Mastercard Track advances cross-border trade through collaboration, as Claire Thompson, EVP Enterprise Partnerships writes. Our strategy is to fully integrate Mastercard Track with other unifying trade platforms in the industry. We believe the combined benefits will significantly enhance the client experience and further democratise trade.

As the digital economy is becoming the economy, businesses of any size are looking for simpler, more unified ways to exchange information and buy or sell goods and services on global markets. Realising the digital promise for global trade and trade finance requires better co-operation across the entire eco-system. Co-operation is a core competency of Mastercard, having operated a global payments network in conjunction with its partners over the past 50+ years. Track was developed in collaboration with Microsoft, which enables unparalleled scale and flexibility. It addresses fundamental challenges by further streamlining and automating the procure-to-pay-process – enabling businesses to manage business identity, compliance and payments in a more efficient way. Our purpose is to simplify and enhance how companies around the world do business with each other.

This article details four pain points that Mastercard Track will address to make the business of doing business easier.

1. Embracing digital and erasing friction

While the consumer economy has made huge progress toward digitisation, the B2B segment is lagging behind. Inefficiencies are estimated to cost businesses hundreds of billions of dollars per year – caused by conflicting standards, technology and data formats.

Let’s look at a hypothetical global procurement transaction to highlight the challenges. Suppose a large US mass market chain wants to open a private label women’s apparel line with a new textile supplier in Vietnam. Onboarding a new supplier includes ensuring that this trading partner is compliant with risk management policies, is not in a position to disrupt current supplier relationships, is capable of delivering the goods, is not owned by corrupt financial sources, is not on any international sanctions lists, can pass credit checks and will agree to ethical policies. Finally, the supplier will need to agree to the invoicing and payment process maintained by the retailer. If performed manually, this process typically takes weeks and sometimes even months.

With Track, buyer and supplier communicate through a digital interface that facilitates Know Your Trading Partner (KYX) in real-time. Track minimises the level of data input buy auto populating a significant part of the initial onboarding requirements. Information about buyers and suppliers is fed by the Track trade directory, a constantly updated database of 210+ million company records and 20,000 compliance lists. Weeks can become two days or even less.

Once a supplier is up and running, tracking of purchase orders, invoices and payments has traditionally been spread across disparate systems. With Track, companies can track the status of any payments – whether bank transfers or cards – across different systems and networks. It also unifies and simplifies business credit reporting with daily alerts for potential credit risk.

2. Towards a unified identity

The analog processes that slow down global trade also foster a lack of trust. Without a consistent digital record a potential partner lacks reliable information; tracking the performance of a current partner is labour-intensive. Is the company solvent? Compliant? Credit worthy? Is a port of entry available to accommodate a delivery? Does the CEO have a solid reputation?

Part of the solution lies in the creation and adoption of an interoperable digital identity. This represents the promise of a common format for companies to log standardised digital information and documents with a single-entry point to fulfill all import, export and transit-related regulatory requirements. With such a digital ID system, a company uses just one identity to engage in digital interactions with any other agent (government, partner, bank, etc) in global trade – instead of the current system, which assigns one identity per digital service provider.

Digital ID will sit at the core of the Track platform: a unique Track ID holding identifiers and associated data elements that may be used for a wide range of applications.

Digital ID secures identity data through a stringent verification process, ensuring the integrity of identity verification assertions, protecting data held by a trading organisation. It also links transactional trade data such as invoices that can be presented for financing. The system-wide adoption of layered security technologies ensures that interfaces between parties are accurate and immutable.

The Track ID enables businesses in three key ways:

- Finding suppliers and buyers: Companies that want to grow in new markets and offer new products look for new trading partners. Through its pre-populated trade directory, Track simplifies identifying and onboarding of new suppliers, improving the time to revenue and reducing costs.

- Providing visibility: The Track ID enables critical information to move freely across borders, putting businesses in a position to easily monitor payment methods, terms and timing to anticipate and address cash flow needs.

- Enabling compliance: As governments mandate businesses to automate key processes including invoices, inspection certifications, customs documents, bills of lading, warehouse receipts, the Track ID carries through any interaction. In Singapore, Track has been integrated into the country’s Networked Trade Platform, which has been designed to promote increased exports – especially by small and medium-sized businesses (SMEs).

3. Efficiency through ePayments

Approximately, half of all global trade is still conducted in paper format – causing fees, delays and fraud. A 10% increase in “bilateral digital connectivity” is estimated to raise goods trade by nearly 2% and trade in services by over 3% .

Electronic payments are a key pillar for digitising global trade. They are instrumental in automating, integrating and simplifying payables processing. They feed analytics, tools and solutions that manage the international financial supply chain. The results: reduced costs of paper check processing, improved control of disbursement and better visibility into spending.

As the number of trading partners grows, standardising messages across institutions and companies has never been more important. Mastercard Track payment services will be based on the ISO 20022 financial services series of exchange messages. Because customers’ payment files can get routed through Track, payment timing details and rich remittance data can be captured – enabling improved cash flow forecasting and improved reconciliation of payments.

4. Open Banking technology

For businesses engaged in global trade, Open Banking promises more choice of innovative solutions and better access to the APIs of a broad range of service partners.

Track enables both businesses and financial services to realise the opportunities of open banking. 85% of the largest financial service institutions run on the Microsoft Azure cloud platform. Banks encouraged by improved cloud security and changing regulation are building cloud-ready trade finance applications, of which open APIs are an integral part.

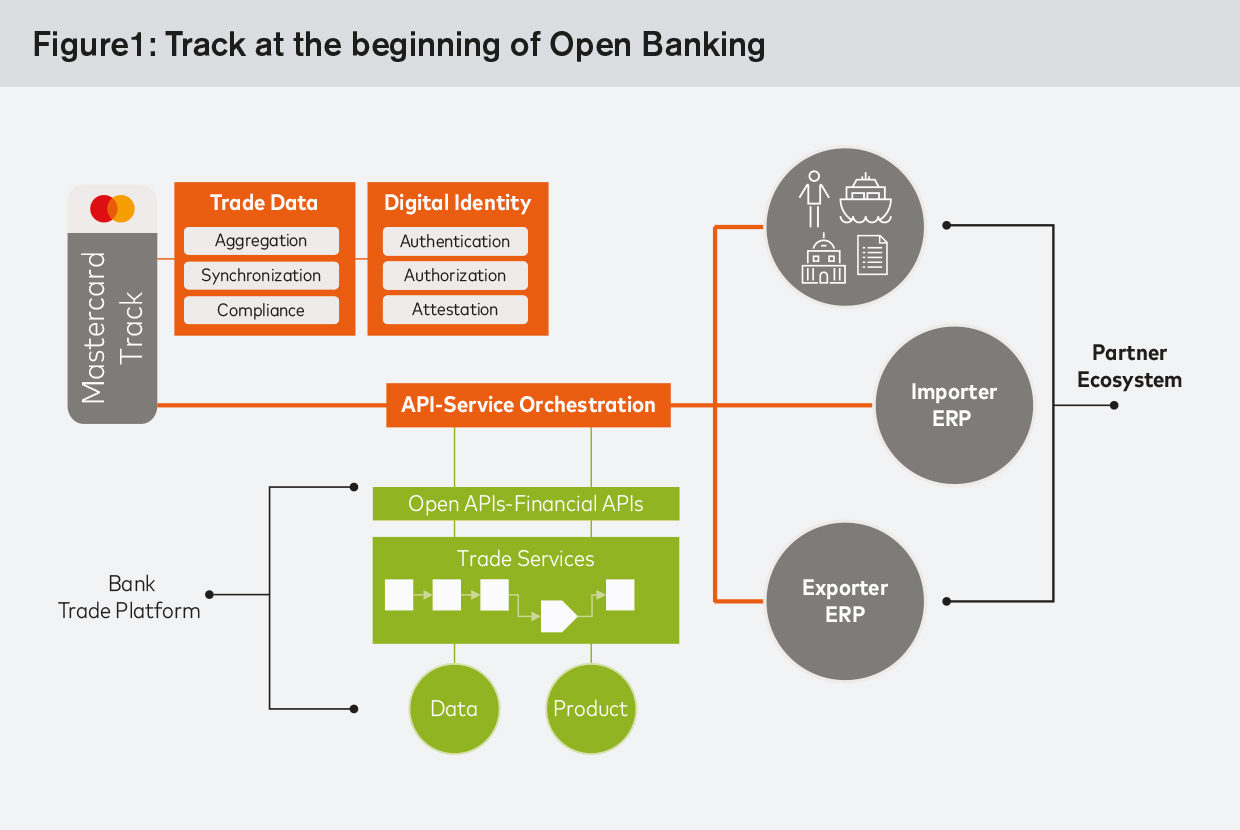

Access to open API technology enables companies to access data and compliance regulations from different countries and industries. For example, a Lagos-based oil company that wants to increase its business in the US can start by accessing the International Trade Association’s open API database to access market intelligence, trade leads, events, export regulations and tariff information. Emerging markets have lacked the technical capabilities to access API and other technologies. Mastercard Track aims to operate an API Exchange that functions as a cloud-based API abstraction layer for integrating trade services. As seen in Figure 1 Track provides access to API orchestration from trade services product and data, and then connects to enterprise resource planning.

Conclusion: Envisioning a frictionless future

As government grapple with trade policies, it’s businesses that are growing the global economy. This growth will be facilitated and democratised by two main factors. One: reducing friction in global trade processes through collaboration among key players – technology companies, banks, freight carriers, buyers and suppliers. Two: removing the barriers to trade finance for companies that want to join or navigate the global trade opportunity. When combined on a unified platform and interoperating with banks and other service providers, capabilities such as digital ID, ePayments and API access have the potential to make global trade more inclusive, agile and resilient. Mastercard Track will continue to expand globally, build more partnerships and enable new network connections. We invite current and potential partners to work with us to simplify complex global supply chains in applying their services to create a frictionless future.