Rebecca Harding, CEO of Coriolis Technologies, discusses Mena’s trade performance, its projected growth and key political risks for 2020.

Note on the impact of Covid-19:

This report was compiled before the Covid-19 pandemic and therefore refers to patterns and trends based on data that was current at the time of writing in February 2020. The full impact of Covid-19 on trade is unknown, but the World Trade Organization estimates that trade will fall by anything between 13% and 32% globally during 2020. Alongside this, and ahead of any impact on trade, the Mena region was already being affected by the collapse in global oil prices, which happened in March and, again, was not factored into this report. However, the points in the report remain valid: that the region’s dependency on oil will have an impact on its trade and economic performance, greater in net oil exporting countries than in net oil importers.

There are other general concerns amongst trade finance professionals around the role of the trade credit insurance sector, which is now heavily exposed to the sharp downturn in global trade. Inventories are collapsing as just-in-time distribution models struggle to cope with restrictions on the physical movement of goods. This is affecting invoice payments and, while it is too early to say exactly how this will affect the recovery from the current crisis, it is undoubtedly the case that many businesses in supply chains worldwide will not survive. As a result, the role of government agencies at present is vital in supporting exporters. In addition to fiscal support, countries will also need clear and robust strategies to rebuild economically once lockdowns are lifted.

GTR: 2019 was a sluggish year for trade. How was Mena affected by this general climate of uncertainty?

Harding: Mena has had a tough few years and last year was not really any different. The combined effects of the trade war between the US and China, the UK’s exit from the EU and enduring intra-regional tensions, particularly between the US and Iran, made 2019 a poor year for trade.

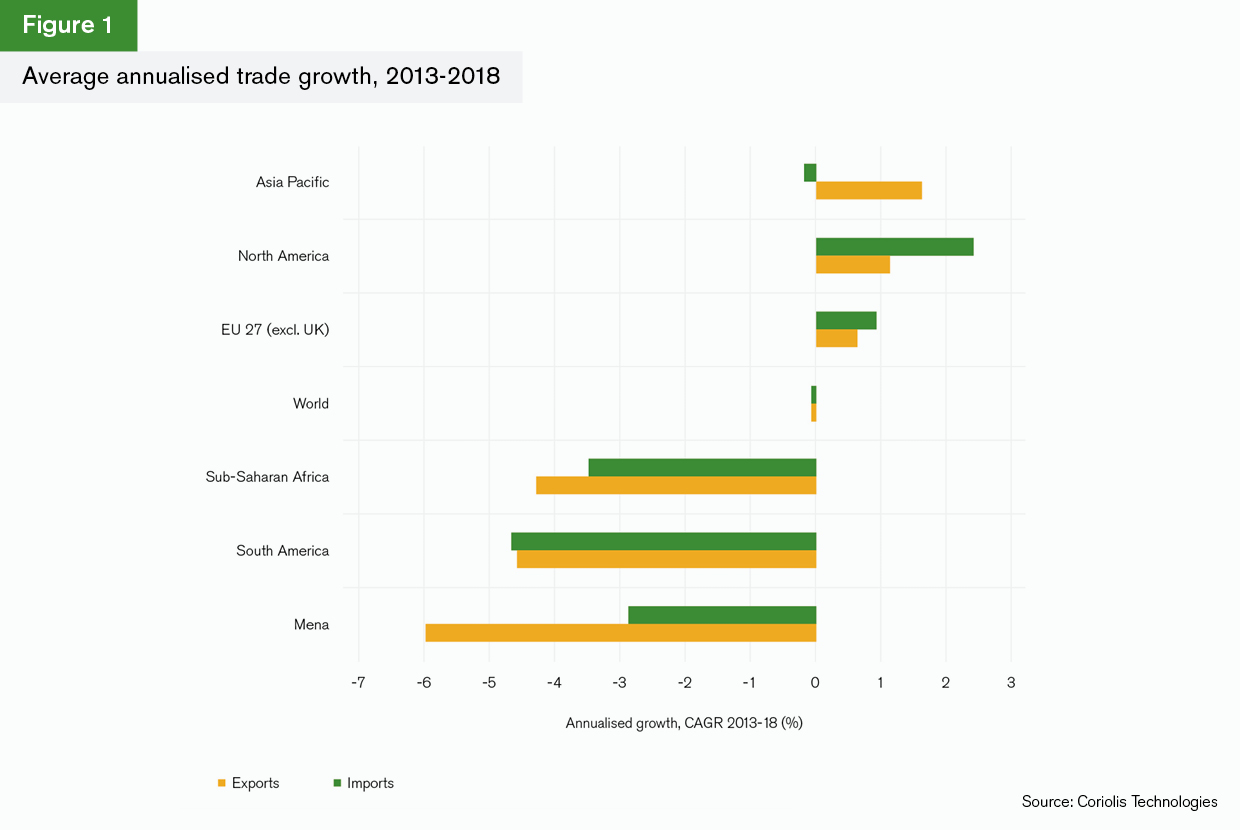

This follows five years of sluggish growth. A weak or volatile oil price over the period since 2013 to the end of 2018, which is where the data is actual rather than forecast, has meant that export revenues have dropped at an annualised rate of 6% in Mena – the highest decline of any global region (Figure 1). This has had a spill-over effect on the region’s economies as well, with imports falling back by nearly 3% annually over the period, suggesting weaker demand both within Mena and globally for the goods that are re-exported from the region.

The Mena region is particularly vulnerable to underlying uncertainties globally. It is highly dependent on two things: oil prices and global demand for the goods that are shipped through the Gulf via its largest ports. As a result, the overall picture for the region in 2020 is likely to be mixed and show no particularly clear pattern of recovery from the uncertainty that has dominated the last few years in terms of oil prices, and 2019 in terms of broader geo-economic and geopolitical issues (Figure 2). The collapse of oil prices, following an OPEC meeting in early March, was a product of Saudi Arabia’s decision to launch a price war; this will have major repercussions for the region.

What stands out from Figure 2 is that, in spite of the difficult environment around sanctions and its fraught relationship with the US, Iran is projected to fare well in trade terms during 2020, especially in terms of its exports. That said, care should be taken when interpreting Iran’s data as a lot of its trade is hidden or executed with poor reporting partners.

Even if the figure of a 55% increase in the projected value of Iran’s exports seems extreme, it arguably reflects a slowdown in trade in 2018 as a result of US sanctions, and a pick up into 2020 as the country finds a way to work around the restrictions it now faces. Its largest export partner is China and the projections suggest an increase in export trade during 2020 of around 8%, alongside imports from China of around 17%. But it is not just China where Iran is seeing trade growth. Exports to the UAE are set to grow by nearly 39%, to the Republic of Korea by over 52% and, perhaps most intriguingly of all, to parts of Asia not indicated elsewhere (Asia NIE) of more than 2,000% year on year.

Asia NIE is Iran’s second largest export partner. It is an amalgamation of trading partners that are too small or too unreliable in their reporting to be classified individually as countries in trade statistics. The fact that it is both a large partner and that its growth is volatile but substantial during the course of the coming year suggests some of this growth is a reaction to the political and economic uncertainties that exist in the region.

Morocco is another country in the region which is predicted to see export growth in 2020. This reflects its position as a non-oil-dependent trading nation with an increasingly strong manufacturing base. Its top five trading partners are European, which points to its role as a gateway for trade between Mena, Europe and Africa. Its imports from Spain, for example, are increasing rapidly, with growth predicted at 8% during the course of the coming year. While oil and gas are important imports to Morocco from Spain, machinery and components, automotives and electrical products and equipment imports are also large and growing sectors. Spain has also taken over from France as Morocco’s largest export partner.

Nonetheless, the region remains vulnerable to global trade’s broader fragilities. These are likely to continue into 2020, not least because there is no sense that trade tensions have gone away, even if in an election year for the US there may be a slightly toned-down rhetoric. Trade growth remains negative or flat for most of the region’s countries and this will affect the extent to which GDP picks up.

GTR: Is there any sign that Mena has increased its resilience into 2020 and beyond?

Harding: The real measure of resilience in the region is the extent to which it is managing to reduce its dependency on oil. This is most evident in its imports (Figure 3). The region’s GDP expansion has failed to pick up since the collapse of oil revenues and, according to the IMF, is likely to be around 1.6% in 2020, down from 2.2% in 2017.

The fact that economic growth looks to have slowed somewhat has had an impact on the region’s imports. For example, imports of machinery and components (which includes computer machinery as well as tools for infrastructure development projects), will decline by 0.6% in 2020. The longer-term outlook to 2023 also points to an annual drop in imports of 0.3%. Iron and steel products, aircraft and automotives all exhibit a similar pattern.

This could arguably be a function of two things. First, the region’s infrastructure has gone through a growth phase as ports and airports have been constructed to support its increased role as a trade hub. The slowdown now may well be because this construction process has slowed as more projects have been completed.

The second cause may be a slowing of regional or global demand, as might be suggested by the drop in automotive imports. This could suggest that there is a bigger picture to the sluggishness of trade in the region.

However, the data does not support this interpretation. The Mena region imports over US$75bn in automotives each year and exports just US$13bn. Exports are forecast to increase both in 2020 and for the next few years (Figure 4). This suggests that the region is potentially becoming more important as a hub, and that it will be re-exporting more in the coming years. The slowdown in imports therefore looks as if it can be attributed to the region’s economic fortunes. Indeed, the fact that iron and steel product imports are also declining indicates that there is less construction work going on.

Even so, the projected growth in exports is encouraging. The region has a trade deficit in all of its largest sectors except mineral fuels and some of the import sectors where growth is slower, such as infrastructure products like iron and steel, may simply be a function of the fact that a lot of resource has been put into catching up over the past couple of decades and that this development is now slowing. Growth in exports of other infrastructure sectors such as machinery and components, aluminium and electrical products, alongside growth in automotives, suggests that the region’s role is changing – and this will mean that its long-term resilience is somewhat more assured.

GTR: How is intra-regional trade developing in Mena?

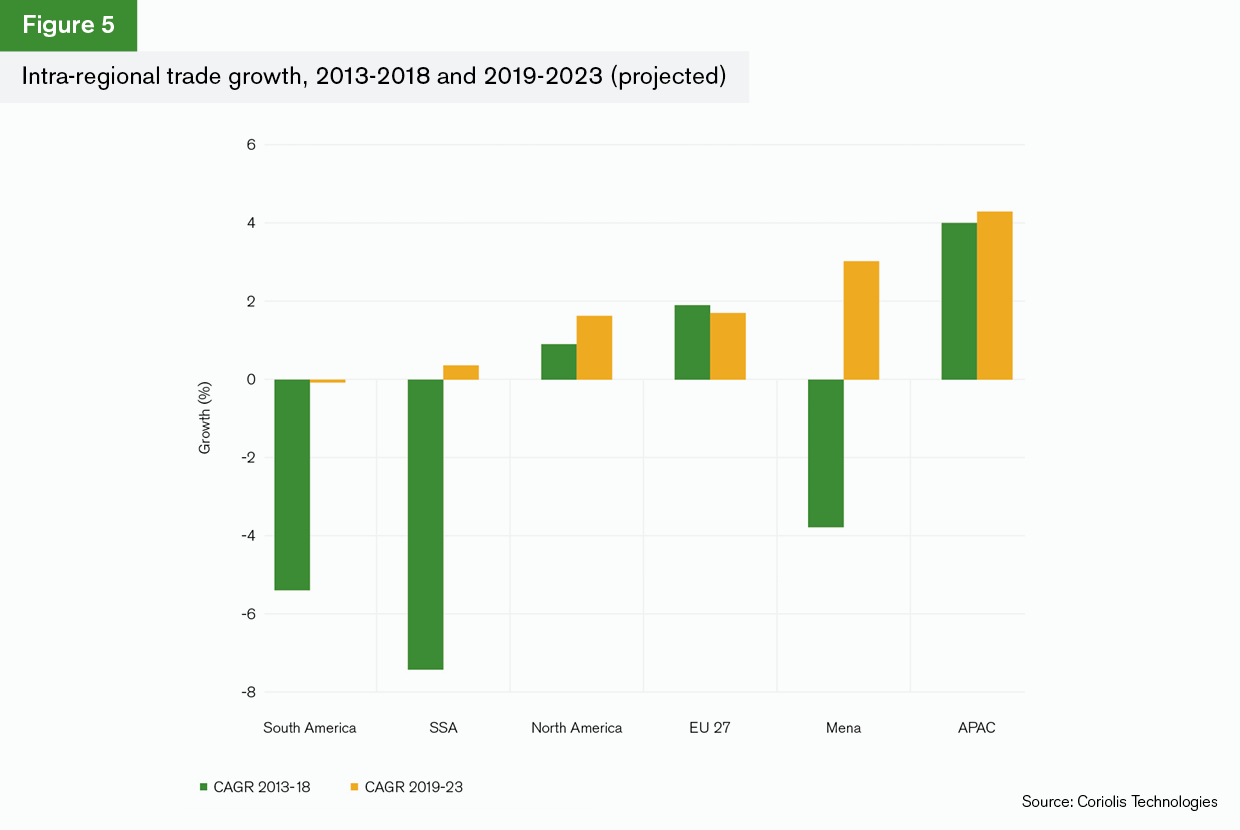

Harding: Mena will see an increase in intra-regional trade from 2019 to 2023, and this is noticeable in comparison to the pick-up in intra-regional trade in other net oil exporting regions such as South America and Sub-Saharan Africa (Figure 5). The only other region with faster intra-regional trade growth is Asia Pacific (APAC).

While oil remains the dominant traded sector in Mena, this greater intra-regional trade indicates either that the region’s oil dependency is declining or simply that there is a greater amount of cross-border trade within the region.

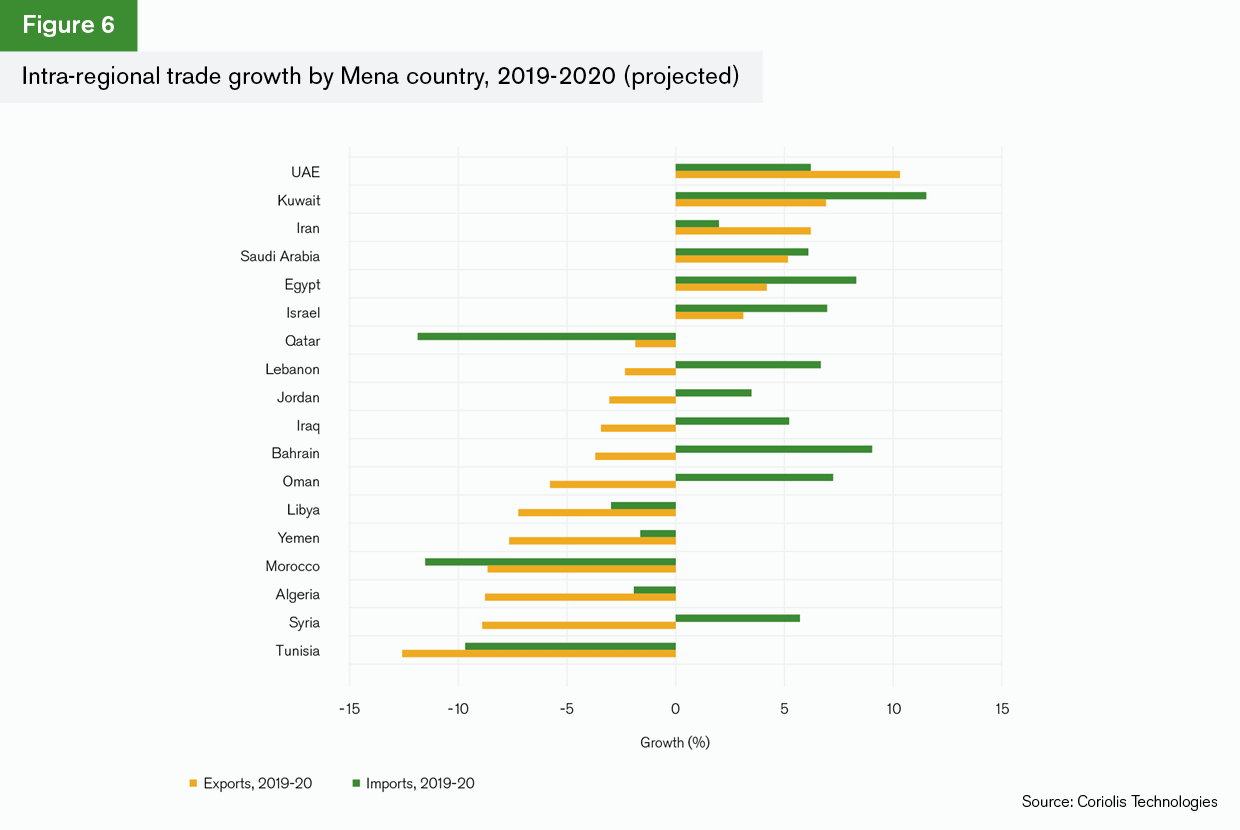

Could this therefore mean that more export diversity across the region is behind the growth in regional trade? A first glance suggests not. The top five countries for intra-regional exports are the UAE, Saudi Arabia, Iran, Iraq and Oman. In terms of export growth, the UAE, Iran and Saudi Arabia are growing quickly, but Iraq and Oman are falling back. Similarly, the top five countries for intra-regional imports are the UAE, Saudi Arabia, Egypt, Iran and Oman. All of these countries are likely to see growth in intra-regional import values between 2019 and 2020 (Figure 6).

A couple of points stand out from this chart: first, the impact on Qatar’s trade because of the blockade, which began in June 2017, is evident. Intra-regional trade values fell back between 2013 and 2018 at an annualised rate of over 20%. While this initially aligned with the collapse in oil prices, an annualised decline of 16.1% in imports between 2016 and 2019 covered the pick-up in oil prices and the onset of the blockade, while intra-regional exports over the same three-year period fell annually at over 22%. The data suggests that this will continue into 2020.

Furthermore, Morocco’s trade with the region looks set to decline at the same time it increases with the EU27 and Spain and France in particular. The country’s trade with Mena spiked during the financial crisis, largely because of an uptick in gold prices, with a three-year growth in imports of over 300%, albeit from a low base. Other imports, such as automotives, clothing and accessories, and milk and dairy products have remained on a consistent downward trend since 2014.

Morocco exports hard commodities and plastics to the rest of Mena, and these have also been on a downward trend since 2014 because of weak commodity prices. In other words, the structure of Morocco’s trade with the rest of the region is very different to its trade outside of the region, which is focused on intermediate manufactured goods.

This leads to the conclusion that, in fact, growth in intra-regional trade has been driven by a rise in oil prices, rather than any diversification efforts. Indeed, between 2017 and 2020, intra-regional trade in oil and gas grew by nearly 6% annually. The UAE, Egypt, Jordan and Bahrain have been major beneficiaries of this pattern, which looks set to continue.

GTR: Geopolitical tensions between the US and Iran have added a layer of uncertainty into the 2020 outlook. How will this play out during the course of the year?

Harding: On January 3, US forces carried out a drone strike near Baghdad International Airport killing Qasem Soleimani, commander of Iran’s Quds Force and right-hand man to Ayatollah Ali Khamenei, Iran’s supreme leader. Khamenei vowed “severe revenge”. Five days later, on January 8, 16 short and medium-range ballistic missiles were launched at two US airbases in Iraq (Ain al-Asad and Erbil). No fatalities were reported, which US officials attributed to an effective satellite early warning system known as the Space Based Infrared System. It is likely that Iran’s response was an example of ‘escalation for de-escalation’; by providing the US with a degree of early warning, casualties could be minimised and direct conflict with the US avoided, while still demonstrating to Iran’s domestic base that action had been taken. From the US perspective, President Trump was equally unlikely to be willing to become embroiled in a costly war during an election year.

Although tensions between Iran and the US are unlikely to lead to direct conflict, there are two real risks to the region. The first is that of miscalculation – in other words, the danger that either Iran or the US misinterprets the actions of the other and acts accordingly. For example, had the US had any fatalities from the Iranian response, there may have been a more severe, escalatory response. This risk is always there but the fact that neither side appears to have much appetite for conflict means that it is unlikely to be the major issue affecting trade during the course of the year.

Of more consequence is the second risk that is apparent in the region at present, which is that it is increasingly caught in the power struggle between Russia, China and the US. As Coriolis Technologies has been observing for some time now, Russia is increasing its influence in the region. Our data suggests that the average annualised growth in imports from Russia for the period 2016-2020 will be around 14%. While much of this is oil and gas, the period 2015-2018 saw a worrying exponential growth in so-called commodities not elsewhere specified – trade in which closely correlates with conflict around the world. This reflects Russia’s role in Yemen and Syria in particular.

The consequence for trade of this type of uncertainty is obvious. It holds back investment as businesses outside of the region tread cautiously to avoid conflict. However, while Russia’s engagement in the region provides a backdrop to traditional “hard” power, the US is now using its financial power rather than military means to support its regional objectives.

The tightening of sanctions on Iran since the US withdrew its support for the Iranian nuclear treaty (JCPOA) has affected the way in which banks can operate in the region. The risk of secondary sanctions, for example inadvertently using the US dollar for a transaction, as well as the direct risk of trading with a sanctioned entity or person is the core way in which trade with the region will be affected.

Mena continues to be dominated by trade with areas not elsewhere specified (Areas NES), which is an agglomeration of countries which are either too small or report too irregularly, potentially indicating hidden trade. Exports to this partner were worth US$519bn in 2018; US$97.1bn of these exports were in commodities not elsewhere specified. The region’s exports to Asia NIE were worth US$19bn in 2018.

What this says is that trade in the region remains opaque. While this continues to be the case, it is very difficult for dollar-denominated trade finance to work with banks in the region. Swift has shut down its messaging services to Iran; and although European government officials announced in April that Instex, a trade vehicle set up to bypass US sanctions on Iran, has successfully completed its first transaction, there remain doubts over the viability of the mechanism. China, Russia, Iran and Turkey have been building an alternative to the Swift network, but as this would be subject to the same sanctions constraints as other regions, unless and until US strategy changes, the opacity and political nature of trade will be a core challenge for the region as a whole.

GTR: The largest ports like Dubai are increasingly focusing on their role as trading hubs for re-exports. How will this expand in the coming year?

Harding: The best way of approaching this question is to look at trade with free trade zones (FTZs). These are the economic areas around ports or airports which are specific to a sector and which enable re-export activity by providing tax and customs duty incentives to overseas investors and trading businesses. Dubai alone has more than 30 of these zones; the UAE has the greatest number of FTZs of any country in the region.

Because countries report exports to FTZs, but FTZs do not report imports as a country in their own right, the data depends on the reliability of the partner country and, as a tax and duty payment mechanism rather than as a trading partner, the numbers tend to be small. The Mena countries are amongst the least reliable reporters globally, so the data is somewhat erratic but nevertheless tells an interesting story:

- Mena as a region exported some US$981mn to freeports in 2018. The dominant products that the region exported were electrical products and equipment, precious metals and stones (gold and diamonds), commodities not elsewhere specified, machinery and components and mineral fuels (oil and gas).

- Mena imported some US$220mn of goods from freeports in 2018. The dominant sectors were commodities not elsewhere specified, mineral fuels, electrical products, machinery and components and coffee and tea.

- Exports to FTZs declined between 2013 and 2018. However, Coriolis Technologies is expecting growth in exports to be nearly 150% between 2018 and 2019, and to fall back to around 2% between 2019 and 2020.

- The trade with FTZs is not necessarily attributable to hidden trade as such. By way of comparison, the region trades over US$519bn with areas not elsewhere specified and US$27.5bn with Asia not elsewhere specified. Since these have been shown to be highly correlated with sanctions avoidance and conflict as discussed, the distinction is an important one to be made.

These patterns tell an interesting story about how FTZs may be utilised at present. Oil and gas, precious metals and stones and commodities not elsewhere specified are sectors which hide other patterns in trade. However, trade in electrical products, automotives, machinery and components and coffee and tea suggest that something else is happening given the expected overall growth in trade with FTZs.

Because trade looks to have grown so quickly between 2018 and 2019, FTZs clearly play an important role in the region’s trade. The data is naturally opaque, so any conclusion is to some extent speculative. However, tighter sanctions and the risk of secondary sanctions against Iran from the US means that trade with one of its main trading partners became very difficult for Mena during that year. Alternative mechanisms, such as FTZs, mean that trade technically does not touch either Iran or its financial institutions. As a result, FTZs may become a route to continued legal trade with sanctioned countries.

GTR: China is playing an increasingly active role in Mena. What are the key developments and are there any particular sectors of interest?

Harding: One cannot overstate the importance of China to the Mena region. Imports from China were worth US$146bn and exports worth US$169bn in 2018.

Mena’s exports to China are dominated by oil and gas, which makes up nearly 76% of the total at US$128bn.

Imports from China are far less concentrated. The top five imports from China are electrical products and equipment (US$38.1bn), machinery and components (US$22bn), knitted clothing and accessories (US$4.6bn), iron and steel (US$6.2bn) and automotives (US$6.2bn).

China is strategically focused on its electronics exports and, in 2019, Mena is estimated to have imported US$9.2bn of specialised electronic equipment from China. This represents an annualised growth of 27% since 2016, when President Trump came to power in the US and China became more explicit about its global aspirations. While China’s imports from Mena may well be focused on energy security, it is extending its reach into the region through technology.

Yet trade growth overall has been sluggish. Over the period between 2013 and 2018, imports from China grew at an annualised rate of 1%, while exports increased by just 0.6%. This is largely because of oil price related economic weakness in Mena, which has affected both domestic demand as well as the value of exports to China.

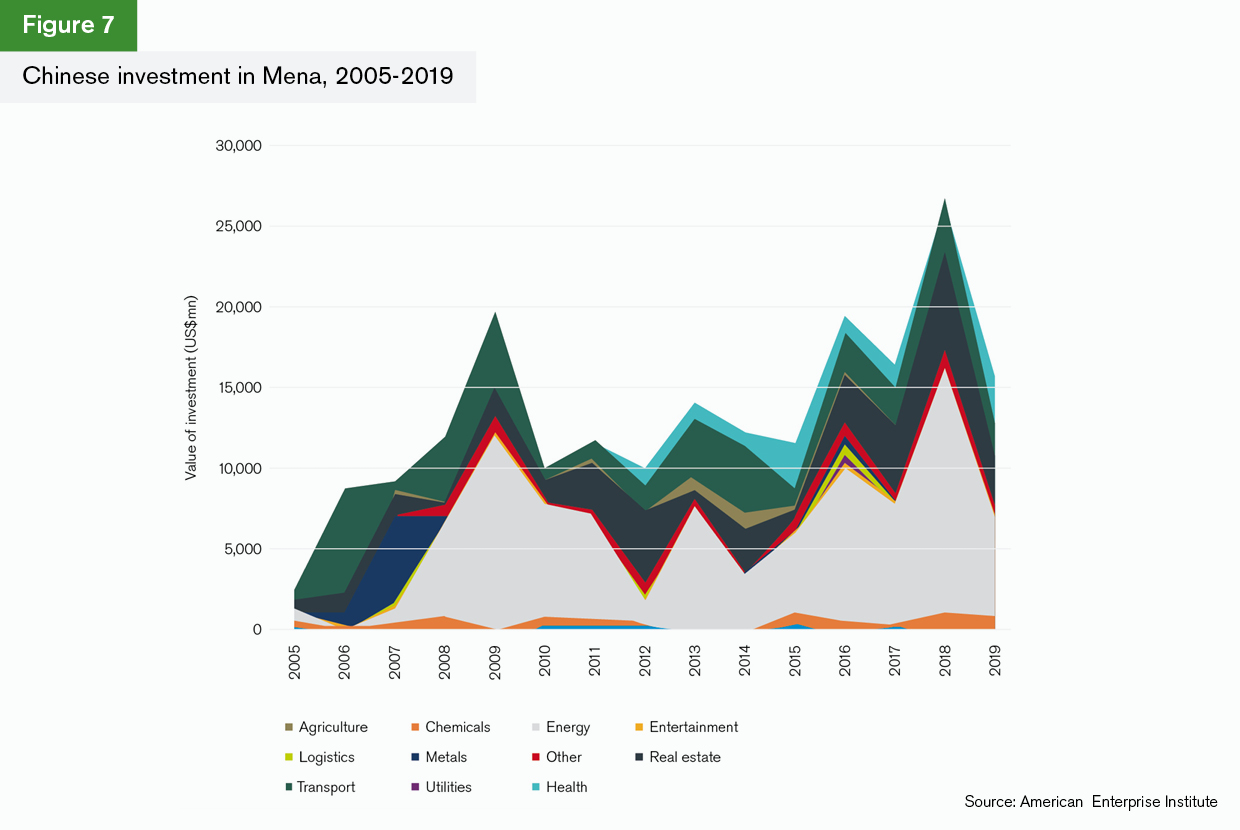

Even so, Mena’s trade with China is twice the size of trade with its second largest country-level export partner, the US. China overtook the US as the region’s largest country partner (excluding blocs like the EU27) in 2009. The growth in the trading relationship was particularly evident between 2002 and 2014, likely driven by Chinese investment into the energy sector, given that post-2014 growth has trailed off amid lower oil prices (Figure 7).

Despite China’s expansionary policy through the Belt and Road Initiative (BRI) to develop infrastructure more generally, it is energy security that seems to underpin its trade with the region. Investment has supported that with the majority going into the energy sector. This highlights the fact that China invests for its strategic purposes, although real estate (construction) and transport have featured strongly. In effect, then, the BRI has just given a name to an investment trend that has been growing gradually since before the financial crisis (Figure 8).

Up to 2013, all investments by China into Mena were classified as non-BRI, but since 2014, all investments have been classified as BRI – this is again a reflection of how China is now categorising its investments. The pattern is clear, though: the general trend is for more investment in the region, both in terms of consistency and in terms of value. The fact that investments appeared to drop in 2019 may reflect two things: first, the general uncertainties during the course of the year that arose from the US-China trade war which held back investments globally. Second, and as a result of the dispute, China was relatively quiet about the BRI during the course of the year having been very public about its intentions the previous year – perhaps as a signal to the US that it was growing its economic power.

Whatever may be the case, what is important is that the investments appear to support China’s trade aspirations in the region.

GTR: What are the key upside and downside risks to growth in the region in 2020 and what are the consequences for trade finance?

Harding: Trade within the region is substantial and the value of bank-intermediated trade finance from intra-regional trade alone is as much as US$122bn per year. Electronics trade between countries in the region has grown by 36.7% since 2016, machinery and components by nearly 19% and, against the odds perhaps, Iran’s intra-regional trade is growing by an annualised figure of 47%.

Much of the growth in trade finance will depend on the risk appetite of the region’s financial institutions. There is plenty to invest in, as is clear from this report, but the region itself has a number of challenges which banks will need to overcome: Coriolis Technologies risk indicators for the region, particularly around the risk of terrorism, the risk of repression and threats from regimes, are among the highest in the world. While businesses on the ground are trying to reduce the region’s dependency on oil, particularly in technology and digitalisation, this reputational risk cannot be ignored.

The region is particularly prone to commodity price fluctuations. The collapse of oil prices since the beginning of 2020 presents a serious threat to Mena’s economic wellbeing. Saudi Arabia is unlikely to be able to thrive economically at an oil price below US$70 a barrel. With 82% of its export revenues coming from oil and gas (approximately US$455bn in 2019) and its next largest export products like plastics also being heavily oil dependent, its overall trade is 96% correlated with the price of oil.

Russian influence in the region is growing as a result of the US strategy to withdraw militarily and, in reality, economically as well. Since the global financial crisis, imports from Russia have grown from US$11.8bn in 2009 to US$27.8bn in 2018. Similarly, exports have grown over the same period from US$1.9bn to US$4.2bn. Increased trade with Russia and China is likely, not least because of the sanctions that are now associated with any trade in US dollars that might touch Iran. This will have the effect of limiting trade and investment – and the role of global banks – in the region if there is any compliance risk from supporting intra-regional trade in particular. Meanwhile, greater Russian involvement in Mena will add to the complexity of already fraught relations between countries in the region, with the potential of an escalation into broader conflict.

The Covid-19 pandemic has caused widespread economic disruption around the world. This is a key risk which could impact events in the region, travel and tourism and, of course, oil trade. These are risks that are the same for everywhere in the world at present, but the potential for a global recession is obvious. The extent to which the region’s reforms over the past few years have created economic resilience are likely to be tested during the course of this year.