with new risks and rapidly changing business conditions. Treasuries are now required to track and report group-wide exposure to contingent liabilities and risks related to bank and corporate guarantees, standbys, sureties and letters of credit. Unfortunately, the ongoing prevalence of paper documents makes this task especially challenging and time consuming. For example, according to a recent survey of corporates and financial institutions conducted by PwC, the vast majority of guarantees issued in Germany and Austria are still paper based.1

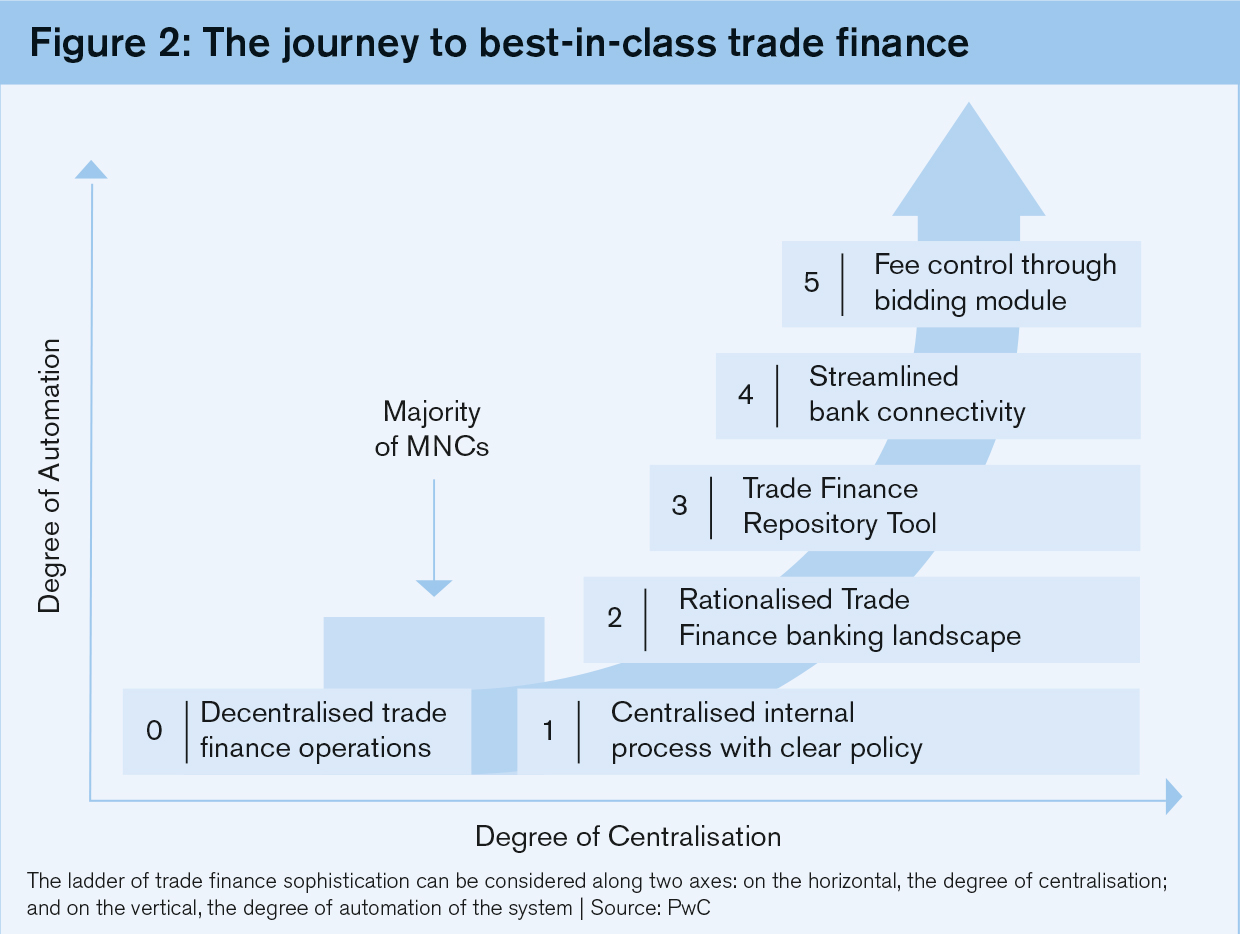

The same study found that multinational corporations (MNCs), despite mostly having decentralised processes, are increasingly looking to optimise their trade finance operations. MNCs are beginning to implement electronic multibank connectivity, consolidate processing and control, improve transparency, proactively manage financial relationships, and use online bank fee quotation services.

One of the main factors holding back adoption of trade finance technology by corporates is their fragmented and unique processes. In the past, only MNCs with large trade finance teams and IT budgets were able to deal with this complexity and implement solutions for the management of letters of credit and guarantees.

However, new types of pre-configured cloud-based solutions offer SMEs a streamlined approach for improving their trade finance operations with less effort and capital investment. A solution connected to multiple banks and interfaced with corporates’ internal systems that took 12 to 24 months to implement a few years ago can be now deployed in under four months.

Trade finance solutions are becoming not only easier to implement, but also offer a wider set of cost reduction features. For example, they now present an integrated option for comparing commission, confirmation and discounting rates across multiple financial institutions. This leads to substantial savings, especially for high-value transactions.

Centralised trade finance management also saves fees by expanding the use of corporate guarantees. This is achieved by standardising the process, enabling internal allocation of operational and financial costs and real-time tracking of exposure. The technology also handles financial accounting for intra-company guarantees under various accounting standards, such as IFRS-9.

More advanced cloud solutions are starting to take advantage of emerging industry utilities and offer a true end-to-end connectivity to all parties involved in a trade transaction. The connectivity evolution started when SWIFT allowed corporates to use its messaging network to exchange letter of credit and bank guarantee information as well as related documents with banks back in 2009.

Since then, hundreds of banks and corporates have adopted SWIFT for trade finance and it has become a de-facto industry standard.

The industry is now experiencing the next fundamental shift in digitisation capabilities. It has been triggered by the wide adoption of technologies such as APIs, micro-services, digital signatures and shared ledgers, on one hand, and increasing acceptance of electronic document laws and regulations on the other. The latter trend was drastically accelerated by Covid-19-related risks, safety concerns and costs of paper-based processes.

This year saw the emergence of application service providers that combine various financial, messaging, compliance and logistics utilities into one fully integrated corporate ecosystem. The industry may soon see a single letter of credit solution incorporating electronic advice, a marketplace for obtaining confirmation and discounting quotes, ERP interfaces for document preparation, digital documents of title and certificates of origin, pre-checking using artificial intelligence, discounting using a digital bill of exchange or a promissory note, automatic updates of receivables and treasury system payments.

For bank guarantees and sureties, such integrated solutions include obtaining commission quotes from multiple financial institutions, electronic connectivity with banks, insurance companies and surety brokers, digital guarantee delivery to beneficiaries, as well as digitisation of all post-issuance events: amendment, reduction, release, etc.

By managing the complete transaction cycle, the solution provider can further tailor its system to address the unique needs of different industries. For example, construction companies and suppliers of capital goods are often required to provide guarantees or sureties with a long or even unlimited expiry period. Upon completion of the underlying commercial transaction, these guarantees require the beneficiary to return the original paper document to a bank along with the letter, often notarised, confirming the release. This is a labour-intensive and time-consuming process, especially if the beneficiary has changed offices several times and must look for an original received a long time ago.

The integrated corporate trade finance solutions also offer significant benefits to financial institutions. When the multibank concept for trade finance was first offered to corporates in the early 2000s, most banks opposed it. They saw it as a threat that could commoditise the trade finance business by weakening captive corporate relationships and putting additional pressure on reducing fees. However, as regulatory pressures forced financial institutions to de-risk more and more of their relations, it became clear that MNCs and even medium-sized corporates transacting globally need multiple banks. The integrated platforms provide financial institutions with an opportunity to preserve corporate relationships by offering value-added services. For example, such a solution can automate bank agent services for managing facilities and settling fees. It can also help a bank to increase its deal origination potential while seamlessly off-selling financial risk to other banks or securitising it for distribution to a wider pool of investors.

One important factor to consider when implementing an end-to-end digitisation solution is its ability to switch to the traditional paper-based process at any stage of the transaction. The 2020 ICC Global Survey on Trade Finance reported that many regions, especially those with the largest volumes of letters of credit and bank guarantees, still require paper versions of documents such as bills of exchange, insurance policies, promissory notes, bills of lading and certificates of origin.2 Many beneficiaries, even in digitally advanced countries, insist on hand-signed paper guarantees and sureties. A corporate that decides to digitise its trade finance operations should check that the proposed solution can also deal with paper-based processes and can easily transition between paper and digital platforms in a user-friendly way.

Corporates are also subjected to increasingly strict information security and privacy demands primarily necessitated by personal data protection regulations such as GDPR in Europe, CCPA in the US and similar national laws in other countries. These regulations require companies to validate and demonstrate information security compliance not only for their own operations, but also for all suppliers handling their personal and commercial information. The associated effort and cost are significantly reduced if an IT service provider can demonstrate compliance with industry frameworks such as ISO 27001, SOC 1 and SOC 2.

To summarise, when choosing a trade finance solution, the corporate should clearly understand the solution’s impact on its operations, value proposition and total ownership costs. For the wider ecosystem, it is also important to analyse the legal and governance framework describing the roles, responsibilities and liabilities of their participants. Asking an IT provider for a clear explanation of these issues ensures smooth implementation and long-term success of the trade finance solution.

References

- https://www.pwc.be/en/news-publications/2021/revolutionising-guarantees.html

- https://iccwbo.org/publication/global-survey/

Over 25 years ago, GlobalTrade Corporation (GTC) pioneered multi-bank trade finance solutions for corporates. The company continues to lead the industry with developing ecosystems aimed at digitising all stages of a trade finance transaction and connecting all transaction parties. The latest version of the company’s cloud solution includes features for establishing and managing relationships with banks and insurance companies, pricing of trade finance instruments, their issuance and advice, post-issuance events, managing electronic documentation and risk participation. Recognising that trade finance it tightly connected to other areas inside and outside a corporate organisation, GTC supports multiple interfaces and formats for sharing information with other internal corporate systems, such as ERP, financial reporting, cash management and payments, user management, as well as external platforms for connecting with banks and logistics providers. Taking the knowledge and expertise that GTC acquired from over 20 years of servicing MNCs, it created a streamlined version of its platform for SMEs that delivers major benefits of the enterprise version at a reduced cost and implementation effort.