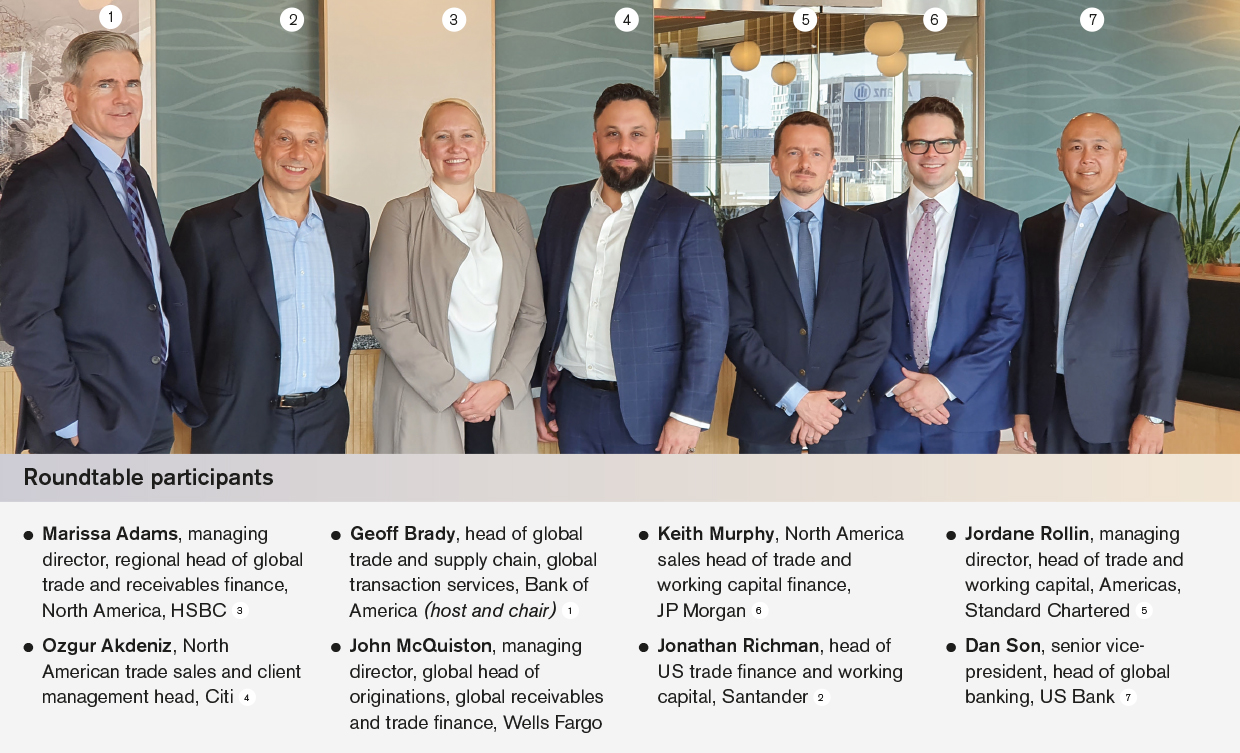

GTR’s annual US-based roundtable discussion gathered senior trade finance bankers in New York to talk advances in technology, shifts in physical and financial supply chains, and developments around ESG in the context of the post-pandemic environment.

Roundtable participants

- Marissa Adams, managing director, regional head of global trade and receivables finance, North America, HSBC

- Ozgur Akdeniz, North American trade sales and client management head, Citi

- Geoff Brady, head of global trade and supply chain, global transaction services, Bank of America (host and chair)

- John McQuiston, managing director, global head of originations, global receivables and trade finance, Wells Fargo

- Keith Murphy, North America sales head of trade and working capital finance, JP Morgan

- Jonathan Richman, head of US trade finance and working capital, Santander

- Jordane Rollin, managing director, head of trade and working capital, Americas, Standard Chartered

- Dan Son, senior vice-president, head of global banking, US Bank

Brady: What are you seeing emerge as major trends in the trade and trade finance space in the current post-Covid environment? How has your business changed?

Richman: The most obvious initial response to the pandemic in the world of trade and trade finance was the effort to digitise. The situation created the impetus for a number of digitisation initiatives – and there’s been a proliferation of those since 2020. It has led to more end-to-end solutions and better processing, as well as newer types of solutions that we didn’t have before. As a result, today we’re able to have greater reach to the trading partners of our clients, who likely did not have access to financing solutions in the past. Not only can we better reach them, but we also now have improved abilities to provide more flexible credit.

There is still a lot of legacy technology within banks, so we’re not pretending that we’re fully automated. But who would have thought we’d be able to work remotely as well as we do today and be able to capture data so efficiently in order to build new products? We have a long way to go, but there’s been a lot of significant progress – and our clients definitely want us to be digital.

Brady: How willing are clients themselves to go through that change and become more digital in a post-Covid environment?

Adams: International corporates are certainly willing and able to invest in becoming more digital, but in the mid-market and smaller client space, it’s still a considerable effort. The irony is that in order to move to a digital solution, companies generally have to invest in at least one person to change the processes and enable connectivity between their enterprise resource planning (ERP) software and their bank’s system.

The investment of money and time is a challenge for many companies. The more we can do across the industry to minimise the effort on their side, the better the take up will be of digital solutions.

Son: The willingness, for sure, is there. But there’s still a disconnect between the motivation and the execution because it ultimately comes down to resources and prioritisation. You see a lot of companies start well in taking up digital solutions, and then halfway get distracted because something else comes up. Within the companies themselves, the success of these initiatives also depend on who is driving them.

McQuiston: It’s taking more time and more investment to get more sophisticated solutions. It’s tough because banks are not tech companies – and neither are corporates – and the solutions are all very technology based.

Brady: Is it the technology itself that’s proving to be the biggest challenge, or is it the rules and regulations that govern banks’ ability to use the technology?

Murphy: It’s a little bit of both. Governing bodies have invested a lot of time and effort on digitising this space. It’s not there yet, but there are markets, such as Singapore and the UK, which have taken the lead on shifting legislation to better enable digital trade. The Uniform Commercial Code here in the US would do well to follow that lead.

In terms of immediate opportunities, we’ve had some deals just kind of evaporate because there were no IT resources at a corporate customer. For many companies, their stack of priorities and IT resources are being directed towards their own transformation as a business.

For banks, on the back end, we’re all trying to do things to make life easier for customers, while at the same time focusing on the regulation side to ensure there are no unnecessary burdens to digitising trade.

McQuiston: The tech solutions are there; it’s the bureaucracies of banks and corporates that are the larger hurdle. The tech is developing so quickly now that you could do something very sophisticated for clients if funds were unlimited. But we still have many clients saying: ‘We don’t have time to do an 810 [invoice transaction] flat file setup, so can we send you Excel spreadsheets that you can put into your processing systems?’

Akdeniz: During Covid, I was really surprised by the ingenuity and speed at which we developed solutions in order to continue to operate. It was a unique situation, where the banks and the corporates – and everyone else – were living the same reality. Usually the problem is only on one side. But because it was a collective issue, our speed to development was incredible: we moved to electronic signatures in a matter of a week or two. There was good progress that came out of that situation which we shouldn’t forget now that we’re back to normal.

Rollin: Covid, and the need for business continuity and supply chain sustainability, has driven a number of digital innovation initiatives in the industry. Some of these initiatives, such as digital signatures and video conferencing, were fairly simple – and certainly we won’t go back on some of those developments that bring significant efficiency in a post-pandemic world.

Richman: The primary reason why clients use our services is not because of technology; it’s because they need liquidity, working capital or risk mitigation – or support for their trading partners. But I do believe there is an expectation that we need to be automated in that process. And by virtue of automating, we should be able to capture data. And we should be able to use that data to improve our service levels and to improve our product capabilities. We have to keep that ball moving forward – it’s an essential component of what we do.

Brady: How are physical supply chains being affected by the new reality? Are your clients shifting and diversifying their supply chains? How important has inventory become in the conversations you’re having with clients in the US?

Son: A positive development we’ve seen come out of Covid is the focus not only on supply chain cost efficiency but also on the resilience of supply chains – which has led to a greater interest in our finance solutions.

When it comes to onshoring, nearshoring or regional diversification in terms of the procurement function, while there is a lot of talk, the execution of those shifts is very complicated. It’s not linear and is dependent on a number of factors such as the industry, the vertical and the geography. There’s still a bit of a tug of war between supply chain resilience and profitability – but they shouldn’t be mutually exclusive.

Adams: There’s been a well-documented shift in thinking on inventory holding from ‘just in time’ to ‘just in case’. But the reality is that a lot of clients are still dealing with massive supply backlogs. It’s a very delicate balance that they have to strike, which can become a real issue when it comes to sourcing financing.

As banks, we need to think about whether our existing solutions are able to support clients whose needs are a bit more nuanced with regard to their inventory management – or whether there’s a need for other, newer solutions.

Richman: The conversation around working capital has changed, and resilience has become very strategic for our clients – more so than ever before. Beyond supply chain finance, we are using commodity finance structures, like prepays, to help our clients secure vital inventory while supporting their trading partners at the same time. It’s not entirely altruistic. Companies need to ensure their supply chains are robust, and that they – and their suppliers – have buffer stock when they need it.

Akdeniz: It’s interesting because some of our global clients who would have previously never entertained the notion of supply chain finance are now coming to us and asking to set up a programme with a handful of suppliers. It’s becoming more prevalent in certain industries, such as semiconductors, for example.

Another related point is pricing competition, which for banks, pre-pandemic, was very fierce. During the pandemic, people realised that wasn’t sustainable for a number of different reasons. But I think we may now be coming out of that phase. Can we continue to compete only on price? Arguably, we have a commoditised offering on some of these things, right?

Richman: There are new sectors – and products – that are not commoditised yet from a price perspective. But the traditional form of supply chain finance as we know it – the post-confirmed invoice – that’s commoditised. Although it’s not always a price game, and there are other aspects in terms of value add on top of that, whether it’s pre-shipment finance, or long tail finance, or other features that are not yet commoditised, where you can still get reasonable margin.

I also take some comfort in the fact that trade and supply chain finance is the most resilient source of liquidity in a time of crisis. We saw that during the pandemic, the 2008/09 crisis and the Asian financial crisis, and our clients know it. Any stress that you see in capital markets, while it may be bad, is where trade finance really shines.

As of last year, there was that downward pricing pressure, high liquidity, lower usage levels. It’s starting to reverse now. And with that, yes, we need to differentiate our products. But the most important thing is that we remain reliable and that we are there for our clients when other sources of capital or liquidity are not.

Brady: I would argue that the key indicator for resilience of supply chain finance is the secondary market. It’s also a good indicator of where pricing is going to go. I don’t think we have seen a lot of movement in spreads in the secondary market, which perhaps indicates that we’re probably not going to get a big lift on pricing that we’re going to originate. Would you agree with that? Do you think there’s going to be some sort of a shock coming in the secondary market? Or do you think we’re going to continue where we are?

Murphy: I think the secondary market will start to pick up at some point. The world is interconnected and if you look at what’s happening in the emerging markets right now, there’s likely to be a big liquidity squeeze for countries whose populations are reliant on imports of food.

I agree wholeheartedly that this is a very liquid, stable source of financing. It’ll continue to be so, but my perception is that at some point, we’ll begin to see spreads gap out a little bit in the secondary market.

When I first started out in this business as an analyst, I thought that some money market funds would one day come in and just fund all the investment-grade supply chain finance assets. It’s still not there yet. Granted, in the high investment-grade space you do see a lot of institutional investors that like simple, vanilla standardised stuff. But for the most part, a lot of our assets are still with the banks.

Son: That’s part of the resiliency, when you’ve got the secondary market that’s still dominated by banks. Most banks are still focused on the client – even in terms of the secondary market perspective. So they’re not just participating to get the right return and build up assets, it’s about the relationship and how we can best serve our customers.

Brady: One of the questions I get asked a lot is how geopolitical situations around the world today impact trade and supply chains, and what effect they have on banks and their risk appetite. How has the geopolitical environment of the last 18 months impacted your business and our collective business?

Adams: The situation has forced the need to return to the risk mitigation element, the very core of trade finance. I think that might have been less of a priority for some of our clients when the fintechs started to make a play for this business a few years ago. But the ever-changing geopolitical environment is making people think ‘maybe I do need a letter of credit; maybe I do need to have a conversation to secure this’.

It’s kind of counterintuitive, because you would think that with challenges to globalisation, there would be less of a need for our business. But the opposite is true. It’s really shown how valuable trade finance is, and how relevant banks – with all the expertise we have built up in our teams – are to our clients. Interest in our products has increased significantly.

Murphy: In my 16 years in the industry, I have never seen the tail winds that I see right now as a result of the geopolitical situation. It’s impacting every part of the business. We’re even seeing demand for letters of credit in North America like never before. From my perspective, it’s been a boon for the business.

Richman: This is why trade finance was born in the first place, many hundreds of years ago. Parties who didn’t know each other needed to be able to trade in an efficient way. Today, clients have working capital issues, they have trading partners under stress, they have to reconfigure their supply chains and move activity from one place to another. They’re dealing with new parties, one side or the other.

McQuiston: This is one of the virtuous products of banking. It is a win-win for all parties if clients do it right. We see most clients doing the right thing saying, ‘let’s share the benefit of the credit arbitrage’.

Adams: One of the interesting things we’ve seen is that many of our clients are still committed to, or doubling down on, their environmental, social and governance (ESG) objectives in this challenging geopolitical environment. From an HSBC perspective, we’re seeing that clients’ trade and supply chains are integral to that strategy. It’s a really interesting time because there’s this focus on risk and protection as well as this important resilience piece that links to the futureproofing of clients’ businesses – and the role that we play in supporting them in that endeavour.

Rollin: The need for clients to adapt to an ever-changing environment is even more acute now than it was maybe eight years ago. What we provide is not only the financing and risk mitigation, but it’s also supporting those changes every step of the way. That’s something we’re able to do because of the network we have, either as individual banks or collectively through correspondent banking.

Brady: All of our clients want to talk about ESG – let’s all agree that it’s important to our clients and to us as institutions. That then brings us to a more tactical question: where have we got it right, where have we made a positive impact? And where do we have challenges to making more of an impact on anything related to ESG for our clients?

McQuiston: I think a lot of this comes down to the politics, and what governments are willing to do to drive ESG. For many countries, the bulk of their electricity is still powered by coal, despite their virtue signalling.

A lot of us have done many different ESG transactions, as we’ve seen in the press. While it is important, it’s a drop in the bucket compared to the power governments have to actually make a change.

Son: I think it’s less about what we’ve done to date and more about the fact that the trade finance products that we all manage are ideal for ESG. We’ve got the right products, and we’re leveraging existing solutions – there’s no need to reinvent the wheel. By the same token, that application doesn’t always work.

You could try to take an existing solution, like supply chain finance, to a minority-owned company for example, to provide a financial incentive to do an ESG deal. But that may not be necessarily what they’re looking for. They may just be looking for US$200,000 in funding for general working capital so they can go buy more inventory or hire real estate space. I think that’s the gap right now, at least on the ‘S’ side of ESG – we think it’s working capital but it’s actually just lending. Banks struggle with that.

Brady: Is the greatest benefit that we can provide to create that link to the suppliers, which we know through their big buyers?

Son: Absolutely. Before we were working with the buyers, banks had never heard of their suppliers. But again, to make progress in this space the mindset has to shift because even after the introduction, even after explaining how well we know the supplier, banks still tend to look at it with the same credit lens.

Adams: It’s the partnering where we provide the greatest benefit. We’ve just come out in the press with a large programme that we did with PVH Corp, which is a partnership around their sustainable supply chain. We’re not selling a product; we’re partnering with companies to find a solution. As we progress, an interesting inflection point will be whether all of our products just become ESG.

I think the real challenge in all of this is the role we play in helping the smaller companies further down the supply chain cope with all these changes. Maybe we need to flip the script a little bit when it comes to looking at those businesses in a way that isn’t the way we traditionally review credit or think about our business models.

McQuiston: I just don’t know how much of ESG is really within the purview of banks to have as big of an influence on the companies and their policies as the governments that enforce laws.

Murphy: Everyone has to play a role. In the trade space, I think a lot of it has been marketing buzz because people are still trying to figure out exactly howto do it. Probably some of the most tangible examples in our industry would be some of the export credit agency financing we’ve seen for things like renewable energy.

The biggest benefit that has surfaced with some of the ESG supply chain finance programmes we’ve done is with corporates whose principal aim is to have their suppliers get ESG rated, and who are using supply chain finance as an incentive to do that. These companies need to get their entire supply chain scored before they can really make material improvements themselves.

Akdeniz: Instead of being hard on ourselves, it’s worth remembering that ESG is still a very nascent industry. 10 years ago we were just talking about it, but the rate of change has really picked up – starting with the ‘E’ part, and more recently the ‘S part, which has really been driven forward, especially in this country. To date, our biggest lever is price. But we’re starting to evolve some of our offerings to milestone-linked funding.

I’m excited to see where this goes in the next two to four years if we continue at this pace. That’s the next sort of big, competitive battleground: who can produce a solution that’s more creative than just a price concession.

Brady: In closing, very briefly, what’s the biggest change we’ll see in trade finance in the next five years?

Murphy: My hope is that we make material strides in the application of blockchain in the industry. It would help to democratise financing for a lot of investors and users of trade finance.

Son: It is my hope that trade finance becomes a lot more standardised, democratised and digitised – so that it becomes a more even playing field.

Rollin: Whether it’s digitisation or sustainability, changes happen when everybody plays their part. We’re making good progress collectively as an industry on both, but it’s not going to happen overnight.

Akdeniz: I think we’ll see the further development of the banking ecosystem around various initiatives, for example the Trade Information Network.

The closer banks get, the more we can standardise, and the more we can develop as an ecosystem. A rising tide lifts all boats.

Adams: Banks need to continue to meet clients where they want to be serviced – not according to banks’ own needs. That’s the ecosystem and the intertwining between technology and our products. It’s not about banks selling to clients, but rather providing a platform for them to then enable the rest of their supply chain and their clients. It might not look the way it does today.

Richman: Building on that, I think we will see trade banking become more strategic to clients. So if today we’re involved on a treasury level, we’ll start to see more C-suite connectivity. Our solutions will be more digitised, and as such will deliver more benefits. They will reach clients and their trading partners, multiple tiers, everywhere, in a much more on-demand way, where we’re able to use data to give more flexible financing across the entire supply chain.

McQuiston: Technology is going to enable going further, and deeper, down supply chains. When Wachovia first started doing supply chain finance, a company had to do US$3bn in revenue; now that’s US$500mn. When does it get to US$100mn? The tech enables smaller and smaller companies to get the benefit because banks can do it economically.

Brady: I think the goal should be to democratise, and provide access to the pool of capital that’s interested in investing in trade finance. There needs to be an evolution of our delivery model to allow for all of the capital, be it from asset managers, insurers or whoever, to invest in trade finance. We can then start to bridge the US$1.7tn trade finance gap. As banks, our most valuable role is in connecting the providers of capital to those seeking essential financing.