When a landmark acquisition repositioned Energean Power as a leading E&P in the Mediterranean with a focus on gas, it brought renewed focus on reserve-based lending as a well-tailored source of finance. Deutsche Bank’s Clarissa Dann explains.

During International Petroleum Week in London on 25 February 2020, Mathios Rigas, CEO of independent exploration and production (E&P) company Energean shared his energy transition strategy from oil to lower CO2 emission gas through developing offshore resources in the Eastern Mediterranean.1

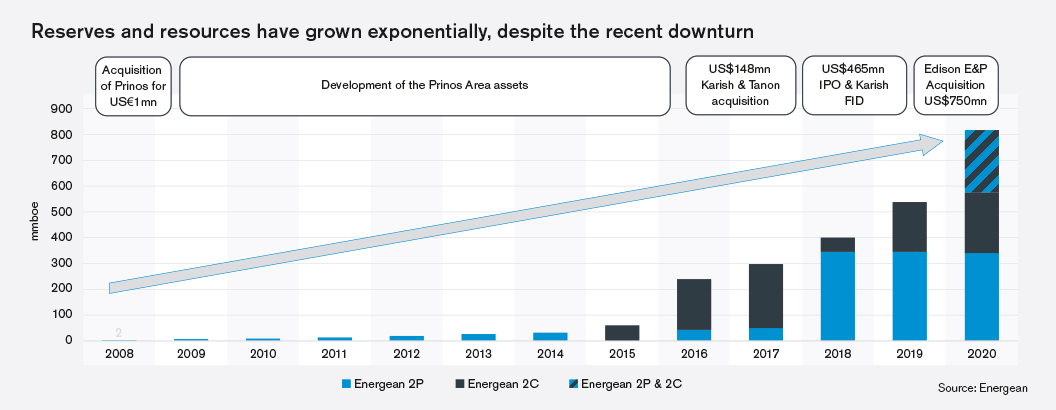

It has been a remarkable journey and one made possible by both equity raisings and working capital financings for the investments along the way. This article takes a closer look at the route, along with how reserve-based lending was pivotal to Energean’s most recent acquisition of Italian utility company Edison Exploration & Production SpA’s (Edison) upstream assets located in Croatia, Egypt, Italy and the UK.

Prinos to Karish

In a 2018 Energy Council interview Rigas, a former petroleum engineer, explains how “Greece was flooded with oil and gas explorers in the 1960s, but drilling proved unsuccessful for the most part”. An exception to these disappointments was the Prinos offshore oil field discovered in 1974 by Northern Aegean Petroleum Company. However, when the oil price crashed to a 25-year low in 1998 and rendered production unsustainable, foreign companies started to leave Greece, creating a huge economic impact. Spotting a “perfect opportunity” to acquire an “undervalued, producing asset in shallow waters with existing underutilised infrastructure” in 2007, Rigas teamed up with shipping entrepreneur Stathis Topouzoglou to form what is now Energean.2

Listed on the main market of the London Stock Exchange with market capitalisation of around US$2bn, the company explores and invests in new ideas, concepts and solutions to produce and develop energy efficiently, at low cost and with a low carbon footprint. Energean has a 74% gas weighted portfolio, with 1,069 million barrels of oil equivalent (mmboe) 2P (proved and possible) reserves and 2C (proved, possible and contingent) resources, and a clear path to get to production of 200,000 barrels of oil equivalent per day (boepd). This goal should be met once its flagship project, the Karish field, offshore Israel, comes on stream – scheduled for Q4 2021.

Currently, production comes mainly from the Abu Qir field in Egypt and fields in Southern Europe and the UK. However, it is the 3.5 trillion cubic feet (tcf) Karish, Karish North and Tanin developments in offshore Israel that are set to secure the company’s position as the leading Eastern Mediterranean gas producer once the first gas is realised.

Key to this development is the delivery of the only floating production storage and offloading (FPSO) vessel in the region to produce the first gas – scheduled to be delivered from the shipyard in Singapore to Israeli waters in mid-2021.

Energean has signed firm contracts for 7.4 billion cubic metres per year (bcm/y) of gas sales into the Israeli domestic market. These have floor pricing, take-or-pay and/or exclusivity provisions that largely insulate the project’s revenues against global commodity price fluctuations and underpin Energean’s goal of paying a meaningful and sustainable dividend.

The Powering Past Coal Alliance, a coalition set up three years ago to accelerate the transition away from fossil fuels, noted on 16 August 2020 that Israel has reduced coal-fired electricity production from 60% to 30% of output. It has achieved this despite rapid population growth and its status as an energy “island” – in other words unconnected to any international grid – and has to meet 100% of its burgeoning electricity demand domestically.3

“The decision to switch four coal fired plants to natural gas based on first production from Karish in 2021 will reduce CO2 emissions in Israel by 3.6 million tonnes,” declared Yuval Steinitz, Israel’s Minister of Energy in early 2020.

Edison assets

Recent years have seen oil majors invest elsewhere and giant European utility companies retrench from hydrocarbon extraction. In response there has been a growing appetite from a new breed of agile, independent oil E&P entities such as Energean acquiring competitive assets, along with a determination to reach once inaccessible or undiscovered reserves. Where are they finding the cash? As Rigas – who has also worked in investment banking – puts it: “The best way of raising debt and equity capital is to have good assets, a trusted management team and a track record of meeting the promises made to investors and banks.”

Increasingly, the technique of reserve-based lending (alongside private equity) has helped make such acquisitions possible. With Rigas’ appetite for acquiring unwanted energy assets that still offer potential, it was no surprise when in July 2019, Energean entered into a conditional sale and purchase agreement (SPA) to acquire assets in Egypt, Italy, Croatia, UK and Norway from Italian electricity utility provider Edison SpA, with the completion of the SPA being subject to relevant government approvals. The sale was completed on 17 December 2020, with the SPA amended (as a result of Covid-19-related macroeconomic volatility) to exclude the Algerian and Norwegian assets.4

Despite the unprecedented impact in the oil and gas industry triggered by the pandemic, the acquisition was one of the very few transactions completed in the sector that, together with attractive renegotiated parameters, allowed Energean to purchase high-quality assets at the bottom of the market.

The deal has diversified the company into nine countries and further emphasised its focus for a gas-weighted portfolio, while expanding its low-cost production stream across the Eastern Mediterranean, particularly Egypt – which in 2019 regained its status as a net exporter of gas.

RBL solution

In order to finance the acquisition, Deutsche Bank co-arranged and structured a six-year US$280m reserve-based lending (RBL) facility as one of the mandated lead arrangers. This is a senior secured borrowing base structure where funds are lent against the future cash flow of the assets.

The oil and gas reserves of the borrower are reviewed at agreed intervals and the size of the facility and the tenor is based upon the value of the oil and gas reserves, with repayment secured on the proceeds from the oil and gas sales. The agreed value is known as the borrowing base. Yann Ropers, Deutsche Bank’s Head of London for Natural Resources Finance and responsible for RBLs globally, says: “Like other RBL facilities, this structure is self-liquidating with a security package applied to sound and low-cost producing natural gas assets in Egypt.”

Natural Resources Finance Director Danai Koutra, who worked with Ropers on the deal, adds that importantly the Egyptian assets are of “excellent quality, including low reserves risk, high uptime and well-maintained processing facilities with a good track record and long life span over the gas-rich Eastern Mediterranean area.”

Ropers and Koutra point out that long-term offtake contracts with the Egyptian General Petroleum Corporation (Egypt’s national oil company, EGPC) come with an applicable contractual gas price formula (including floor prices even when Brent is 0) that mitigates any oil/gas price fluctuations.

Energean CEO Rigas, concludes: “Completion of our acquisition of Edison E&P marks a key milestone along our path to becoming the leading independent, gas producer in the Mediterranean and significantly advances us towards our goal of delivering material free cash flows and shareholder returns in a sustainable way.”

- https://www.energean.com/media/3692/200224-mathios-rigas-ip-week.pdf

- https://energycouncil.com/speaker-articles/mathios-rigas/

- https://poweringpastcoal.org/members/israel

- https://www.energean.com/investors/completion-of-acquisition-of-edison-ep/

Clarissa Dann is Editorial Director of Marketing at Deutsche Bank Corporate Bank